Coupang (NYSE:CPNG) Valuation Update: Strategic Tech Investments Signal Positive Long-Term Outlook

Reviewed by Simply Wall St

Recent reports show Coupang, Inc. is doubling down on artificial intelligence, robotics, and cloud computing to upgrade its logistics and worldwide reach. These moves are leading to higher profitability and steady customer growth, with notable support for smaller businesses.

See our latest analysis for Coupang.

Coupang’s push into AI and advanced logistics is arriving alongside notable momentum in its stock. The share price return this year sits at a stellar 43.9%, while the 1-year total shareholder return reached 22.2%. Long-term holders have seen the total shareholder return climb 91.2% over three years. Enthusiasm is clearly building, with recent innovation fueling expectations for even more growth ahead.

If Coupang’s strong performance has you thinking about tomorrow’s winners, now is the perfect time to discover See the full list for free.

Still, with Coupang’s stock up nearly 44% year-to-date and trading just below analyst targets, investors are left to wonder if today’s price reflects all its future growth or if there is still room to buy in.

Most Popular Narrative: 7.1% Undervalued

The most widely followed narrative prices Coupang at $34.52 per share, a notable premium over the latest close at $32.07. This takes into account the momentum behind Coupang’s growth strategy and weighs it against current profit margins.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins. Management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

What is the secret recipe that justifies this edge in value? A sharp-eyed forecast for fatter margins and bold expansion powers this narrative’s confidence. Ready to peek at the aggressive revenue growth and ambitious profit targets that fuel this fair value? Discover the vision behind these numbers and see how they might redefine Coupang’s future.

Result: Fair Value of $34.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high costs in new markets and reliance on Korea could undermine Coupang’s bold growth narrative if expansion does not deliver expected returns.

Find out about the key risks to this Coupang narrative.

Another View: What Does Our DCF Model Say?

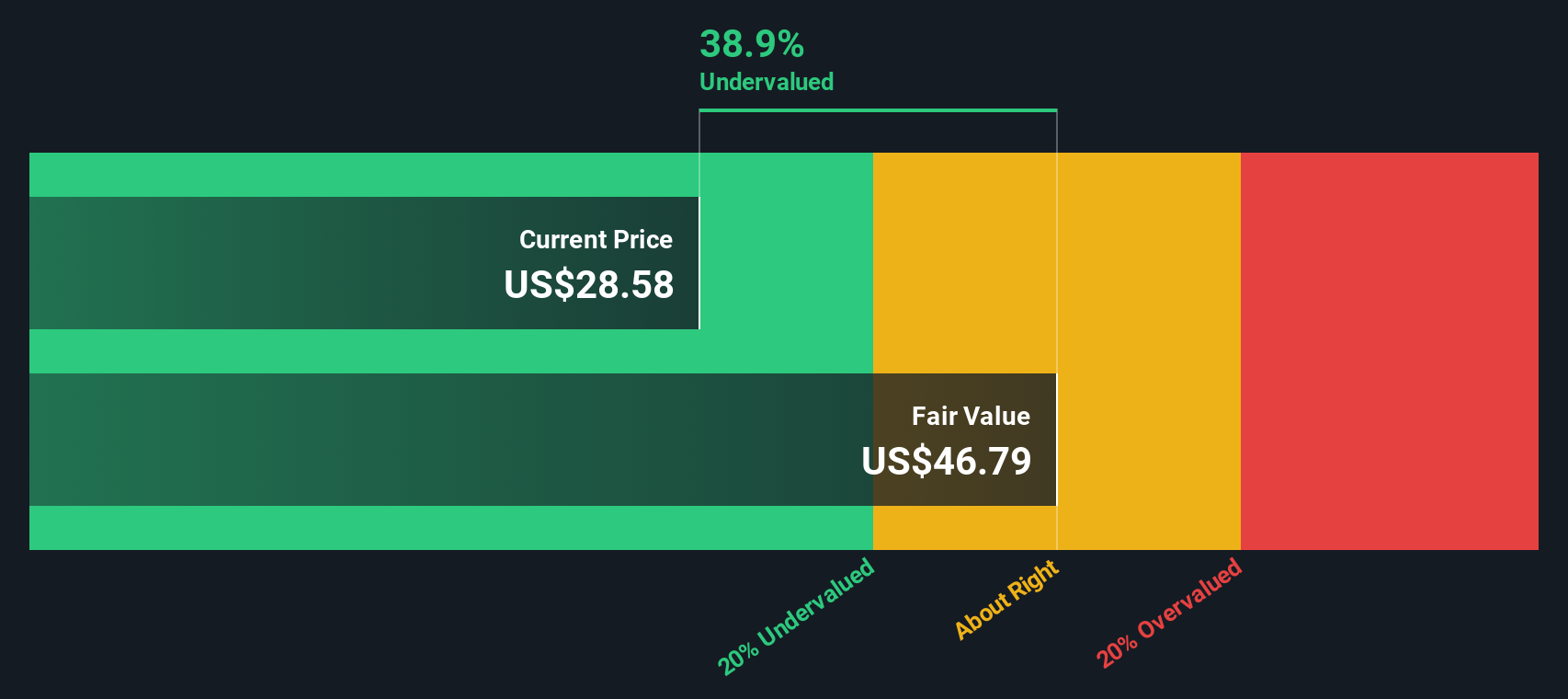

While multiples suggest Coupang’s shares are trading at a modest premium to industry averages, the SWS DCF model presents a much more optimistic picture. According to our DCF analysis, Coupang appears significantly undervalued, with a fair value of $47.79 compared to today’s $32.07. Does this indicate a major opportunity, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coupang Narrative

If you see Coupang’s story differently or want to dig into the figures yourself, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your Coupang research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead of the curve. Level up your portfolio strategy today by searching beyond Coupang and start spotting market movers while others wait.

- Lock in strong income potential by tapping into attractive yields with these 21 dividend stocks with yields > 3%, which stand out from the crowd.

- Seize early opportunities by identifying explosive growth trends among these 26 AI penny stocks, shaping tomorrow's breakthroughs.

- Capture hidden value that most overlook and spot potential market bargains with these 848 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives