- United States

- /

- Retail Distributors

- /

- NYSE:GPC

What Do Recent Gains Mean for Genuine Parts Shareholders in 2025?

Reviewed by Simply Wall St

If you are sitting on Genuine Parts stock, or considering what your next move should be, you are not alone. The company is a well-known name in the retail auto parts sector, and its shares always seem to stir up discussion, especially after the price action we have seen lately. Over just the last three months, the stock has risen by more than 10%, and year-to-date, it is up a strong 20%. That momentum has certainly caught the eye of investors re-evaluating their strategies in a market that remains volatile.

Of course, Genuine Parts is not just riding a wave of short-term optimism. The company has reported steady revenue growth of 3.4% and an impressive net income growth of over 12% over the past year. These numbers can make it tempting to overlook the deeper question: are shares still a good deal at these levels, or has the market gotten ahead of itself?

To help answer that, it helps to look at the valuation score for the company. Out of six major valuation checks, Genuine Parts meets two for being undervalued, giving it a value score of 2. While that does not signal a deep bargain, it also leaves room for further exploration. Next, we will break down how the company's valuation stacks up through different metrics, and later on, discuss what might be a smarter way to think about value in today's market environment.

Genuine Parts delivered 1.3% returns over the last year. See how this stacks up to the rest of the Retail Distributors industry.Approach 1: Genuine Parts Cash Flows

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s value by forecasting its future free cash flows and then discounting those back to today's dollars. This approach helps investors judge what a business is truly worth compared to its current market price.

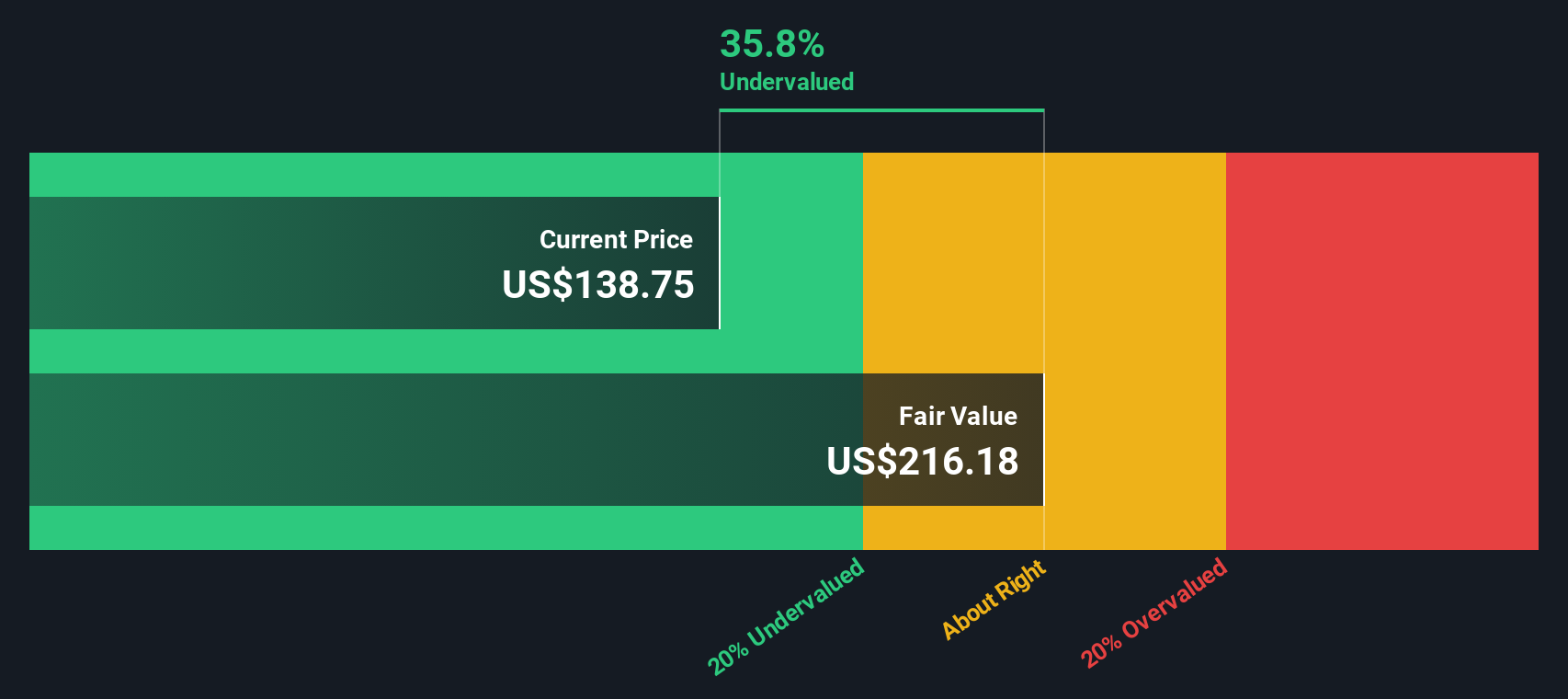

For Genuine Parts, the latest twelve months' free cash flow stands at $292 million, showing healthy fundamentals. Projections suggest that by 2029, free cash flow could reach $1.4 billion, reflecting consistent annual growth over the coming years. Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $215.82.

Currently, the stock trades at a 35.4% discount to this intrinsic value. According to DCF analysis, this indicates it is 35.4% undervalued. This significant gap suggests the current market may be overlooking Genuine Parts' underlying earnings power.

Result: UNDERVALUED

Approach 2: Genuine Parts Price vs Earnings

The Price-to-Earnings (PE) ratio is a standard valuation tool for profitable companies because it relates a company’s stock price to its earnings, offering insight into how much investors are willing to pay for each dollar of profit. For established firms like Genuine Parts, the PE ratio is particularly informative as it reflects both market growth expectations and risk factors. Typically, higher growth prospects or lower perceived risk justify a higher PE, while slower growth or greater uncertainty might warrant a lower one.

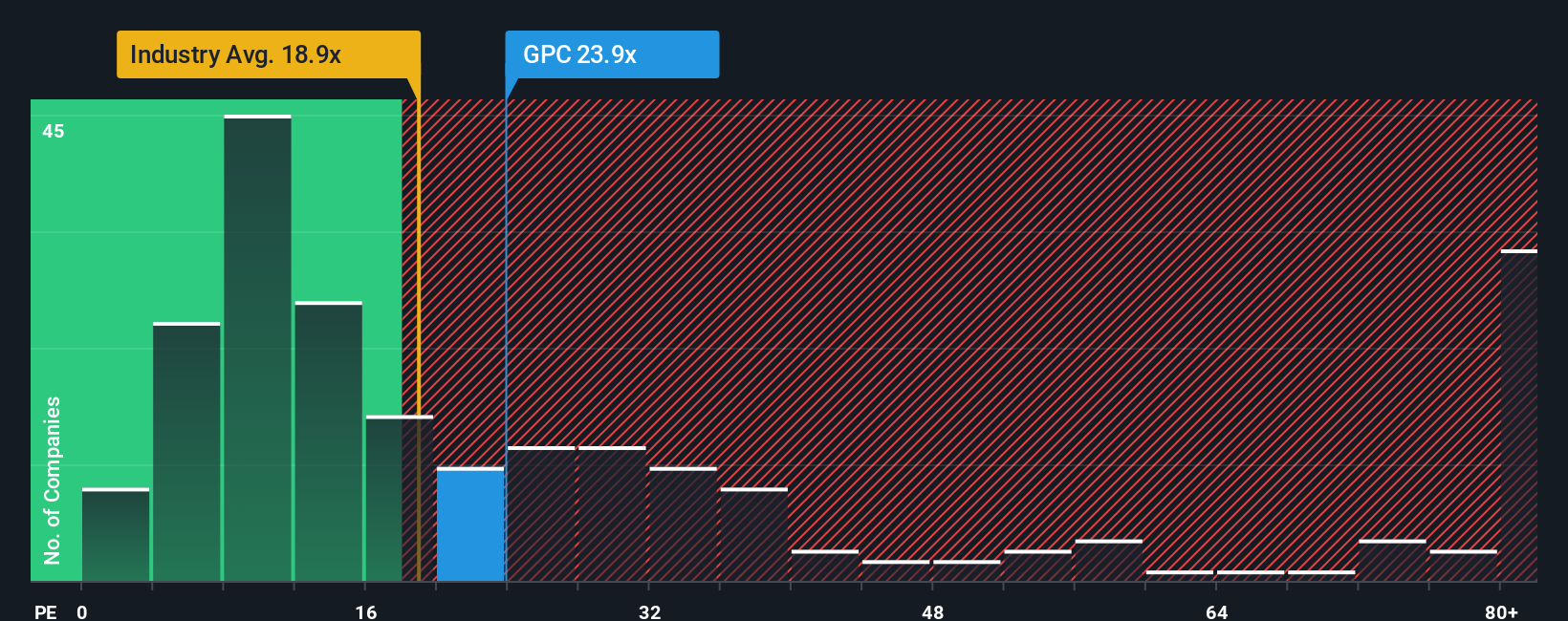

Genuine Parts is currently trading at a PE ratio of 24x. In comparison, the industry average is 19.1x and the peer average is 16.4x, suggesting the company’s shares are commanding a premium. Simply Wall St’s proprietary Fair Ratio, which considers factors such as Genuine Parts’ earnings outlook, profit margins, and market risks, calculates a fair PE of 18.9x for the business.

This indicates that the market is pricing Genuine Parts somewhat above what would typically be expected for a company in its position. The difference between the current PE and the Fair Ratio is just over 5x, which signals that the stock could be on the expensive side by traditional PE standards.

Result: OVERVALUED

Upgrade Your Decision Making: Choose Your Genuine Parts Narrative

Rather than just focusing on numbers and ratios, Narratives are stories you create that link your view of a company’s future with financial forecasts and an estimate of fair value. This approach puts your perspective at the heart of your investment decisions.

With Narratives, you can combine assumptions about key drivers, such as revenue, profit margins, or market risks, with your sense of where the business is heading. This makes it easy to map out potential outcomes and see how those relate to today's share price.

On Simply Wall St, millions of investors use Narratives for Genuine Parts and other companies to quickly compare their fair value with the current market price, helping them decide when to buy, hold, or sell in a way that fits their personal view and financial goals.

Narratives update automatically as new company results, news, or industry data become available. As a result, your outlook and valuation always reflect the latest information without manual recalculation.

For example, some investors are optimistic and set their Narrative-based price target as high as $160.00, while others take a more cautious view and see fair value closer to $119.00. There is plenty of room to explore your own perspective.

Do you think there's more to the story for Genuine Parts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives