- United States

- /

- Specialty Stores

- /

- NYSE:FND

Should Investors Rethink Floor & Decor After 36% Drop and Slowing Housing Market in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Floor & Decor Holdings or wondering whether it is time to make a move, you are not alone. The stock is down 4.7% in the last week and a steep 18.0% over the past month, reflecting a tough period for specialty retailers as broader macro concerns and sector jitters have weighed on investor confidence. Year-to-date, shares have slipped by 26.5%, and over the past year, the decline is even sharper at 36.0%. Looking at a five-year view, the stock is actually in negative territory, down 10.7% since 2019, although there was a brief glimmer of growth three years ago.

Many investors are looking at these numbers and asking whether this is the kind of discount that signals opportunity, or if more risk lies ahead. Some recent shifts in the housing market and rising competition in home improvement are certainly clouding the outlook for now, and sentiment appears cautiously conservative. When we run the numbers through six widely accepted valuation checks, Floor & Decor scores 0 out of 6, which means it is not currently undervalued by any of these standard measures. That does not tell the whole story, however, and there are some nuances worth considering before making any decisions.

Let us explore the different approaches to valuing Floor & Decor Holdings. Later, I will share a perspective that cuts through the noise and can provide an even clearer picture of whether the stock belongs in your portfolio.

Floor & Decor Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Floor & Decor Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. For Floor & Decor Holdings, this approach involves analyzing the company's Free Cash Flow (FCF) both now and for years to come using a two-stage Free Cash Flow to Equity method.

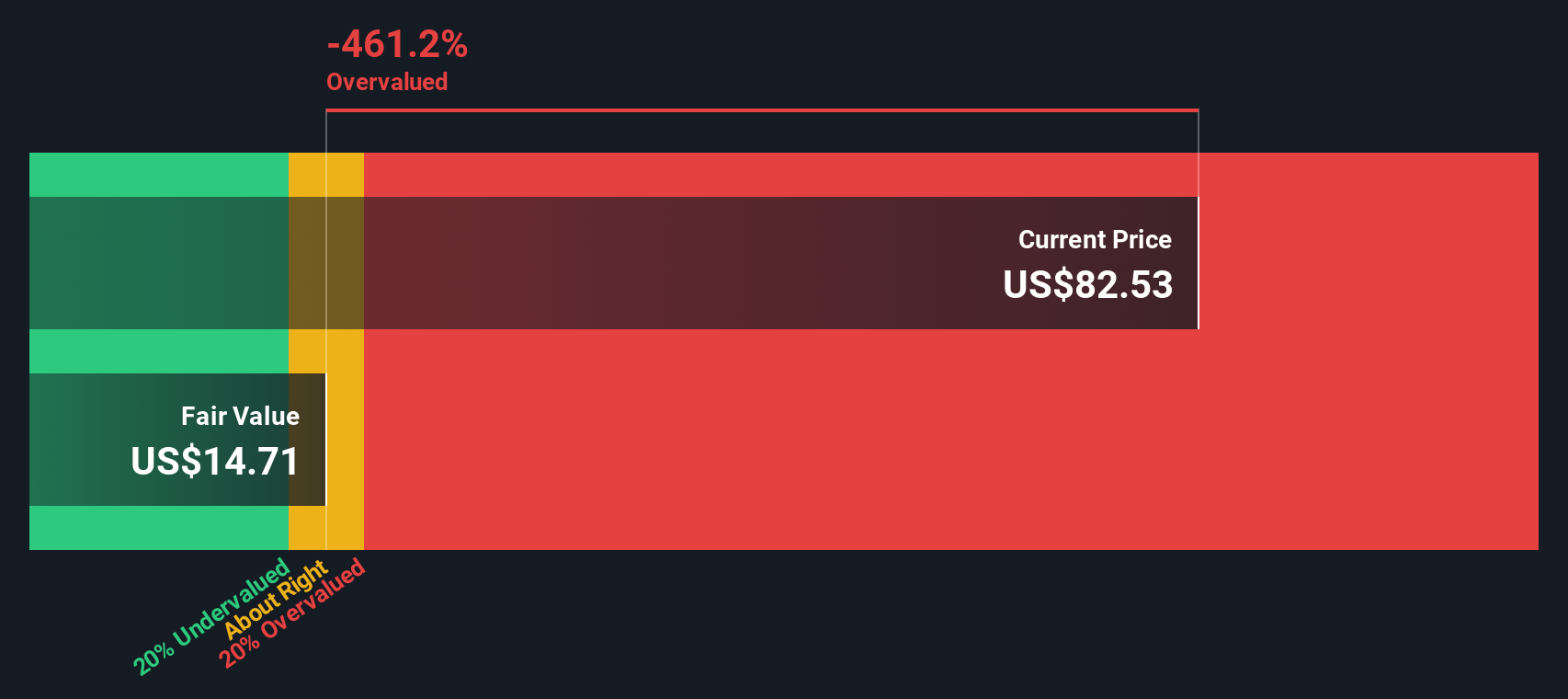

Currently, Floor & Decor Holdings reports a trailing twelve-month Free Cash Flow of -$63.0 million. Analyst consensus provides projections for the next several years, estimating FCF will rebound to $87.8 million in 2026 and reach $123.9 million by 2027. By 2028, the projection shifts to $96.0 million. Extrapolated estimates carry the FCF through the next decade, although with gradually smaller figures, reflecting no expected acceleration.

Using these cash flows, the DCF model calculates an estimated fair value per share of $9.75. Compared to the stock's current market price, this implies Floor & Decor Holdings is significantly overvalued. The intrinsic discount from DCF analysis stands at -635.4%. Despite periods of projected recovery in cash flow, the valuation indicates an extreme mismatch between market optimism and the company's expected cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Floor & Decor Holdings may be overvalued by 635.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Floor & Decor Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a widely recognized method for valuing profitable companies, as it reflects how much investors are willing to pay today for each dollar of future earnings. It is a useful gauge for retail investors because it ties the company's valuation directly to its profitability and near-term growth prospects.

A "normal" or "fair" PE ratio depends on factors like the company’s expected earnings growth and the risks it faces. Companies with higher growth rates, stable profits, or lower risks typically command higher PE ratios, while those with uncertain outlooks or more volatility tend to trade at lower multiples.

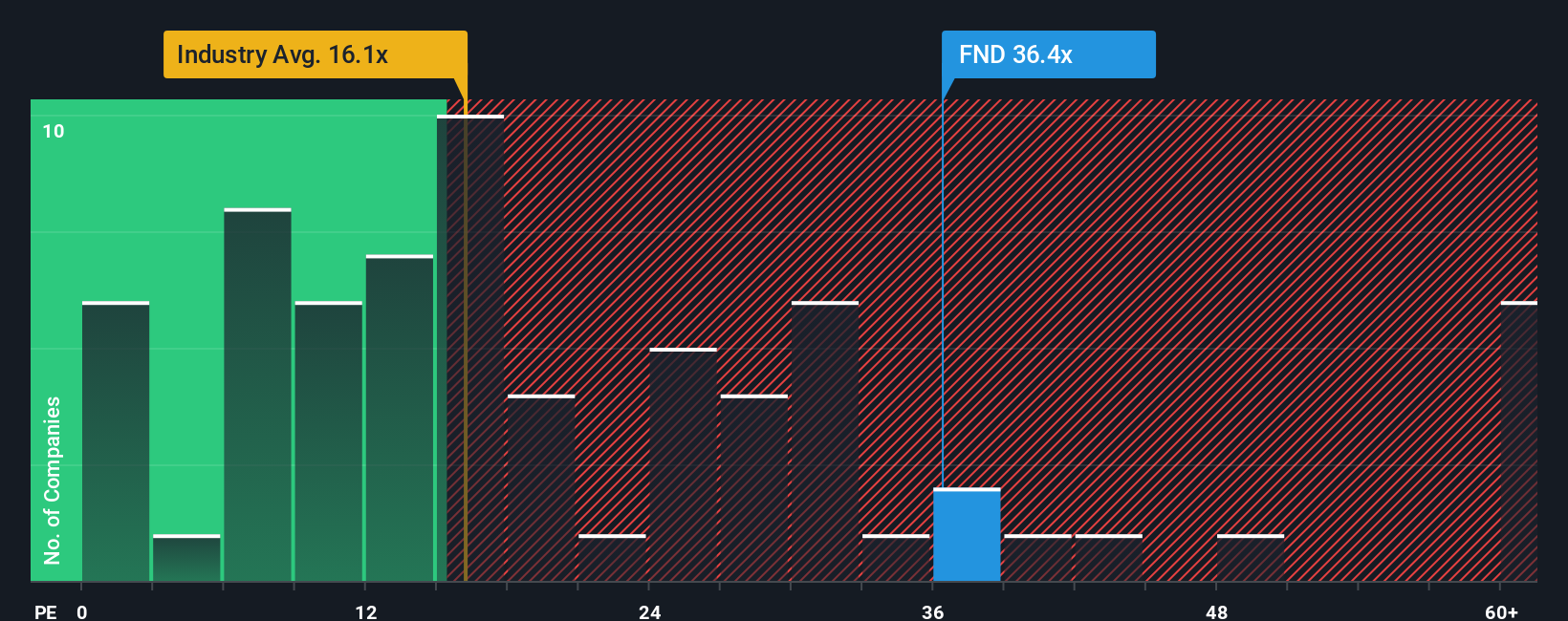

Currently, Floor & Decor Holdings trades at a PE of 36.6x. This is considerably higher than both the industry average of 17.1x and the peer group average of 14.1x. This suggests the market is pricing in robust future growth or sees some unique strengths.

However, Simply Wall St’s proprietary “Fair Ratio” provides a more nuanced benchmark. Unlike traditional comparisons, the Fair Ratio analyzes several factors including industry, profit margin, earnings growth expectations, market capitalization, and potential risks. For Floor & Decor, the Fair Ratio is calculated at 19.0x. This suggests that, given the company's profile and outlook, the market is currently placing a premium on its shares beyond what these fundamentals would typically justify.

Comparing the current PE of 36.6x to the Fair Ratio of 19.0x, shares appear overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Floor & Decor Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let us introduce you to the power of Narratives. A Narrative is your personal investment story: it weaves together your perspective on a company’s future, such as expectations for revenue growth, profit margins, and market dynamics, with the numbers behind it. This produces a clear, forecast-based fair value. Narratives allow you to move beyond just ratios and formulas, linking the company’s true story to financial forecasts and valuation, all in an easy and accessible format available to millions of investors on Simply Wall St's Community page.

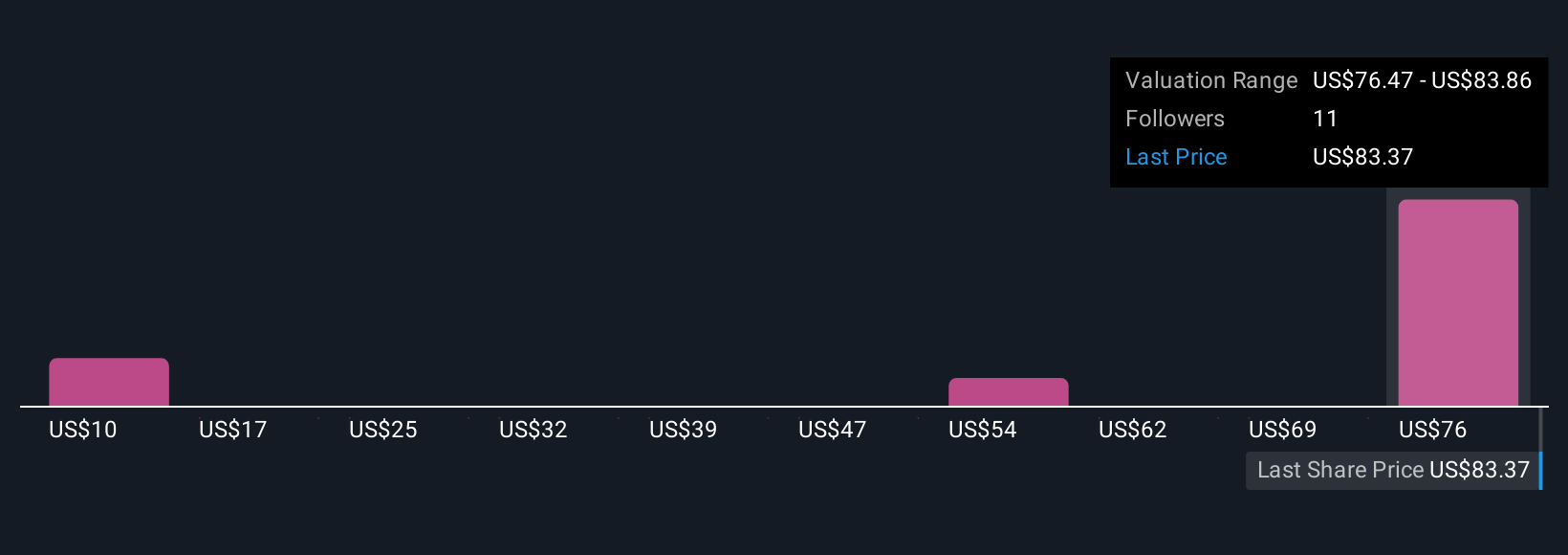

With Narratives, you can quickly compare your estimated Fair Value with the current share price, helping you decide when it might be wise to buy or sell. What’s more, these Narratives update automatically as soon as new information, like fresh earnings or industry news, comes in, so your analysis always stays current. For example, when looking at Floor & Decor Holdings, some investors see robust store expansion and long-term renovation demand justifying a fair value as high as $100.00, while others highlight housing market risks and set a far lower target around $60.00. This shows how perspectives can shape decisions.

Do you think there's more to the story for Floor & Decor Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives