- United States

- /

- Retail Distributors

- /

- NYSE:GPC

Genuine Parts (GPC) Valuation in Focus as Activist Presence and Strategic Review Spark Breakup Speculation

Reviewed by Kshitija Bhandaru

Genuine Parts (GPC) is in the spotlight as it undertakes a strategic review, welcomes new board members, and navigates the involvement of activist investor Elliott, who now holds a sizable equity stake.

See our latest analysis for Genuine Parts.

Shares of Genuine Parts have seen an 8% share price gain over the past quarter and a solid 15% rise year-to-date, signaling momentum as the company’s strategic review and activist investor engagement create buzz. However, longer-term total shareholder returns remain muted, down 3.7% over one year. This reflects how recent action is just starting to shift investor sentiment.

If this fresh wave of activity has you wondering where value and growth stories collide, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With the spotlight on Genuine Parts as activist investors push for change and analysts suggest its auto division is trading at a discount, the big question remains: is this an undervalued opportunity, or are markets already pricing in the road ahead?

Most Popular Narrative: 6.6% Undervalued

Genuine Parts’ most widely followed valuation narrative comes in above the recent closing price of $133.55, pegging fair value at $143. This perceived advantage comes as analysts see catalysts emerging from operational shifts driving efficiency and global diversification.

Execution of global supply chain optimization, pricing strategies, and recent restructuring initiatives is expected to generate over $200 million in annualized cost savings by 2026, supporting future net margin expansion and enhancing long-term earnings power.

Want a look inside the math behind this premium? The tipping point comes from bold forecasts, such as future profit margins and earnings power you might not expect from an old-line parts distributor. Surprised by the high bar set for Genuine Parts’ next chapter? See what drives the story behind the headline value.

Result: Fair Value of $143 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and ongoing international market weakness could challenge Genuine Parts’ ability to deliver on its growth and margin expansion targets.

Find out about the key risks to this Genuine Parts narrative.

Another View: Multiples Tell a Different Story

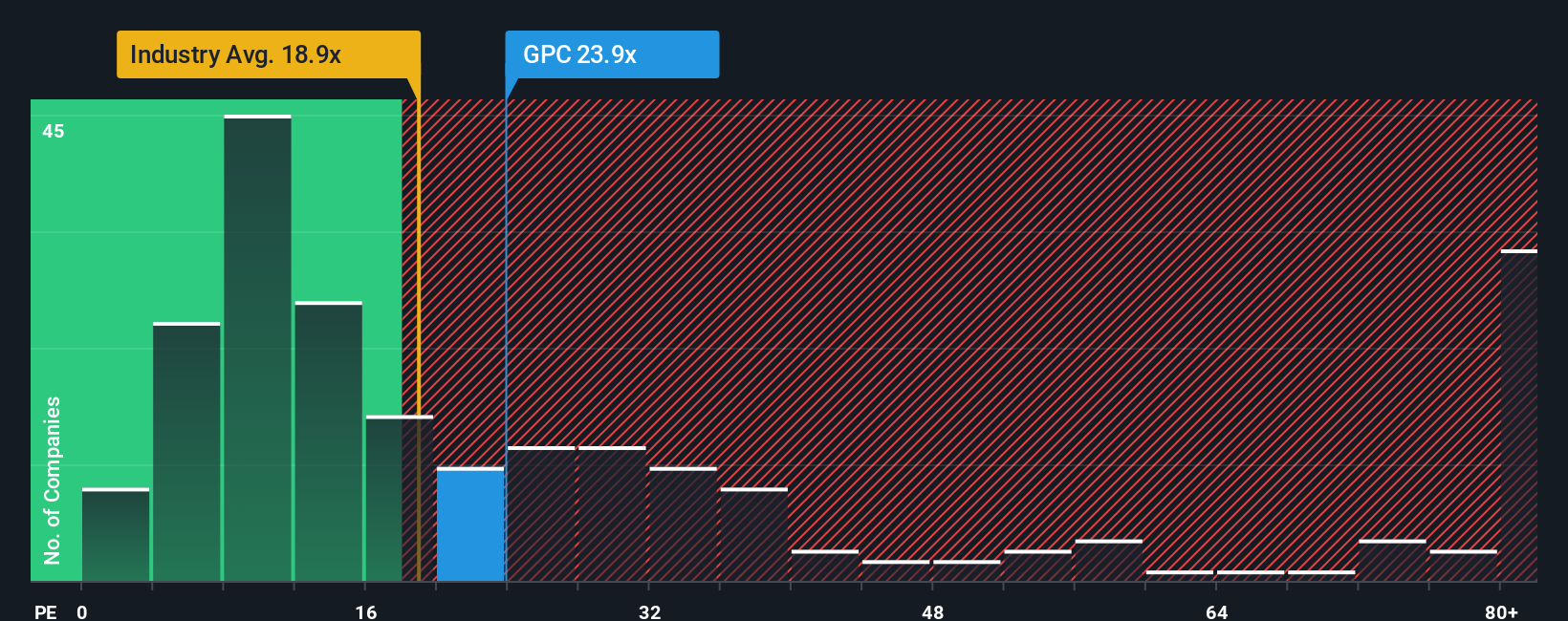

Looking instead at Genuine Parts’ valuation through the lens of its earnings multiple, the market price appears less compelling. The company currently trades at 23 times earnings, which is significantly higher than both its industry average of 18.4 and its peer group at 21.3. Even compared to the fair ratio of 19.4, the shares look expensive. This gap means there could be less margin for error if earnings disappoint. Should investors trust this premium, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genuine Parts Narrative

If you want to dig into the numbers and craft your own interpretation, it only takes a few minutes to build a narrative that reflects your view. Do it your way

A great starting point for your Genuine Parts research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't watch from the sidelines while others grab the latest opportunities. Leverage professional-grade screeners to target the most promising areas shaping tomorrow's market leaders.

- Boost your returns and get ahead of the trend by tapping into these 869 undervalued stocks based on cash flows, identified through rigorous cash flow analysis for deep value opportunities.

- Capture future breakthroughs by accessing these 24 AI penny stocks, which are driving real advances in artificial intelligence and automation.

- Strengthen your portfolio with reliable income by finding these 18 dividend stocks with yields > 3%, delivering attractive yields and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives