- United States

- /

- Specialty Stores

- /

- NYSE:DKS

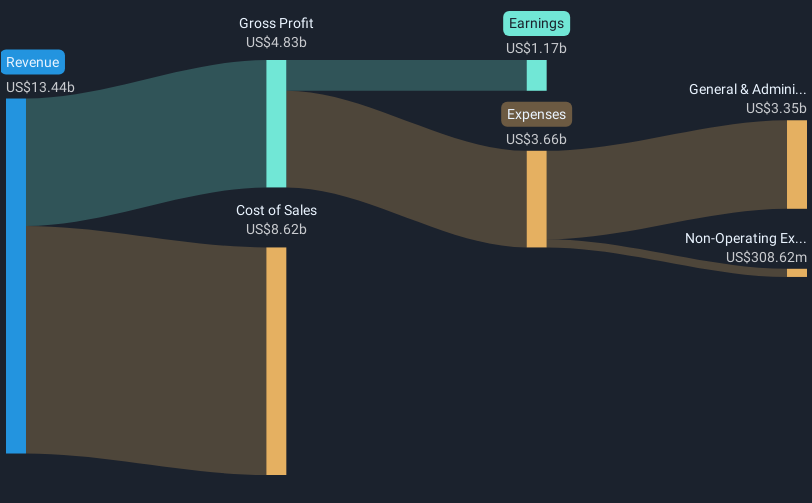

DICK'S Sporting Goods (NYSE:DKS) Reports US$13 Billion Sales and Announces US$3 Billion Buyback Program

Reviewed by Simply Wall St

DICK'S Sporting Goods (NYSE:DKS) recently reported a 1.28% share price decline over the last quarter despite robust earnings growth for the fourth quarter and full year ended February 1, 2025. The company's sales, net income, and EPS all increased compared to the previous year, illustrating strong financial health. Additionally, DICK'S Sporting Goods continued to focus on shareholder value with an extensive share repurchase program, announcing a new $3 billion buyback plan. This comes amid broader market trends of declining indices due to economic uncertainty, heightened by recent policy shifts such as increased tariffs imposed by the Trump administration on Canadian steel and aluminum. The overall market faced volatility, with the Dow Jones and S&P 500 experiencing significant slumps, which potentially contributed to the performance of DKS. Despite these market conditions, DICK'S remains committed to enhancing shareholder value through its ongoing strategic initiatives.

Click here and access our complete analysis report to understand the dynamics of DICK'S Sporting Goods.

Over the last five years, DICK'S Sporting Goods achieved a very large total shareholder return of 1074.22%, highlighting its strong performance. This exceptional growth can be attributed to several key factors. The company experienced robust earnings growth, demonstrated by its consistent increase in sales and net income. Notable contributions include the strategic enhancement of its dividend, now at US$1.10 per share, and an extensive share buyback program, with US$3 billion allocated to repurchasing shares to boost shareholder value.

Additionally, DICK'S exceeded both the broader US market and the Specialty Retail industry in terms of return over the past year, showcasing its resilience and operational strength amid volatile market conditions. The establishment of an 800,000 square foot distribution center in Texas supported operational expansion, while new product offerings, like SQAIRZ shoes, expanded its customer base. These measures, combined with strong leadership appointments, reinforced DICK'S position in the competitive retail landscape.

- Get the full picture of DICK'S Sporting Goods' valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for DICK'S Sporting Goods and understand their potential impact—click to learn more.

- Invested in DICK'S Sporting Goods? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DICK'S Sporting Goods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives