How Investors Are Reacting To Dillard's (DDS) Better Than Expected Q2 Results and Raised Outlook

Reviewed by Simply Wall St

- In the past week, Dillard's reported stronger-than-expected second-quarter fiscal 2025 results, with net sales and earnings per share surpassing analyst estimates due to effective expense control.

- This performance has prompted upward revisions in earnings forecasts, highlighting increased analyst confidence in the company's financial health and sales momentum.

- We'll explore how improving sales momentum and earnings outlook shape Dillard’s investment narrative going forward.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Dillard's Investment Narrative?

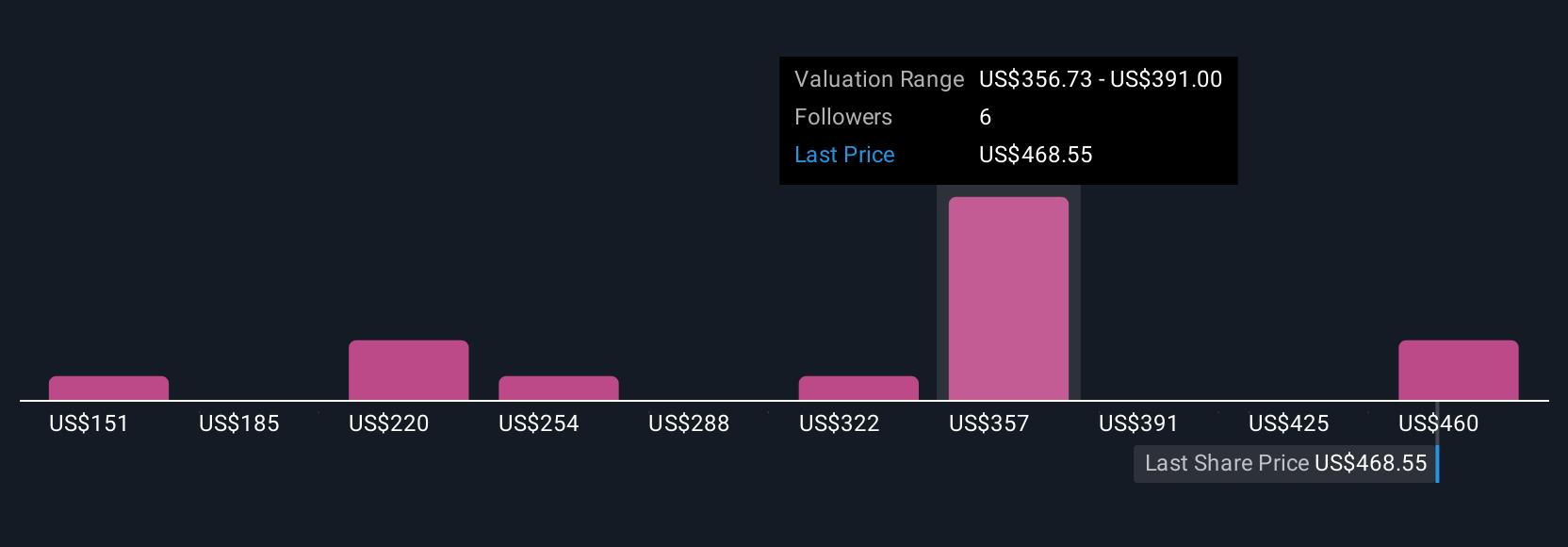

To be a shareholder in Dillard’s today, you’re essentially putting faith in the company’s ability to keep managing costs well and maintain sales momentum as it did in the most recent quarter, which helped push the share price to a new high. The strong results freshen up the short-term story, as they’ve led to analyst upgrades and point to possible catalysts like continued expense control and active capital returns, such as consistent dividends and ongoing share buybacks. Still, risks aren’t off the table. Before this latest release, the main risks centered around declining revenue and earnings forecasts and questions about whether Dillard’s industry could rebound. The recent performance may ease immediate concerns about sales slippage, but profit growth pressures, competitive consumer spending, and the reality that the business is priced above analyst fair value estimates remain factors investors may want to keep in view going forward.

On the flip side, the company’s premium price vs. fair value remains a piece many overlook.

Exploring Other Perspectives

Explore 8 other fair value estimates on Dillard's - why the stock might be a potential multi-bagger!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives