- United States

- /

- Specialty Stores

- /

- NYSE:DKS

Assessing DICK'S Sporting Goods After Strong Q1 Earnings and Robust Three Month Rally

Reviewed by Simply Wall St

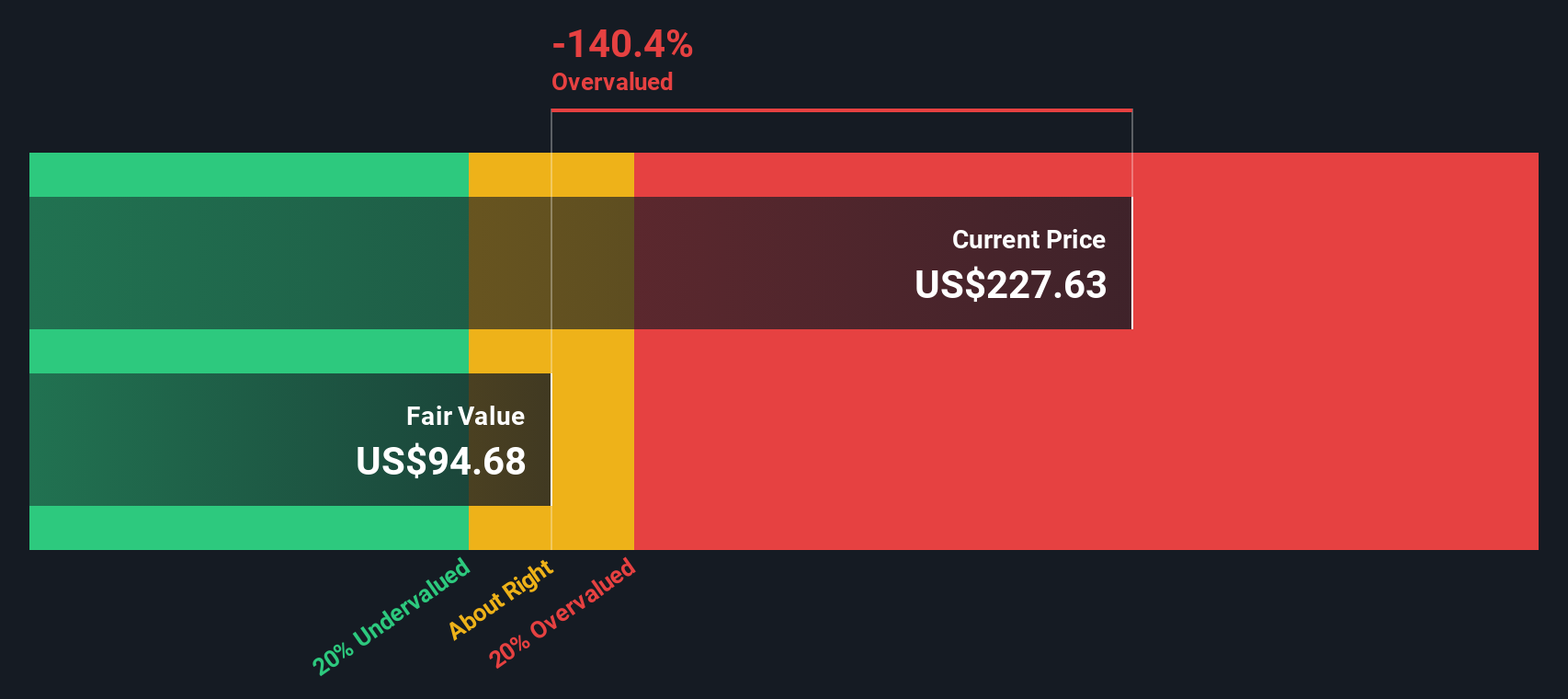

Approach 1: DICK'S Sporting Goods Cash Flows

A Discounted Cash Flow (DCF) model is designed to determine what a business is worth today by estimating future free cash flows and then discounting them back to the present using a required rate of return. This method gives investors a sense of a company's intrinsic value compared to its current market price.

For DICK'S Sporting Goods, the latest reported Free Cash Flow (FCF) is approximately $584 million. Projections suggest that FCF could reach around $514 million by 2035, although estimates fluctuate throughout the decade and some years are expected to dip before recovering. Analysts use these trends to estimate growth and future earnings potential.

Based on these forward-looking calculations, the DCF model estimates an intrinsic share value of $94.99 for DICK'S. When compared to the current share price, this produces a -134.6% intrinsic discount. In DCF terminology, a negative discount indicates that the stock is substantially overvalued according to this model.

Result: OVERVALUED

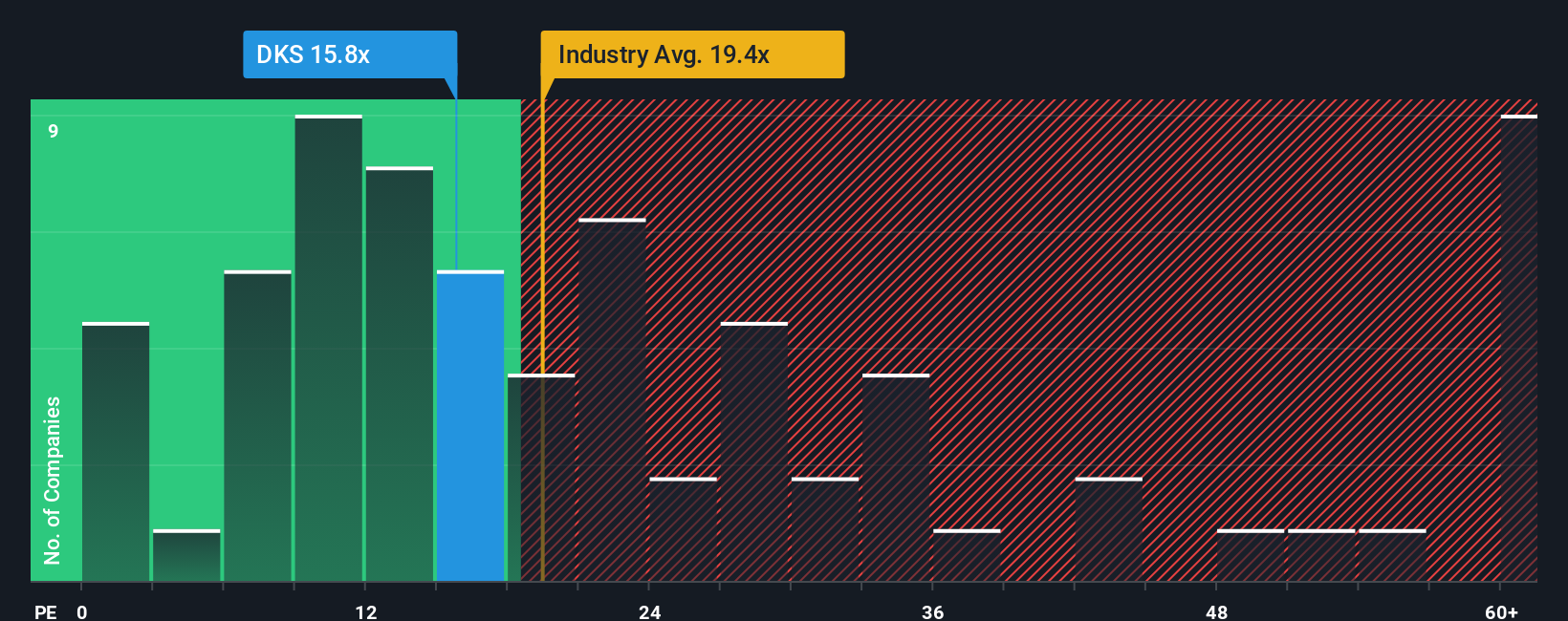

Approach 2: DICK'S Sporting Goods Price vs Earnings

For profitable companies like DICK'S Sporting Goods, the Price-to-Earnings (PE) multiple is often the most useful way to gauge valuation. This ratio measures how much investors are willing to pay for each dollar of earnings and provides a straightforward sense of whether a stock is priced attractively relative to its profits.

What is considered a “normal” or “fair” PE multiple depends largely on expected earnings growth and the perceived risk of the business. Higher growth or lower risk can justify a higher multiple, while slower growth or greater uncertainty usually warrants a lower one.

Currently, DICK'S Sporting Goods trades at a PE of 15.46x. That is below the average for its Specialty Retail industry, which stands at 18.56x, and also below the broader peer group average of 30.46x. According to Simply Wall St’s proprietary Fair Ratio model, which considers factors like earnings growth, market position, and risk, the fair PE for DICK'S is estimated at 15.90x.

Since the fair PE ratio and the actual PE are nearly identical, DICK'S Sporting Goods stock appears to be valued about right relative to its future prospects and industry norms.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your DICK'S Sporting Goods Narrative

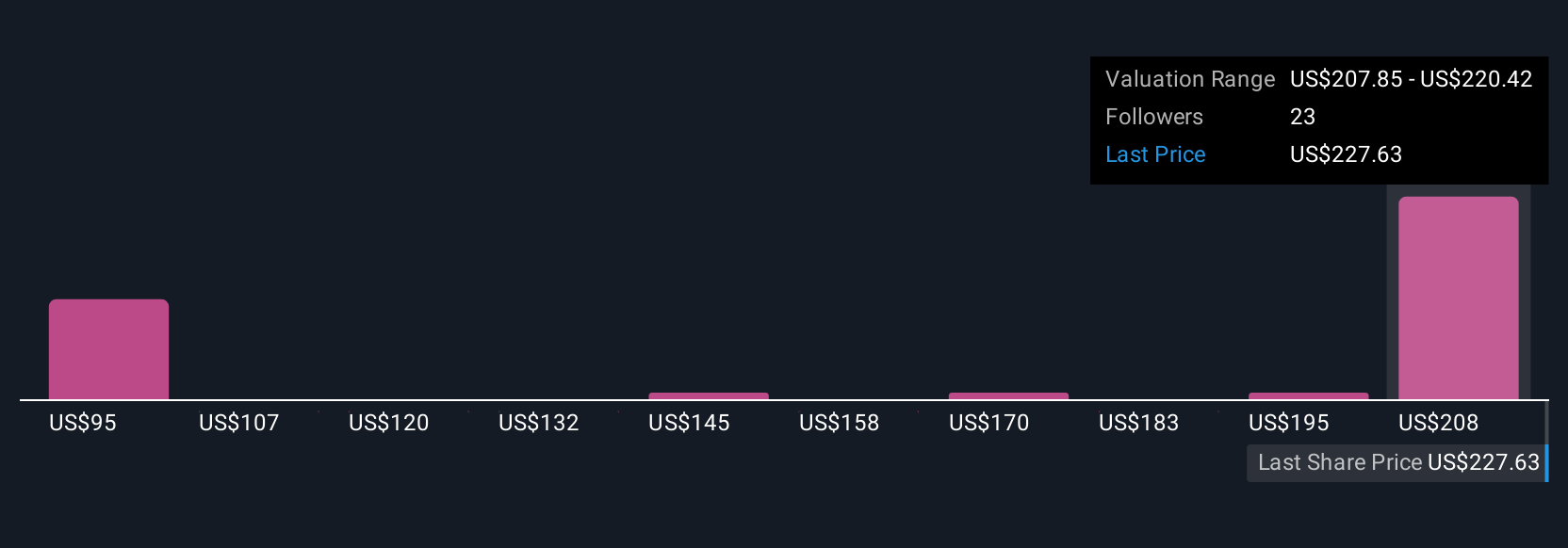

A Narrative is your own investment story. These are the reasons you believe in a company’s future, supported by what you think it will earn, how its sales will change, and what its fair price should be. Instead of just looking at numbers, Narratives connect a company’s story, your forecasts, and a fair value calculation, giving you a complete picture behind the stock price.

On Simply Wall St, millions of investors use Narratives to quickly create, compare, and update their outlooks. This approach makes stock analysis more intuitive and accessible. Narratives help answer the key question: Is the company’s fair value above or below the current share price, and is it time to act?

Narratives are powerful because they automatically update as news, results, or market events change the facts, so your view always stays relevant. For example, for DICK'S Sporting Goods, some investors see upside with a fair value near $270 if new store concepts succeed and margins grow. Others project downside to $165 if costs climb or consumer demand fades.

Do you think there's more to the story for DICK'S Sporting Goods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives