Coupang (NYSE:CPNG): Evaluating Valuation After Taiwan Expansion Deal and Strong Q3 Results

Reviewed by Simply Wall St

Coupang (NYSE:CPNG) just announced a new strategic partnership with TNL Mediagene in Taiwan, highlighting its ambition to scale up digital content and retail media in Asia. This announcement follows stronger-than-expected third-quarter results, fueling investor optimism.

See our latest analysis for Coupang.

Coupang's momentum has been building steadily, especially after its robust third-quarter results and news of a fresh partnership in Taiwan. While shares have cooled off slightly in the past month, posting a 1-month share price return of -10.55%, the longer-term view remains solid. The company has delivered a 1-year total shareholder return of 15.28% and a notable 43.32% total return over three years, suggesting the company's growth story is still very much intact.

If Coupang's strategic moves have you rethinking what's possible, it's worth broadening your search and exploring fast growing stocks with high insider ownership.

With shares down recently despite strong earnings and upbeat analyst forecasts, investors now face a crucial question: is Coupang undervalued at current levels, or has the market already priced in its next phase of growth?

Most Popular Narrative: 21.1% Undervalued

With Coupang’s fair value estimated at $35.75, compared to a last close of $28.22, the dominant narrative sees room for significant upside. Expectations depend on how successfully Coupang balances technology investments and international growth against persistent cost pressures.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins. Management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

Curious which bold financial bets back this upbeat valuation? The secret sauce behind this narrative: explosive earnings growth, rapidly expanding margins, and game-changing international moves. Think you know the real growth drivers? You’ll want to see the detailed projections and assumptions fueling this fair value estimate.

Result: Fair Value of $35.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses in new markets or unexpectedly high expenses could derail Coupang's profit growth and test the optimism behind current valuation forecasts.

Find out about the key risks to this Coupang narrative.

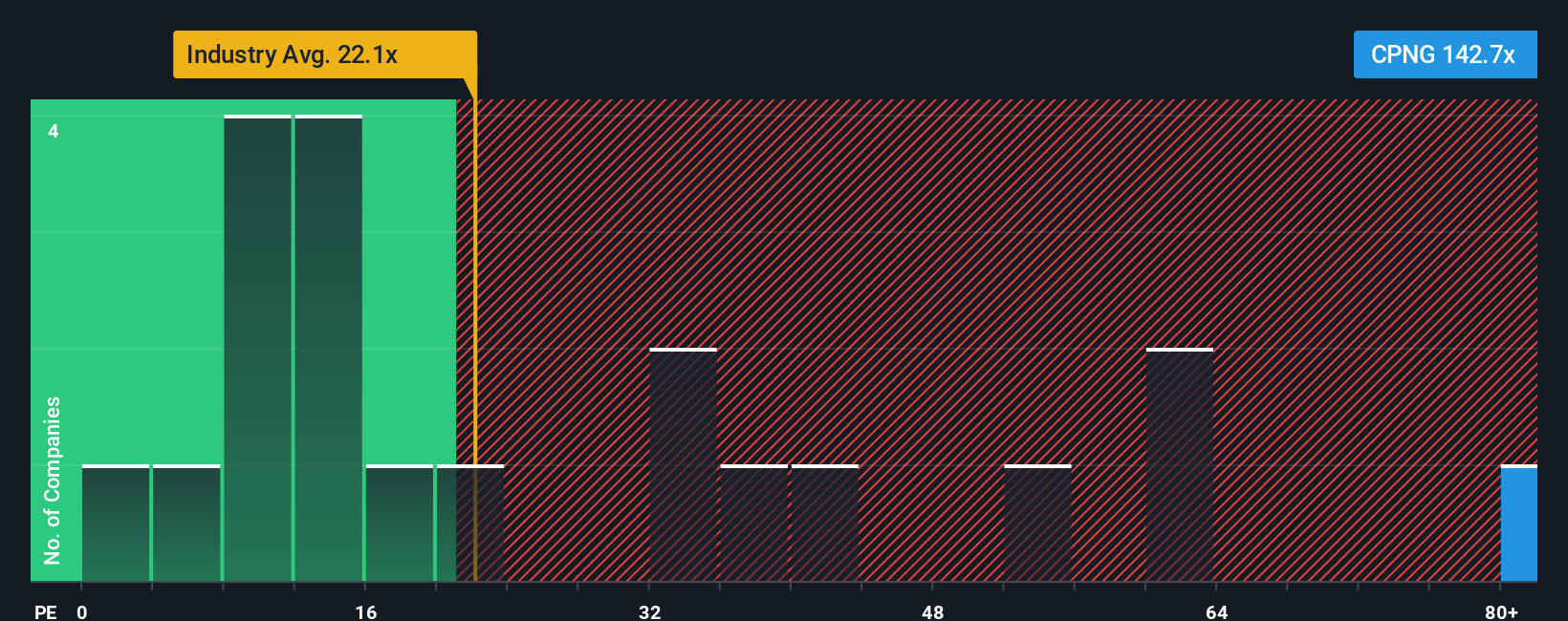

Another View: Multiples Tell a Different Story

Looking at Coupang through the lens of earnings multiples paints a less optimistic picture. The company's ratio sits at 133.6x, which is far above the industry average of 20.2x and the peer group’s 33.4x. This is even further from the fair ratio of 38.1x, suggesting Coupang is expensive on this measure. Will investors be willing to keep paying such a steep premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you want to dig even deeper or see things differently, you can dive into the numbers yourself and shape your own Coupang story in moments. Do it your way.

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want an edge this year, don’t stop at Coupang. The next big winner might be one click away with these focused screener tools:

- Find yield you can count on and kickstart your passive income strategy with these 15 dividend stocks with yields > 3%. This tool offers stable, high-payout opportunities.

- Tap into the AI revolution early by checking out these 26 AI penny stocks. This screener showcases market innovators pushing the boundaries in artificial intelligence.

- Boost your growth potential by uncovering undervalued gems hiding in plain sight with these 874 undervalued stocks based on cash flows, which is based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives