- United States

- /

- Specialty Stores

- /

- NYSE:DKS

Is There an Opportunity in DICK'S Sporting Goods After Latest Earnings Beat in 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with your DICK'S Sporting Goods shares, you are not alone. The stock has become a talking point among both retail and professional investors. With its last close at $234.20, DICK'S has steadily posted gains, climbing 3.1% over the past week and adding 3.6% in the last month. This year, it is up 3.2%, and when you zoom out to the long term, the story gets more impressive: 12.7% higher over the past year, 130.8% in the last three years, and a massive 352.3% jump across five years. Clearly, something is working in the company's favor.

Part of the momentum can be linked to optimism in the consumer sector, as Americans keep prioritizing fitness, outdoor activities, and youth sports. Investors are also starting to view DICK'S as less risky, and that perception alone can move markets. Of course, past performance is just the backdrop. The big question is whether the stock's current price is still attractive compared to its true value.

This is where valuation comes in, and DICK'S Sporting Goods looks compelling: on a scale with six major undervaluation checks, it scores a 5. That means it passes nearly every hurdle analysts use to spot underappreciated companies. Next, we will break down what these valuation approaches actually look at, and why many investors stop short with them. As you will see, there is an even better way to think about DICK'S value coming up later in this article.

Approach 1: DICK'S Sporting Goods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and discounting them back to their present value. This approach offers a forward-looking view and focuses on what the business is expected to generate in actual cash.

For DICK'S Sporting Goods, the latest reported Free Cash Flow stands at $689.8 Million. Analysts provide forecasts for several years, extrapolating the company's cash generation out to 2035. According to these projections, DICK'S is expected to generate $1.95 Billion in Free Cash Flow by 2030, with further increases projected into the next decade. These estimates show a healthy ramp-up in annual cash flow, driven by robust core operations and ongoing business expansion.

Based on this methodology, the DCF model calculates an intrinsic value of $558.07 per share. Compared to the current trading price of $234.20, this means the stock is trading at a significant discount, with a margin of 58.0% below its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DICK'S Sporting Goods is undervalued by 58.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

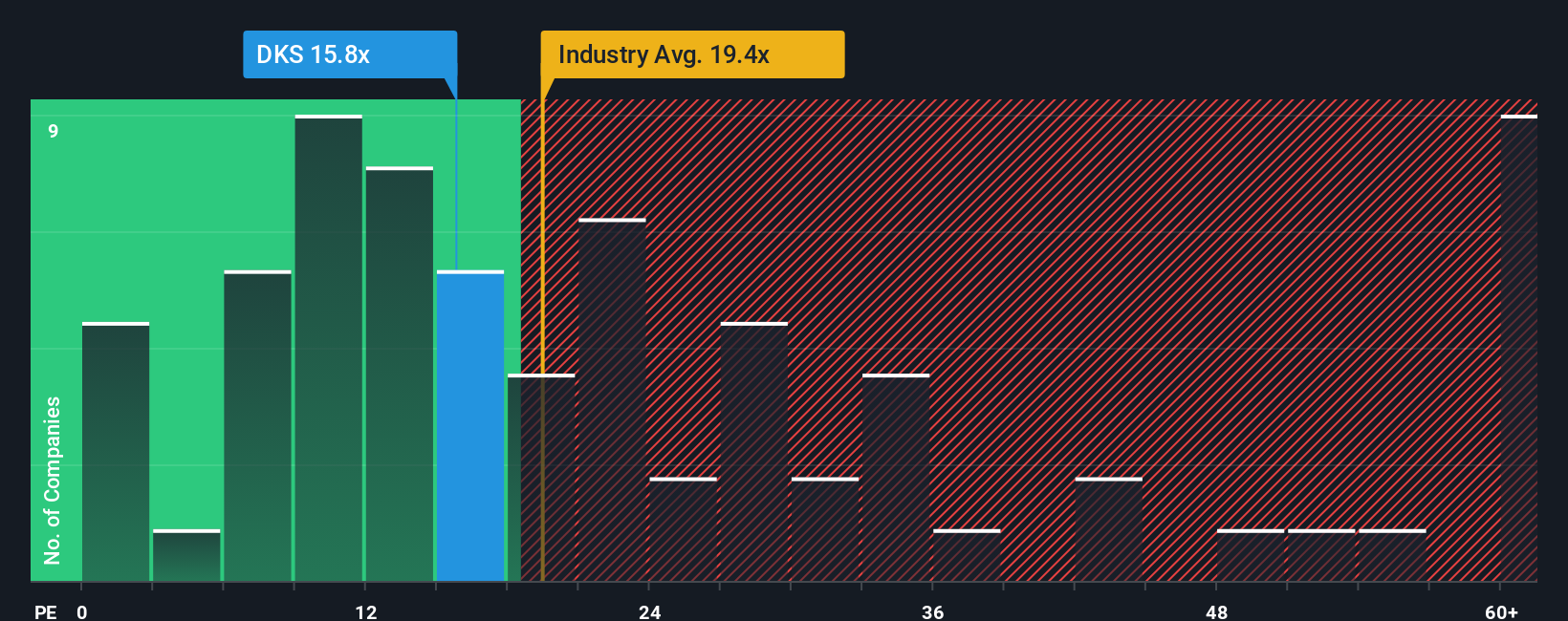

Approach 2: DICK'S Sporting Goods Price vs Earnings

For profitable companies like DICK'S Sporting Goods, the Price-to-Earnings (PE) ratio is often the go-to metric for understanding valuation. The PE ratio tells you how much investors are willing to pay for each dollar of current earnings, making it a direct line to how the market views the company’s profitability and growth prospects.

What counts as a “normal” PE ratio is not set in stone. Higher growth expectations and lower perceived risk generally justify a higher PE, while slow growth or greater risk suggest a lower multiple is fair. DICK'S Sporting Goods is currently trading at 16x earnings, which sits just below the Specialty Retail industry average of 16.6x and is far beneath the peer group average of 45.6x.

Simply Wall St’s “Fair Ratio” helps sharpen the picture even further. Unlike a basic industry or peer comparison, the Fair Ratio for DICK'S is 19.3x, a proprietary benchmark that adjusts for the company’s earnings growth, profit margins, risk profile, industry, and market cap. This approach is designed to be more tailored, recognizing that every company’s context is different and that a simple average may miss critical differences.

With DICK'S Sporting Goods trading at 16x and a Fair Ratio of 19.3x, the stock looks undervalued by this metric. The current valuation sits comfortably below what you would expect, given the company’s unique performance and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DICK'S Sporting Goods Narrative

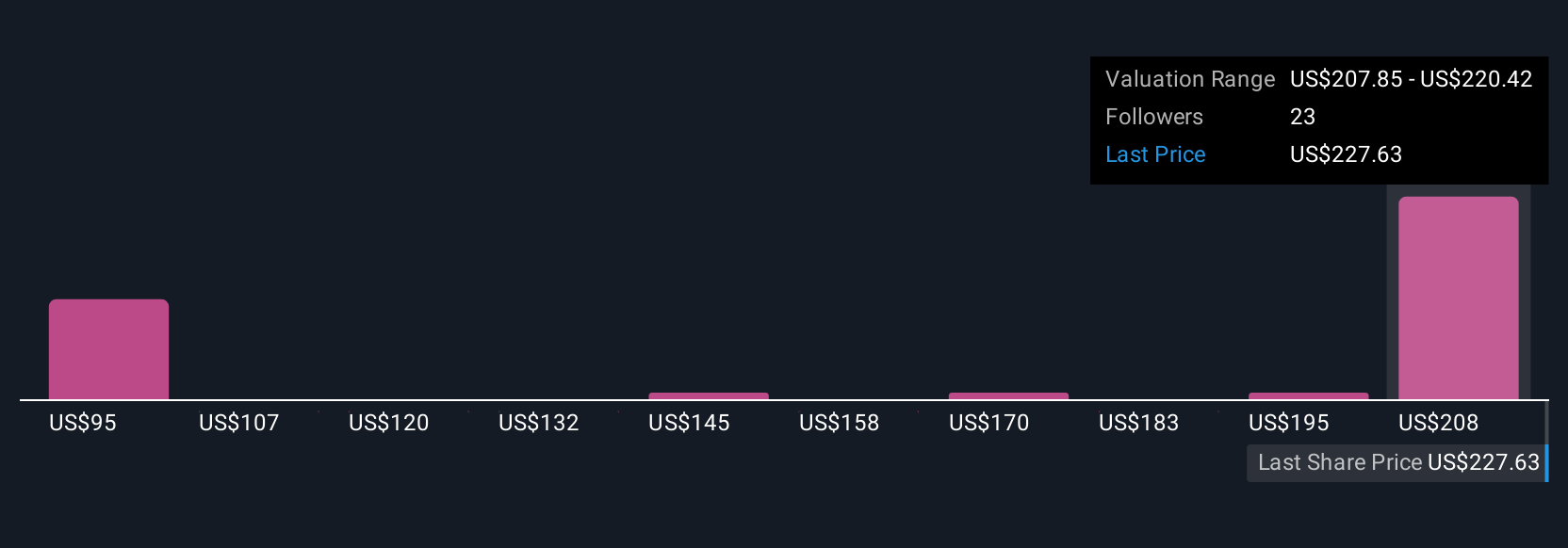

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative provides a clear, story-driven perspective on a company by connecting its outlook, strategies, and risks to a set of financial forecasts, turning big-picture thinking into concrete numbers like future revenue, profit margins, and fair value estimates.

On Simply Wall St's Community page, millions of investors can share and compare these Narratives, making it easy for you to see how different stories about DICK'S Sporting Goods’ future translate into investment decisions. Narratives help you decide whether to buy, hold, or sell by comparing each story’s Fair Value against today's Price. They automatically update as soon as fresh news, results, or events emerge, so your insights are always up to date.

For example, some investors think DICK’S will thrive on the back of omnichannel growth and new acquisitions. Their Narrative sees a high Fair Value, like $280.00 per share. Others are more cautious about integration risks and margin pressure, with a much lower Fair Value, around $165.00. In seconds, you can build or adopt a Narrative that fits your view, helping you make smarter, more confident investment decisions.

Do you think there's more to the story for DICK'S Sporting Goods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives