- United States

- /

- Specialty Stores

- /

- NasdaqCM:GRWG

US Penny Stocks: 3 Picks With Market Caps Over $60M

Reviewed by Simply Wall St

As major U.S. stock indexes face potential weekly losses following a disappointing jobs report and declining consumer sentiment, investors are exploring diverse opportunities across the market spectrum. Penny stocks, often associated with smaller or newer companies, continue to present intriguing possibilities for those seeking growth at lower price points. Despite being considered a throwback term, these stocks can offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.38M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2798 | $10.12M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $90.69M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.82 | $45.59M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.95 | $53.09M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $26.96M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.882 | $81.84M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $396.15M | ★★★★☆☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Entera Bio (NasdaqCM:ENTX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Entera Bio Ltd. is a clinical-stage company developing oral peptide or protein replacement therapies for unmet medical needs, with a market cap of $88.40 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage company focused on developing oral peptide or protein replacement therapies.

Market Cap: $88.4M

Entera Bio Ltd., a clinical-stage biotech company, is pre-revenue with less than US$1 million in sales, highlighting its early-stage nature. The company's financial position reveals less than a year of cash runway and no debt, which can be advantageous but also indicates potential liquidity challenges. Despite being unprofitable and not expected to achieve profitability in the next three years, Entera has managed to reduce losses over the past five years by 2.8% annually. Its experienced management and board provide some stability amid high share price volatility and significant net losses reported recently.

- Click here to discover the nuances of Entera Bio with our detailed analytical financial health report.

- Examine Entera Bio's earnings growth report to understand how analysts expect it to perform.

GrowGeneration (NasdaqCM:GRWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GrowGeneration Corp. operates retail hydroponic and organic gardening stores across the United States with a market cap of $82.35 million.

Operations: The company's revenue is primarily derived from Cultivation and Gardening at $172.35 million, followed by Storage Solutions contributing $28.54 million.

Market Cap: $82.35M

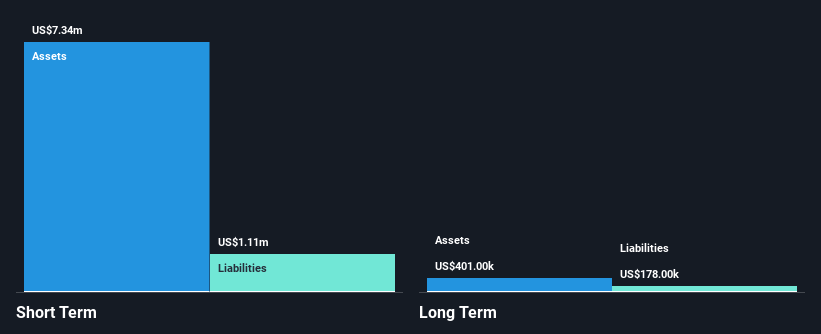

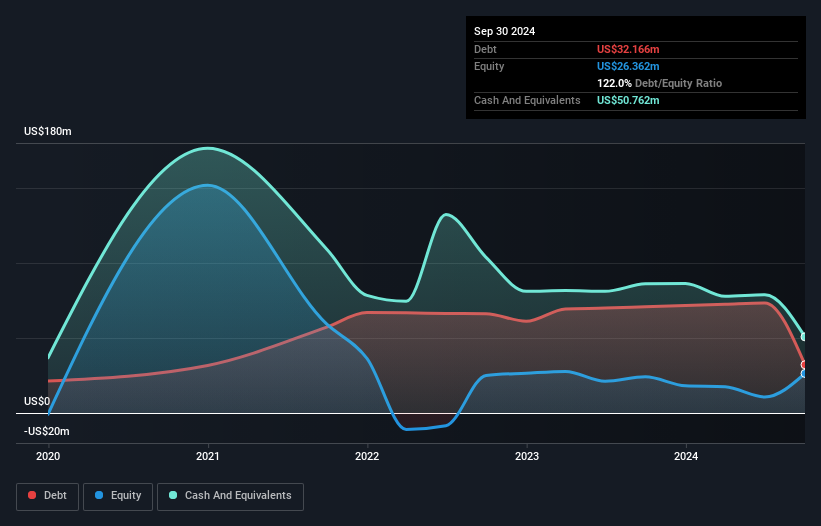

GrowGeneration Corp., with a market cap of US$82.35 million, operates in the retail hydroponics sector and has shown resilience despite challenges. The company reported third-quarter 2024 sales of US$50.01 million, down from the previous year, alongside increased net losses. However, it anticipates 2024 net sales between US$188-190 million and positive same-store sales growth. Recent product launches aim to boost proprietary brand sales to 35% by end-2025. Despite being unprofitable with a negative return on equity and increasing losses over five years, GrowGeneration remains debt-free and maintains strong liquidity with short-term assets covering liabilities comfortably.

- Click here and access our complete financial health analysis report to understand the dynamics of GrowGeneration.

- Assess GrowGeneration's future earnings estimates with our detailed growth reports.

Grove Collaborative Holdings (NYSE:GROV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grove Collaborative Holdings, Inc. is a plastic neutral consumer products retailer in the United States with a market cap of approximately $67.29 million.

Operations: The company's revenue is primarily generated from its online retail segment, which accounts for $213.78 million.

Market Cap: $67.29M

Grove Collaborative Holdings, with a market cap of US$67.29 million, faces challenges typical of penny stocks. Despite reporting third-quarter 2024 sales of US$48.28 million, a decline from the previous year, it has managed to reduce net losses significantly over five years by 35.4% annually. The company remains unprofitable with negative return on equity but maintains strong liquidity as short-term assets exceed liabilities and cash surpasses debt levels. Recent initiatives like the Home Planet blog aim to strengthen customer relationships through sustainability-focused content rather than direct sales promotion, aligning with its strategic emphasis on long-term trust building amid executive transitions.

- Get an in-depth perspective on Grove Collaborative Holdings' performance by reading our balance sheet health report here.

- Gain insights into Grove Collaborative Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Discover the full array of 706 US Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRWG

GrowGeneration

Through its subsidiaries, owns and operates retail hydroponic and organic gardening stores in the United States.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives