- United States

- /

- Retail Distributors

- /

- NYSE:GPC

We Ran A Stock Scan For Earnings Growth And Genuine Parts (NYSE:GPC) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Genuine Parts (NYSE:GPC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Genuine Parts

How Quickly Is Genuine Parts Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Genuine Parts has grown EPS by 27% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

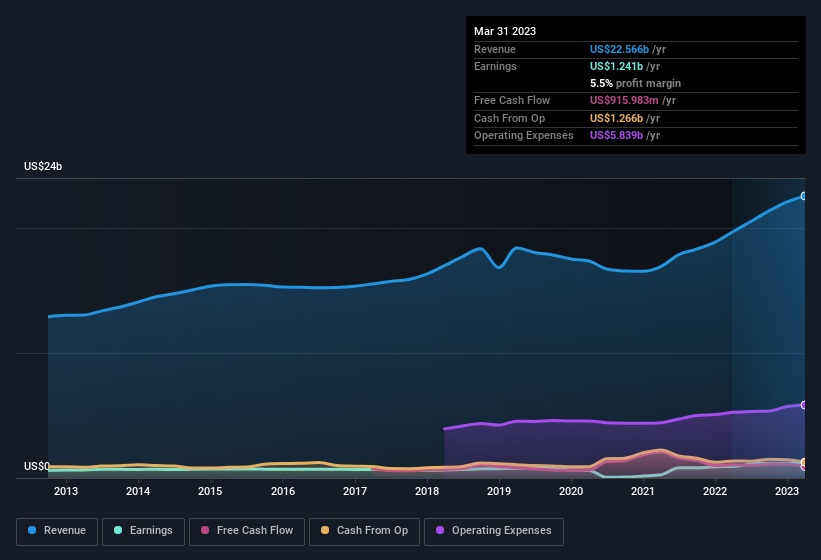

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Genuine Parts maintained stable EBIT margins over the last year, all while growing revenue 15% to US$23b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Genuine Parts' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Genuine Parts Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Genuine Parts will be more than happy to see insiders committing themselves to the company, spending US$628k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Independent Director Robert Loudermilk for US$304k worth of shares, at about US$152 per share.

On top of the insider buying, it's good to see that Genuine Parts insiders have a valuable investment in the business. Given insiders own a significant chunk of shares, currently valued at US$81m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Paul Donahue, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Genuine Parts, with market caps over US$8.0b, is about US$12m.

The Genuine Parts CEO received US$10m in compensation for the year ending December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Genuine Parts Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Genuine Parts' strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. We should say that we've discovered 1 warning sign for Genuine Parts that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Genuine Parts, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Genuine Parts, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GPC

Established dividend payer with adequate balance sheet.