- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Does Carvana’s 79% 2025 Rally Reflect Its Real Value After Debt Progress Headlines?

Reviewed by Bailey Pemberton

- Curious whether Carvana might be a bargain or overpriced right now? You are not alone, as plenty of investors are eyeing the stock for signs of its true value.

- Carvana’s share price has soared 79.1% year-to-date and is up 40.1% over the past year, suggesting renewed optimism in the business or a shift in risk perception.

- One factor fueling recent gains is Carvana’s successful progress in reducing its debt load. This has received positive coverage and made headlines as analysts reassess the company's long-term sustainability. Additionally, industry-wide momentum in the used car market continues to shape investor sentiment, with Carvana often at the center of these discussions.

- When it comes to valuation checks, Carvana scores 0 out of 6, with none indicating undervaluation today. Up next, we will break down what this means through mainstream approaches and reveal a fresh perspective you will want to keep in mind by the end.

Carvana scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Carvana Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors gauge what a business might truly be worth based on its ability to generate cash in the years ahead.

For Carvana, the latest reported Free Cash Flow stands at $520.3 million. Analysts provide cash flow forecasts for up to five years, and based on these and further projections, Carvana’s Free Cash Flow is projected to grow rapidly, reaching approximately $3.4 billion by the end of 2029. Beyond these analyst estimates, future values are extrapolated to provide a long-term view, all in US dollars.

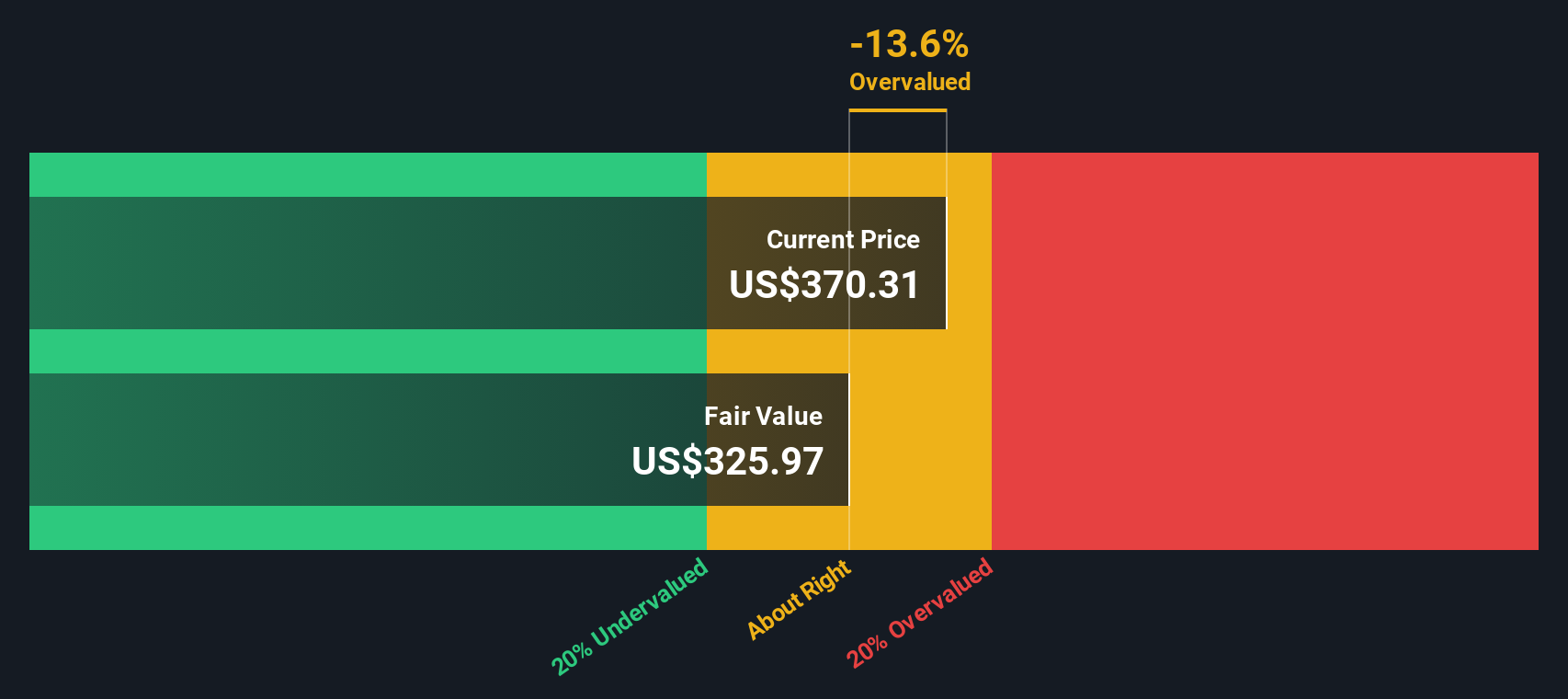

Based on this 2 Stage Free Cash Flow to Equity model, the intrinsic fair value of Carvana is calculated at $354.36 per share. When comparing this figure to the current market price, the analysis finds the stock to be just 0.8% overvalued. This margin is minor and suggests the current share price closely matches what the business is fundamentally worth through the lens of its expected cash flows.

Result: ABOUT RIGHT

Carvana is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Carvana Price vs Earnings

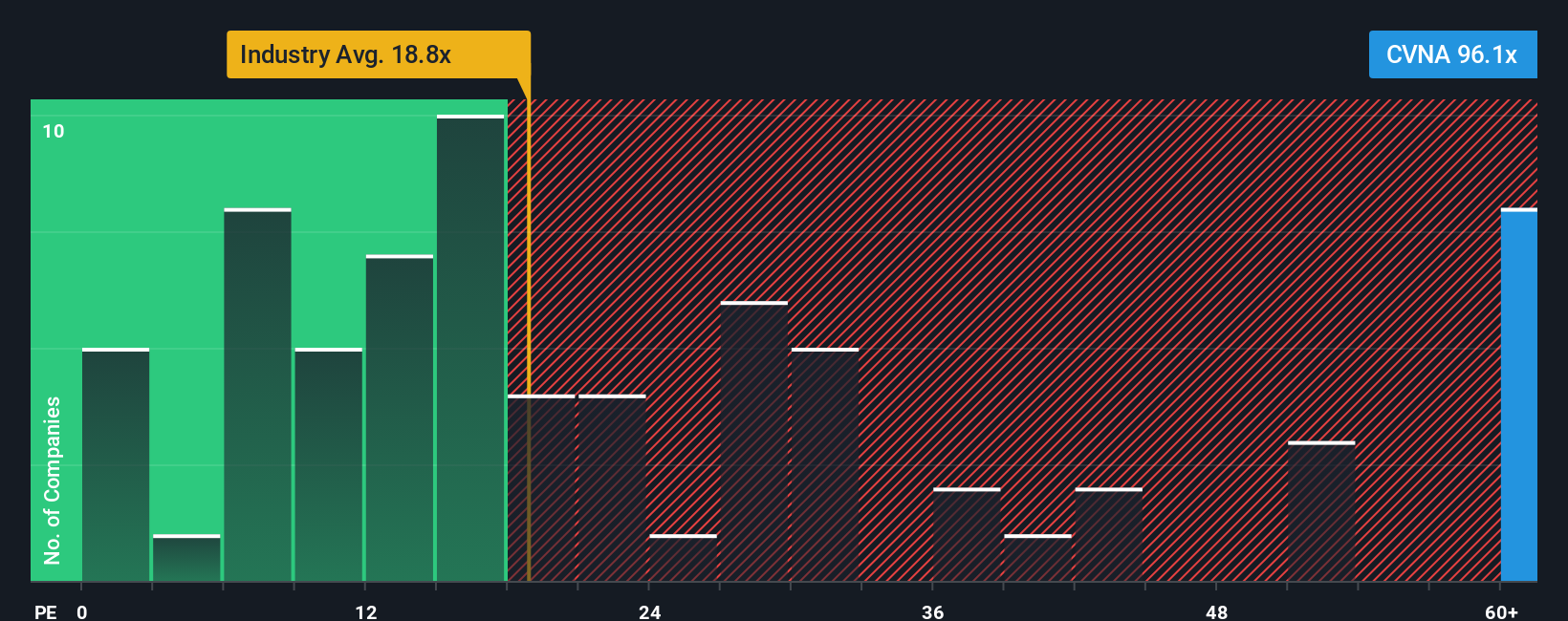

The price-to-earnings (PE) ratio is a commonly used metric for valuing companies that are consistently profitable. It allows investors to compare the stock price to the company's actual earnings, providing a baseline for evaluating whether a stock is priced appropriately relative to its profits.

When determining what a "normal" or fair PE ratio should be, both growth expectations and risks come into play. Companies with higher expected earnings growth or lower perceived risk often command higher PE ratios because investors are willing to pay more for each dollar of current earnings in anticipation of future gains. Conversely, higher risks or slower growth usually warrant a lower PE multiple.

Carvana currently trades at an 80.3x PE ratio, which stands well above the specialty retail industry average of 18.9x and the peer average of 20.2x. On the surface, this may suggest Carvana is richly valued compared to its industry. However, Simply Wall St's proprietary "Fair Ratio" goes a step further by factoring in Carvana's unique outlook for growth, profitability, risk, and market position. The Fair Ratio for Carvana is 38.3x, reflecting its strong expected earnings growth but also its risks and market context.

The advantage of using the Fair Ratio is that it is tailored to Carvana's specific situation, unlike the more generic peer or industry benchmarks. By considering elements like potential earnings power, profit margins, and company size, the Fair Ratio gives a more nuanced assessment of what would be a reasonable multiple for the stock.

Comparing Carvana's actual PE to the Fair Ratio indicates the stock is trading well above where it would be considered fair value by these measures, suggesting caution is warranted at today's levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carvana Narrative

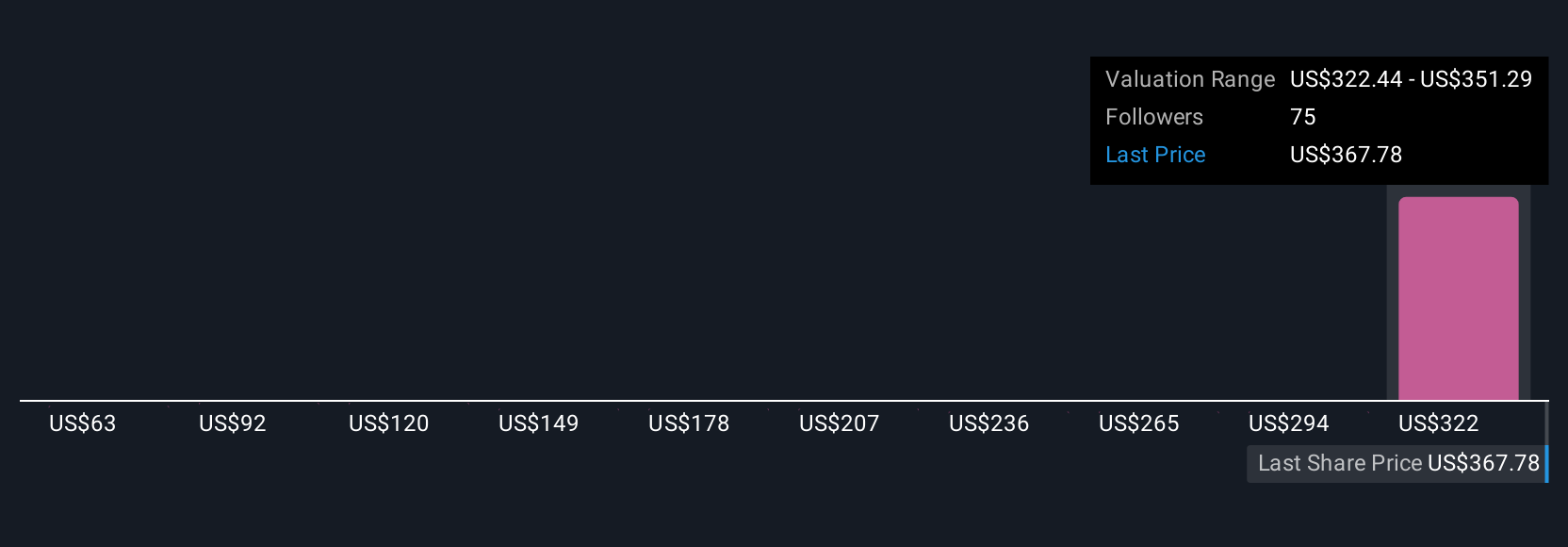

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own storyline about a company. It is the perspective you bring by combining what you believe about Carvana’s business drivers, market potential, and risks, with your assumptions about its future revenues, earnings, and margins. Narratives connect this company story to a financial forecast and, ultimately, to the fair value you estimate.

The power of Narratives is that anyone can create or follow them. With easy-to-use tools available right inside the Simply Wall St Community page, used by millions of investors, Narratives make investment decisions more dynamic by letting investors compare a fair value (based on their Narrative assumptions) directly to the real market price. This enhances clarity about when to consider buying or selling.

Best of all, these Narratives update dynamically as new information, such as news or earnings, arrives, so investors stay in sync with the market's evolving story. For example, on Carvana, one Narrative currently expects a fair value as high as $500.00 (based on aggressive growth and margin assumptions), while another sees just $330.00 (with more conservative estimates and highlighted risks). This underscores how different perspectives directly shape fair value and puts the investor’s viewpoint at the center of smarter decision making.

Do you think there's more to the story for Carvana? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success