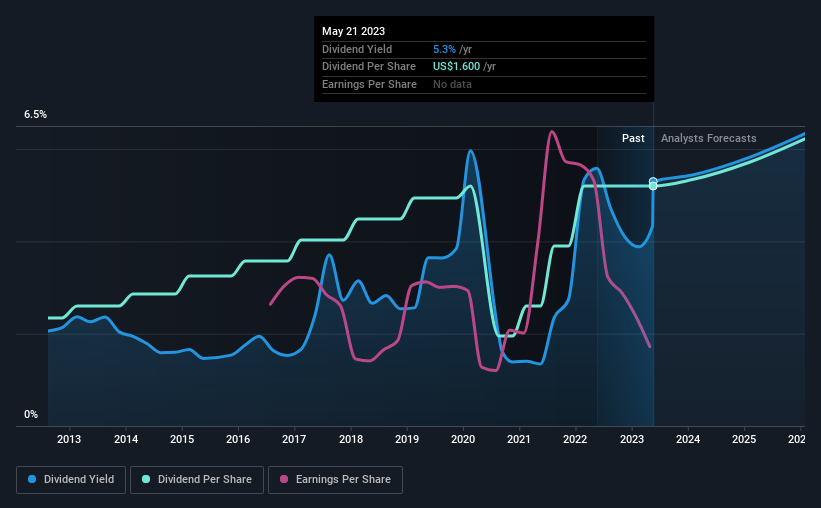

Foot Locker, Inc. (NYSE:FL) will pay a dividend of $0.40 on the 28th of July. This means the annual payment is 5.3% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Foot Locker's stock price has reduced by 32% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

View our latest analysis for Foot Locker

Foot Locker's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, Foot Locker was earning enough to cover the dividend, but it wasn't generating any free cash flows. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Looking forward, earnings per share is forecast to rise by 60.6% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 37% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the annual payment back then was $0.72, compared to the most recent full-year payment of $1.60. This means that it has been growing its distributions at 8.3% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Foot Locker might have put its house in order since then, but we remain cautious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings have grown at around 4.1% a year for the past five years, which isn't massive but still better than seeing them shrink. The company has been growing at a pretty soft 4.1% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On Foot Locker's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Foot Locker is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Foot Locker that you should be aware of before investing. Is Foot Locker not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FL

Foot Locker

Through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East.

Adequate balance sheet and fair value.