- United States

- /

- Specialty Stores

- /

- NYSE:DKS

How Raised 2025 Earnings Guidance And Capital Returns At DICK'S Sporting Goods (DKS) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- DICK'S Sporting Goods recently reported third-quarter 2025 results showing sales rising to US$4,167.77 million while net income eased to US$75.21 million, and the company raised its full-year 2025 earnings guidance to US$14.25–US$14.55 per diluted share alongside updated sales and comparable sales targets.

- At the same time, DICK'S affirmed a quarterly dividend of US$1.2125 per share, continued its multibillion-dollar share repurchase program, and moved to strengthen its newly acquired Foot Locker business by appointing veteran global retailer Matthew Barnes to lead international operations.

- With DICK'S lifting its 2025 earnings outlook, we’ll now examine how this guidance upgrade shapes the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DICK'S Sporting Goods Investment Narrative Recap

To own DICK'S Sporting Goods, you need to believe it can turn the Foot Locker acquisition into a profit driver while keeping its core sporting goods business healthy. The latest results show strong sales but weaker earnings, so the raised 2025 EPS guidance is an important near term catalyst, while integration and turnaround risk at Foot Locker remains the biggest swing factor. This news does not remove that risk, but it does show management’s confidence in the current plan.

The guidance upgrade to US$14.25 to US$14.55 in full year diluted EPS, alongside higher sales and comp expectations, is the most relevant announcement right now. It directly connects to the catalyst of expanding the customer base and improving earnings power after absorbing Foot Locker, while also putting more focus on whether DICK'S can manage costs, store investments and category mix without further margin pressure.

Yet investors should also be aware that integration risk at Foot Locker and heavier store investments could still pressure margins if...

Read the full narrative on DICK'S Sporting Goods (it's free!)

DICK'S Sporting Goods' narrative projects $15.0 billion revenue and $1.3 billion earnings by 2028. This requires 2.9% yearly revenue growth and an earnings increase of about $0.1 billion from $1.2 billion today.

Uncover how DICK'S Sporting Goods' forecasts yield a $236.43 fair value, a 13% upside to its current price.

Exploring Other Perspectives

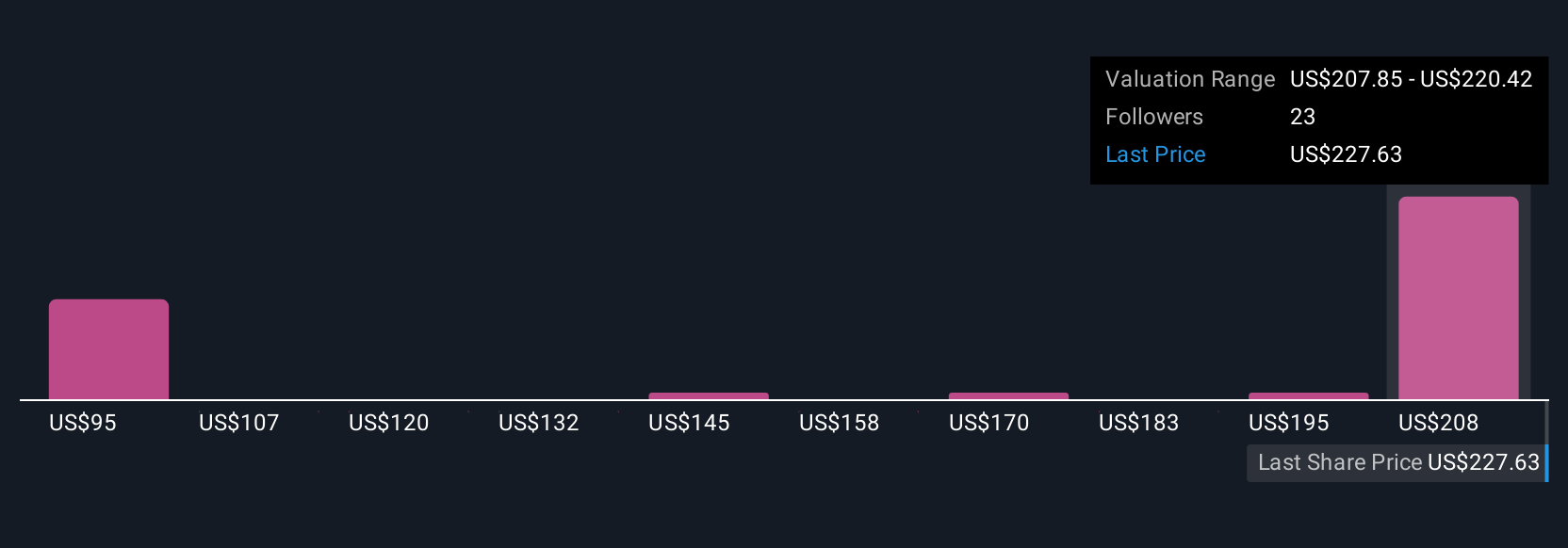

The Simply Wall St Community’s six fair value estimates for DICK'S range from US$153.36 to US$346.76, showing how far apart individual views can be. As you weigh those perspectives, remember that much of the investment case now hinges on whether Foot Locker’s turnaround and the broader footwear exposure support sustainable earnings rather than add prolonged margin strain.

Explore 6 other fair value estimates on DICK'S Sporting Goods - why the stock might be worth as much as 66% more than the current price!

Build Your Own DICK'S Sporting Goods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DICK'S Sporting Goods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DICK'S Sporting Goods' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026