What Dillard's (DDS)'s Dividend Hike and Buybacks Signal About Management's Commitment to Shareholders

Reviewed by Simply Wall St

- Dillard’s announced a cash dividend increase to US$0.30 per share and reported second quarter results with sales of US$1,513.8 million and net income of US$72.8 million.

- Management also completed a major share repurchase program, reflecting a strong focus on shareholder returns and confidence in the business outlook.

- We’ll explore how the dividend hike and continued buybacks influence Dillard’s investment story and management’s shareholder priorities.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Dillard's Investment Narrative?

For a shareholder in Dillard’s, confidence often centers around whether management’s disciplined capital allocation, recently seen in a dividend increase and completion of a substantial share buyback, continues to underpin shareholder returns amid shifting retail trends. The uptick in the quarterly dividend to US$0.30 per share and steady pace of buybacks reaffirm that shareholder rewards remain a core priority for the company. Recent earnings held steady on sales and margins, but a slight dip in net income keeps profitability in focus, especially with forecasts suggesting that both earnings and revenues may pull back over the next few years. While the current return on equity is high and the company looks attractively valued compared to industry peers, longer-term risks tied to revenue contraction, evolving consumer behavior, and sector-wide competition remain top of mind. The latest announcements don’t fundamentally shift the key short-term catalysts or the bigger risks facing Dillard’s, but they do signal continued alignment between management and shareholder interests.

Yet beneath this, continued pressure on revenues is a risk investors should closely watch.

Exploring Other Perspectives

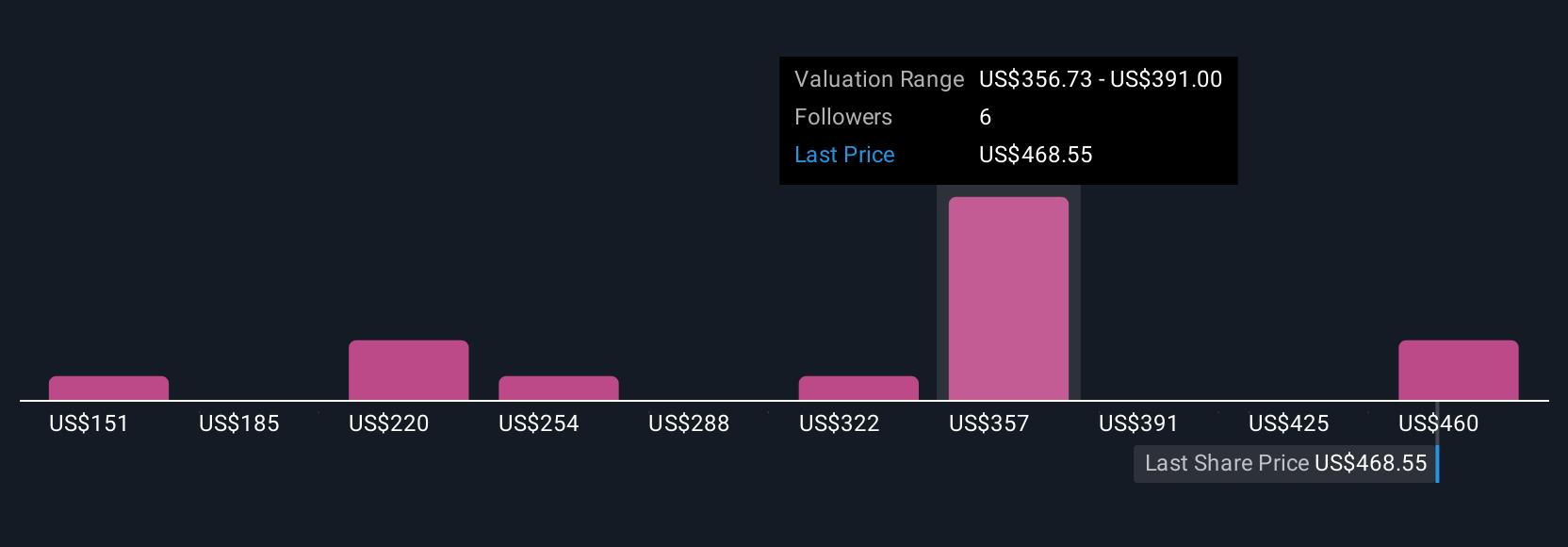

Explore 8 other fair value estimates on Dillard's - why the stock might be worth less than half the current price!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives