- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

How Carvana’s 61.9% Rally and New Partnerships Are Shaping Its 2025 Value

Reviewed by Bailey Pemberton

- Wondering if Carvana is actually a bargain or just riding the hype? Let’s dig into what could be driving its current price and where the value really lies.

- Carvana’s stock has seen wild swings, up a remarkable 61.9% year-to-date but pausing with a 0.3% return in the last week, and even dipping 3.2% over the past month.

- Big moves like these often follow major headlines. Carvana’s recent partnerships and improvements in operational efficiency have been making waves. As a result, investor sentiment has shifted, with more eyes on growth potential and the company’s ability to adapt quickly.

- As for valuation, Carvana scores just 1 out of 6 checks as being undervalued using standard methods, so there’s a lot to unpack. Stick around as we break down how different valuation approaches stack up, and why there’s an even better way to see what Carvana is really worth, coming up at the end.

Carvana scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Carvana Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today using an appropriate rate. This helps investors judge whether the current price reflects the underlying business, rather than just market hype.

For Carvana, the DCF model uses recent Free Cash Flow (FCF) data of $520.3 million and forecasts significant annual growth. By 2029, Carvana’s FCF is projected to reach about $2.75 billion. While analysts provide estimates up to five years out, further forecasts are extrapolated to round out the decade. All projections are presented in US dollars.

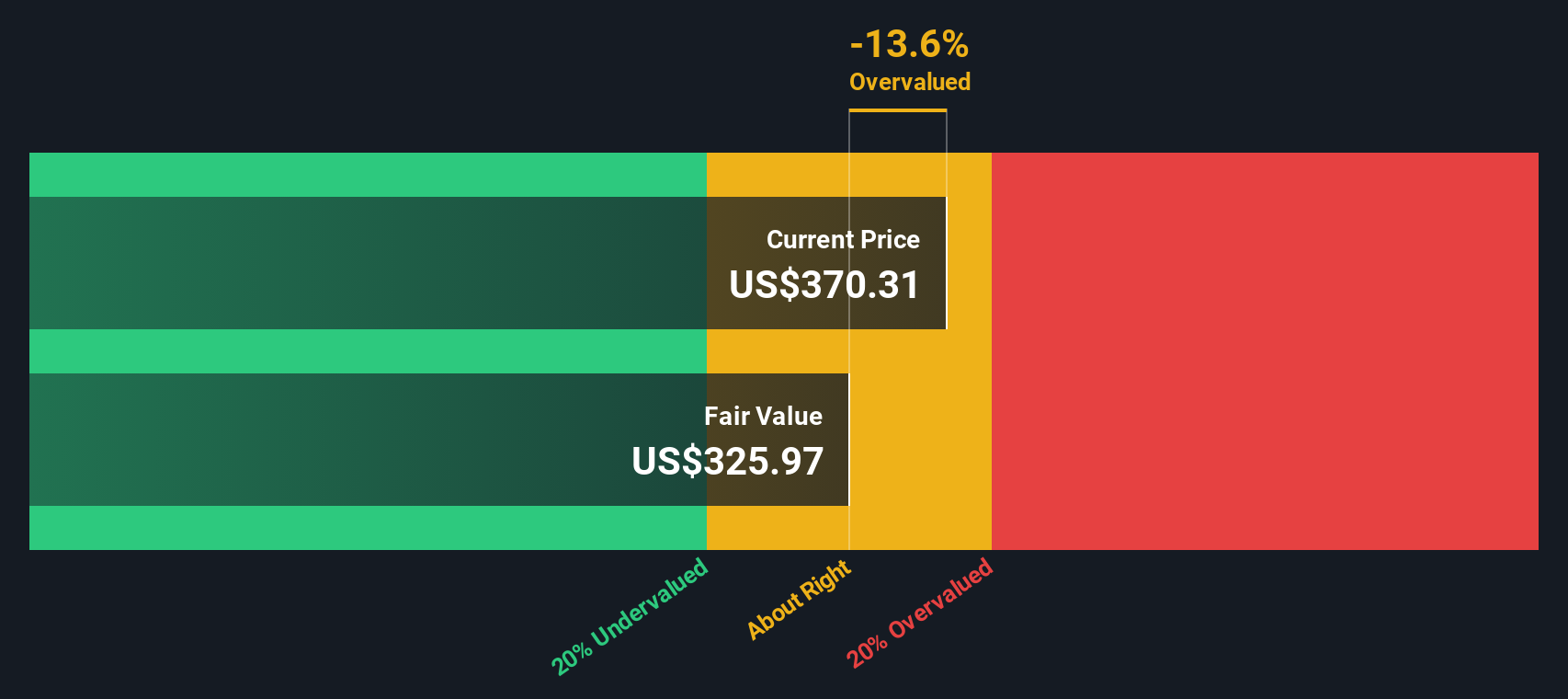

After crunching the numbers with a two-stage Free Cash Flow to Equity approach, Carvana’s estimated intrinsic value comes out to $274.62 per share. However, based on the current share price, the DCF model shows Carvana trading at a 17.7% premium to its intrinsic value, which means it is overvalued according to these projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carvana may be overvalued by 17.7%. Discover 892 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Carvana Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies, as it compares a stock’s current price to its earnings and provides a quick snapshot of how much investors are willing to pay for each dollar of profits. For companies like Carvana, this metric gains relevance as profitability stabilizes and earnings growth becomes a key driver of the stock’s future direction.

Growth expectations and business risk both have a major influence on what a fair PE ratio should be. Fast-growing companies or those with reliable, steady earnings tend to earn higher PE ratios, while more risky or slower-growing businesses usually have lower multiples. This is the market’s way of pricing in future opportunities or uncertainties.

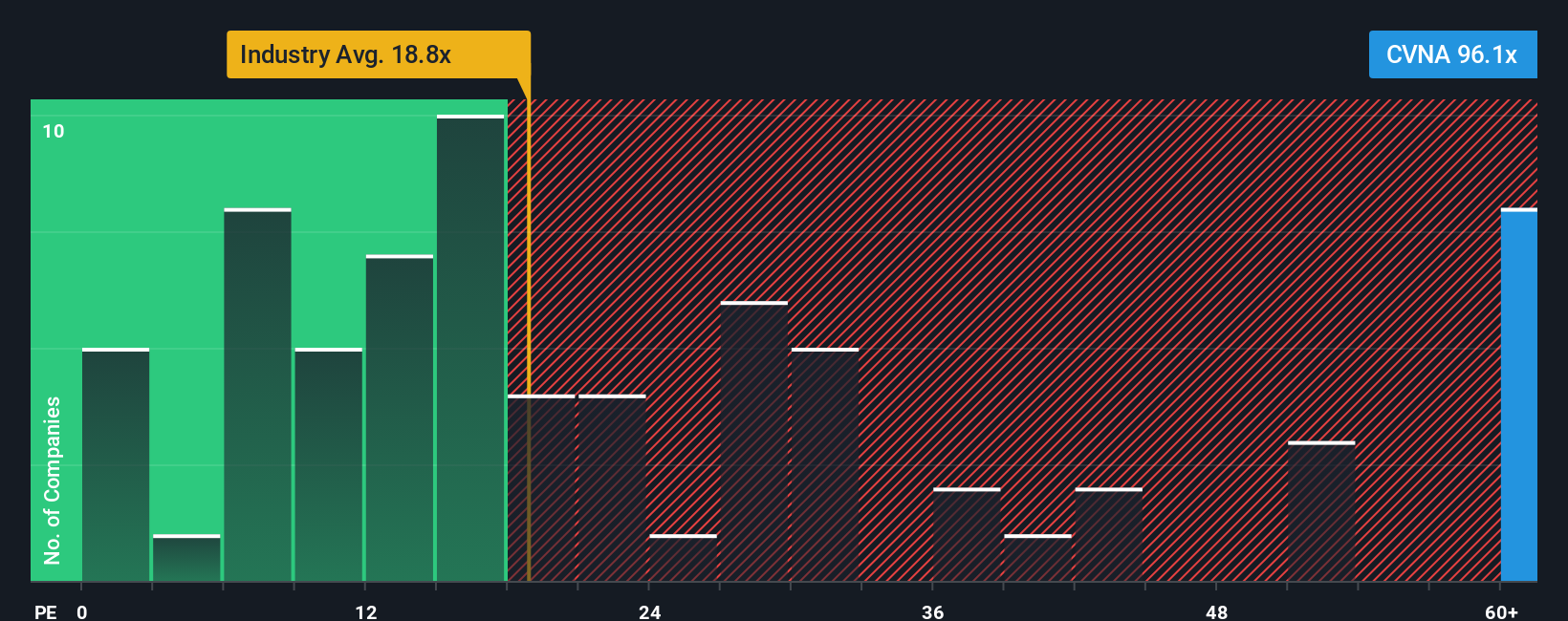

Carvana currently trades at a steep 72.6x PE ratio. For context, the Specialty Retail industry averages at just 16.6x, and Carvana’s closest peers average 19.5x. By these basic benchmarks, Carvana looks dramatically more expensive.

However, Simply Wall St’s proprietary “Fair Ratio” is more nuanced. It weighs not just earnings, but also growth prospects, profit margins, business risks, market cap, and the unique traits of Carvana’s sector. This provides a more tailored expectation of what the company’s appropriate PE multiple should be, which in this case is 37.7x. This approach gives a fuller valuation picture than a simple peer or industry comparison.

So how does Carvana stack up? Its current 72.6x PE is well above its Fair Ratio of 37.7x, signaling the stock is priced well ahead of what the fundamentals would suggest at this point in time.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carvana Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smarter, more dynamic approach to investing that goes beyond the numbers by allowing investors to articulate their perspective, the story behind the company, along with their own estimates of fair value, future revenue, earnings, and margins.

At their core, Narratives connect Carvana's business story, including its growth drivers, risks, and competitive strengths, to a detailed financial forecast, ultimately arriving at a fair value estimate. This means you are empowered to consider not just what the numbers say today, but what they could mean tomorrow when combined with your knowledge or market view.

Accessed easily on Simply Wall St’s Community page (used by millions globally), Narratives help you decide when to buy or sell by surfacing clear comparisons between a stock's fair value and its current market price. As new information, such as earnings or news updates, arrives, Narratives update dynamically, keeping your decision-making fresh and relevant without extra work.

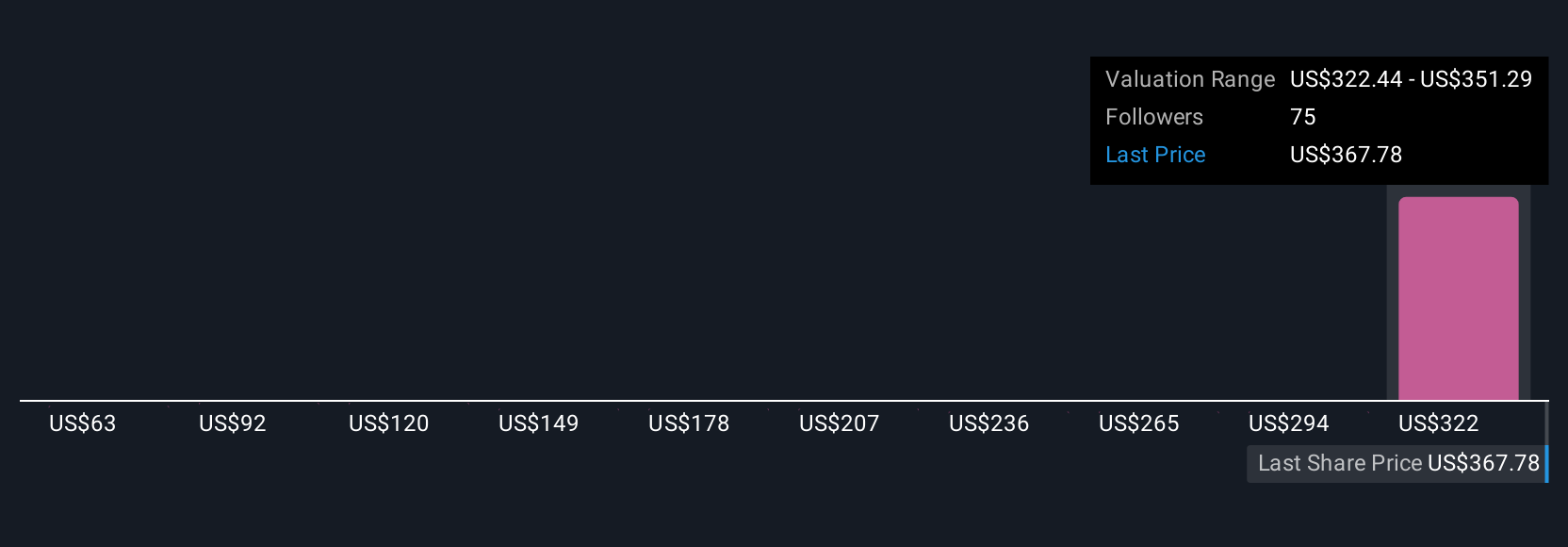

For example, some Carvana investors believe in aggressive digital transformation and forecast future earnings of $3.5 billion, supporting price targets as high as $500, while others who are more cautious see lingering risks limiting earnings to $902.9 million and fair value to $330. Narratives help you capture these views and take action that fits your conviction.

Do you think there's more to the story for Carvana? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success