- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): Assessing Valuation After Rate Cut Optimism and Same-Day Delivery Rollout

Reviewed by Simply Wall St

Carvana (CVNA) shares drew attention after a lower-than-expected inflation reading sparked new hope for an interest rate cut. This added fuel to the company's own momentum from its same-day delivery launch in San Diego.

See our latest analysis for Carvana.

Optimism around cooling inflation and Carvana’s same-day delivery expansion helped reignite momentum, with a 2.69% one-day share price gain and a 75.99% year-to-date return catching investor attention. Despite some volatility, the 1-year total shareholder return of 71.3% highlights a dramatic turnaround and long-term optimism.

If this kind of rapid rebound has you watching for the next big mover, it could be the right moment to discover fast growing stocks with high insider ownership

With shares already boasting extraordinary gains and Wall Street sentiment swinging between glowing price targets and deep skepticism, investors must now weigh whether Carvana’s comeback story still has room to run or if expectations have already driven the stock’s price ahead of its fundamentals.

Most Popular Narrative: 17.1% Undervalued

Carvana’s narrative fair value sits at $423.60, significantly higher than the recent closing price of $351.20. With this gap, the spotlight is on what is fueling such a bold valuation.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market. This supports potential long-term unit and revenue growth. Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reduce per-unit costs, and may contribute to net margin expansion.

Want to see what’s driving this ambitious price target? The narrative hints at breakthrough technology, relentless revenue expansion, and margins reaching levels normally reserved for market leaders. Find out what assumptions back up this eye-catching valuation.

Result: Fair Value of $423.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if operational bottlenecks emerge or competition accelerates faster than expected, Carvana’s optimistic growth story could quickly come under pressure.

Find out about the key risks to this Carvana narrative.

Another View: Are the Ratios Telling a Different Story?

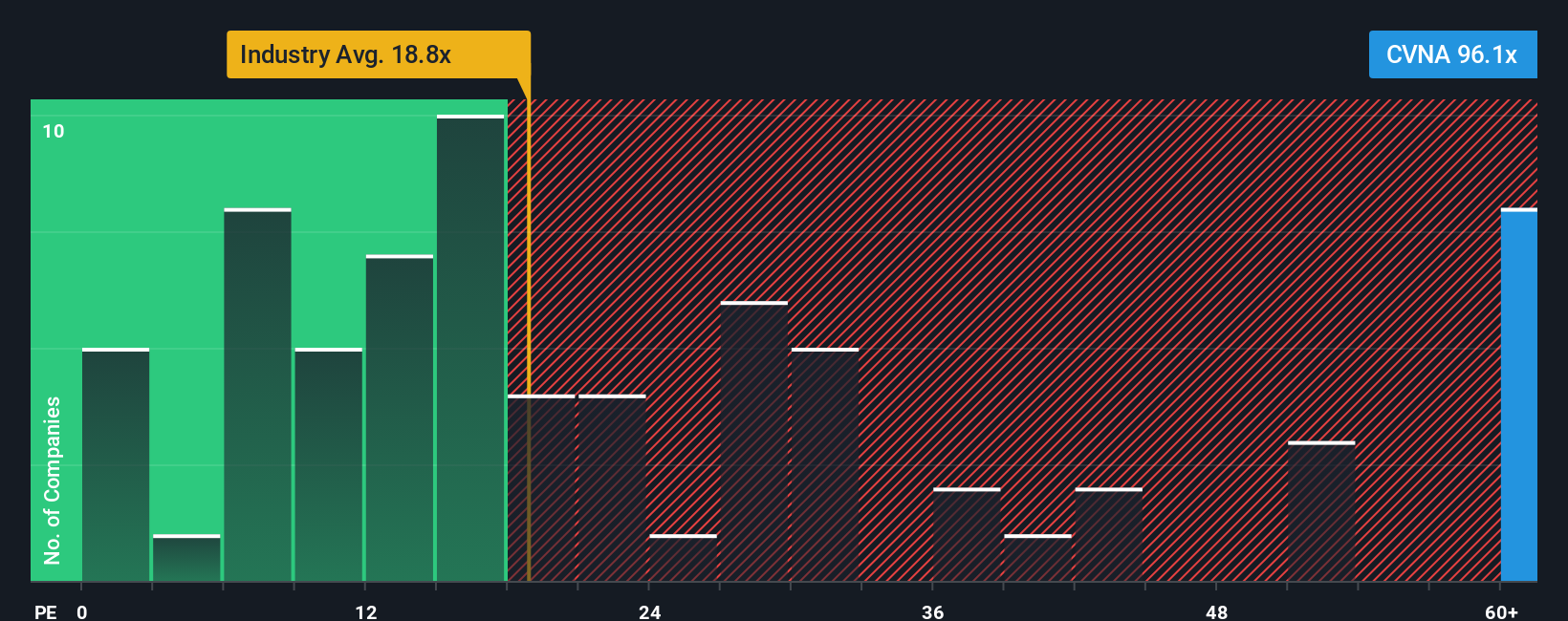

But not everyone agrees with the ambitious valuation narrative. On a price-to-earnings basis, Carvana looks expensive. Its ratio stands at 86.1 times earnings, sharply above the U.S. Specialty Retail industry average of 16.8 and the peer group at 20.2. Even compared to its fair ratio of 41.8, the current multiple suggests the market is assuming a lot of future growth already. Is this optimism justified, or could investors be paying up for lofty expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If you're not convinced by these narratives or prefer to draw your own conclusions, you can dig into the numbers and craft a unique viewpoint in just a few minutes, so why not Do it your way

A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for new opportunities. Make your portfolio stand out by targeting sectors where the next breakout winner could emerge. Don't wait and wish you'd acted sooner!

- Seize strong yields by reviewing these 17 dividend stocks with yields > 3%, a shortcut to finding companies offering robust and consistent income streams above 3%.

- Tap into early-stage innovation and check out these 27 AI penny stocks powering breakthroughs across automation, data, and next-generation technology.

- Benefit from attractive market pricing through these 872 undervalued stocks based on cash flows, revealing stocks with compelling cash flow potential the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives