Coupang (NYSE:CPNG): Evaluating Valuation After Record Data Breach and Regulatory Scrutiny

Reviewed by Simply Wall St

Coupang (NYSE:CPNG) shares pulled back after the company revealed a major data breach affecting nearly 34 million users. This is the largest such incident in South Korea in more than a decade. The breach has drawn immediate regulatory scrutiny and class action threats.

See our latest analysis for Coupang.

The news of this historic data leak sent Coupang’s share price tumbling, with a 1-day drop of 5.36% and a 16.64% slide over the past month. Even so, the stock’s year-to-date share price return is still a healthy 19.56%, and its three-year total shareholder return remains impressive at nearly 49%. This suggests that despite this setback, long-term holders have been well rewarded. The recent slump highlights how quickly market momentum can shift in response to new risks, but also how robust Coupang’s performance has been over the longer run.

With so much changing in the broader tech and e-commerce landscape, it might be the perfect moment to discover fresh opportunities. See the full range of innovative companies in our tech and AI screener: See the full list for free.

With Coupang’s valuation now showing a notable discount to analyst price targets and its fundamentals still solid, the key question is whether this sharp selloff presents a true buying opportunity or if the market is correctly pricing in future risks and growth.

Most Popular Narrative: 25.9% Undervalued

Coupang’s most widely tracked narrative points to a fair value nearly $10 above the last close, highlighting expectations for robust long-term growth and margin gains despite recent volatility. As Coupang’s discount rate drifts slightly lower, excitement continues to build over its regional expansion and operational leverage.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins. Management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

Want to know why this story stands out among retail giants? A bold assumption about future operating leverage lies at the heart of this valuation. There is more beneath Coupang’s growth engine that could shift perceptions of its entire business model. Are you ready for the full set of numbers that make up this calculation?

Result: Fair Value of $35.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if scaling inefficiencies persist in Taiwan or if higher operating costs reduce Coupang’s growing margins and delay profitability.

Find out about the key risks to this Coupang narrative.

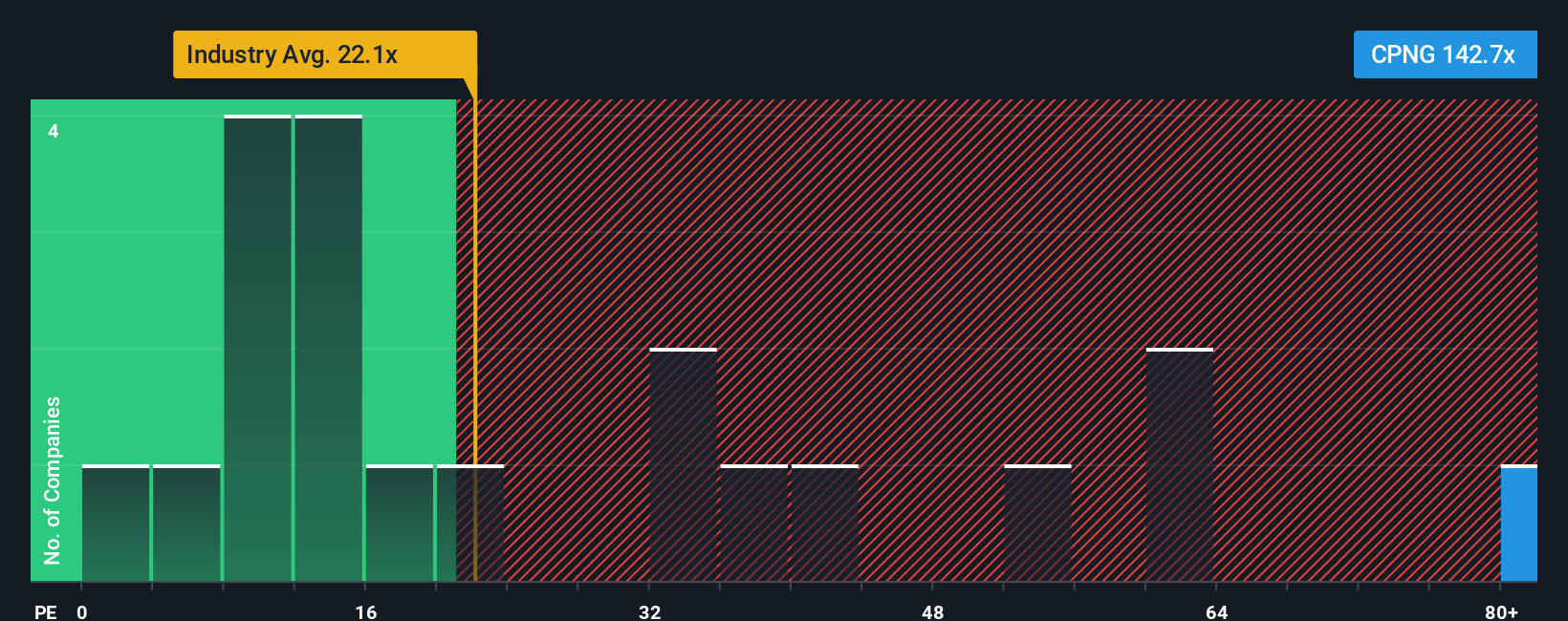

Another View: Market Multiples Give a Different Signal

Looking at Coupang through the lens of price-to-earnings, its valuation looks lofty. The current ratio of 124.8x stands far above both the global retail industry average of 20.2x and the peer group average of 33.4x. Even compared to the fair ratio of 43.7x, Coupang appears expensive. This sizable gap suggests heightened risk if the market adjusts its expectations. Could future growth justify such a premium, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you see things differently or want to dig into the numbers on your own, why not craft a personal take in just a few minutes? Do it your way

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

The market’s best returns often come from venturing beyond the obvious. Give yourself an edge by looking at fast-growing, innovative, or stable companies you might not have considered yet.

- Tap into tomorrow’s technology with these 25 AI penny stocks, a resource to find companies unlocking breakthroughs in artificial intelligence.

- Grow your income by checking out these 14 dividend stocks with yields > 3%, which features stocks with attractive yields and strong records of shareholder rewards.

- Stay ahead of market trends with these 81 cryptocurrency and blockchain stocks, highlighting businesses at the forefront of cryptocurrency and blockchain evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026