Do Steady Sales and Buybacks Reveal Dillard’s (DDS) Evolving Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Dillard’s, Inc. recently reported steady Q2 2025 results, with both total retail sales and comparable store sales increasing 1%, and the company repurchasing 24,500 shares for US$9.8 million as part of its ongoing buyback program.

- This combination of consistent operational performance and continued capital return to shareholders appears to have further solidified investor confidence in the company.

- We’ll explore how the steady sales growth and ongoing share buybacks are shaping Dillard’s investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Dillard's Investment Narrative?

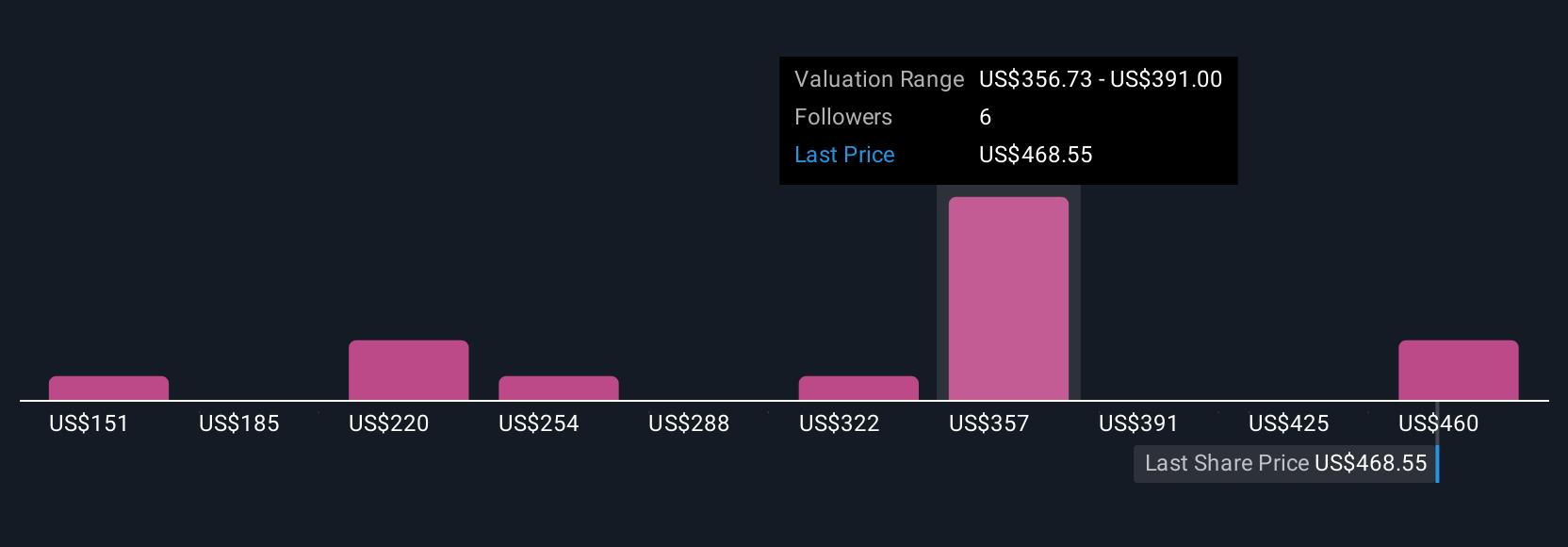

For a Dillard's shareholder, the big picture story hinges on consistent operational execution, reliable shareholder returns, and an ability to sustain margins in a challenging retail environment. This quarter’s slight uptick in retail sales and continuing buybacks reinforce investor confidence, reflected in the recent stock price strength and the company hitting a 52-week high. However, headwinds remain: board independence concerns persist, and both revenue and earnings are forecast to see high single- to double-digit annual declines. While the Q2 results are steady, they aren't likely to meaningfully shift those underlying trends or the biggest questions around long-term earnings power. In the short term, continued buybacks and steady dividends are supporting the stock, but expectations for declining profitability and a lofty valuation relative to consensus targets may keep risk on the table, especially as price now stands above analyst fair value. On the flip side, investors should pay close attention to concerns about future earnings growth.

Dillard's shares are on the way up, but they could be overextended by 10%. Uncover the fair value now.Exploring Other Perspectives

Explore 8 other fair value estimates on Dillard's - why the stock might be worth less than half the current price!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives