- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME): Taking Stock of Valuation as Investor Interest Returns

Reviewed by Kshitija Bhandaru

See our latest analysis for GameStop.

GameStop’s share price has been volatile lately, but longer-term total shareholder returns tell a striking story. Despite a roughly 24% share price drop year-to-date, anyone holding since 2019 is still up over 600%. Short-term momentum looks muted, yet the big picture remains dramatic, and shifts in sentiment often lead to sudden moves in stocks like this.

If you want to see what other stocks are catching investors’ attention, take the next step and uncover fast growing stocks with high insider ownership.

With shares far below their recent highs but long-term gains still intact, is GameStop currently offering hidden value, or is the market already accounting for any future turnaround? Could this be an overlooked buying opportunity, or not?

Most Popular Narrative: 80.6% Undervalued

According to prime_is_back, the latest narrative sees GameStop undervalued at $120, compared to its recent close at $23.30. This wide gap draws attention to dramatic financial shifts and bold strategic moves at the company.

GameStop’s Q1 2025 financials, combined with an amazing shareholder community, just showed its takes-money-to-buy-whiskey strategy at work. This demonstrates its status as a compelling investment, as the retail investors have been saying for years while fighting a corrupt legacy media, bots, social media manipulation, and hedge funds. GameStop delivered a stellar adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

Why such a high valuation? The narrative hints at robust cash reserves, a major Bitcoin position, and an aggressive profit turnaround. Want to know exactly which mix of earnings growth, digital bets, and operational cutbacks are fueling this price target? Unlock the key details hidden in the full narrative.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Bitcoin's price falls or GameStop's retail turnaround stalls, this bold narrative could quickly lose momentum with investors.

Find out about the key risks to this GameStop narrative.

Another View: Valuation by Market Multiples

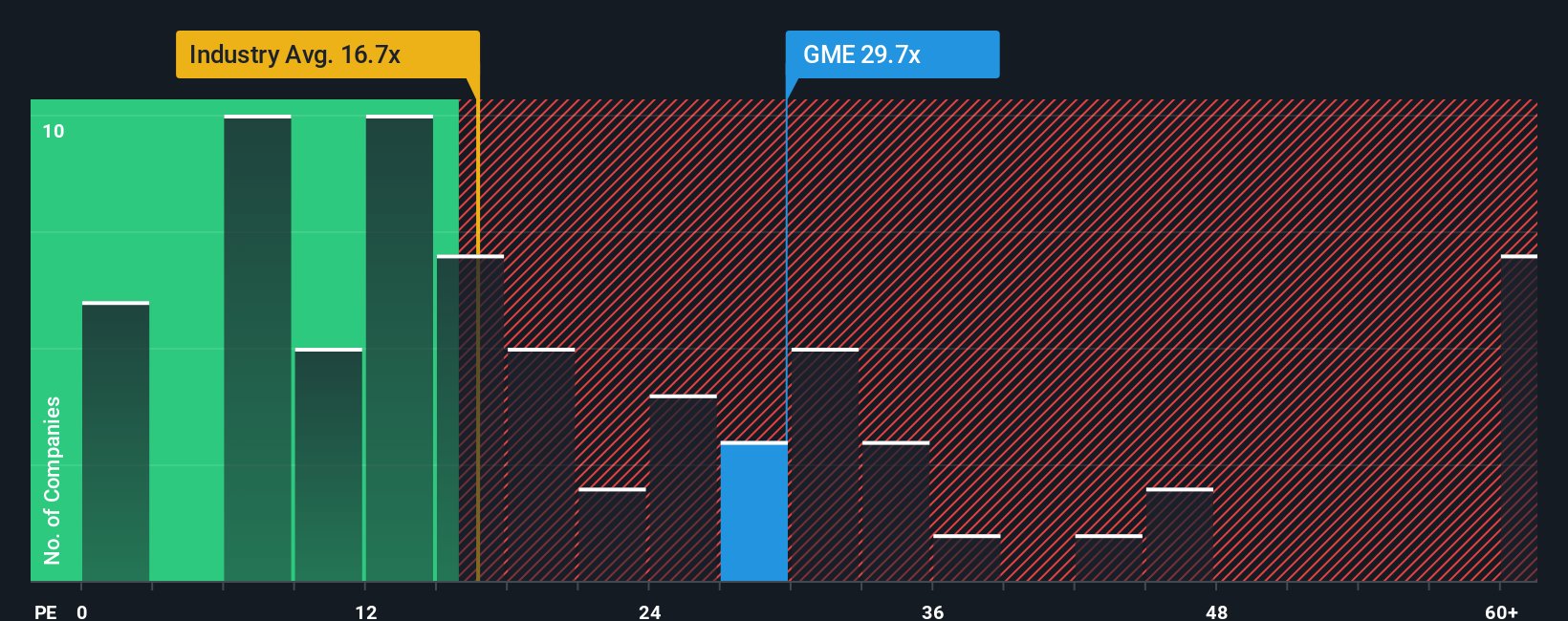

While narratives point to significant undervaluation, the numbers look different through a market lens. GameStop’s price-to-earnings ratio stands at 28.8 times, which is significantly higher than the US Specialty Retail industry average of 15.8 and above the peer average as well. This gap may signal premium risk rather than overlooked value. Could this enthusiasm be running ahead of reality, or is the market discounting a turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you see things differently or want a fresh take, you can dive into the data and build your own GameStop story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

Smart investors never stop hunting for what’s next. Act now or risk missing unique sectors and hidden gems primed for growth, income, or tomorrow’s headlines.

- Grow your money with companies boasting rising cash flows and unbeatable value using these 899 undervalued stocks based on cash flows.

- Tap into the future with high-potential businesses pushing boundaries in artificial intelligence through these 24 AI penny stocks.

- Collect reliable income streams by targeting top picks offering yields greater than 3% with these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives