- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Does Chewy’s 29% Share Price Surge in 2025 Reflect Its True Value?

Reviewed by Bailey Pemberton

If you have been eyeing Chewy stock lately, you are not alone. Many investors are weighing whether now is the right moment to buy in, sell, or just keep watching from the sidelines. Chewy's share price has certainly taken investors on a ride, with the most recent close at $37.44. Just in the past week, the stock slipped by 4.1%, while over the last year it surged 28.9%. Depending on your time frame, the story looks pretty different; the stock is up 10.5% year-to-date, but if you zoom out to a five-year window, Chewy is actually down over 41%. This rollercoaster performance often reflects shifting perceptions around pet industry growth, e-commerce trends, and the overall market appetite for high-growth names.

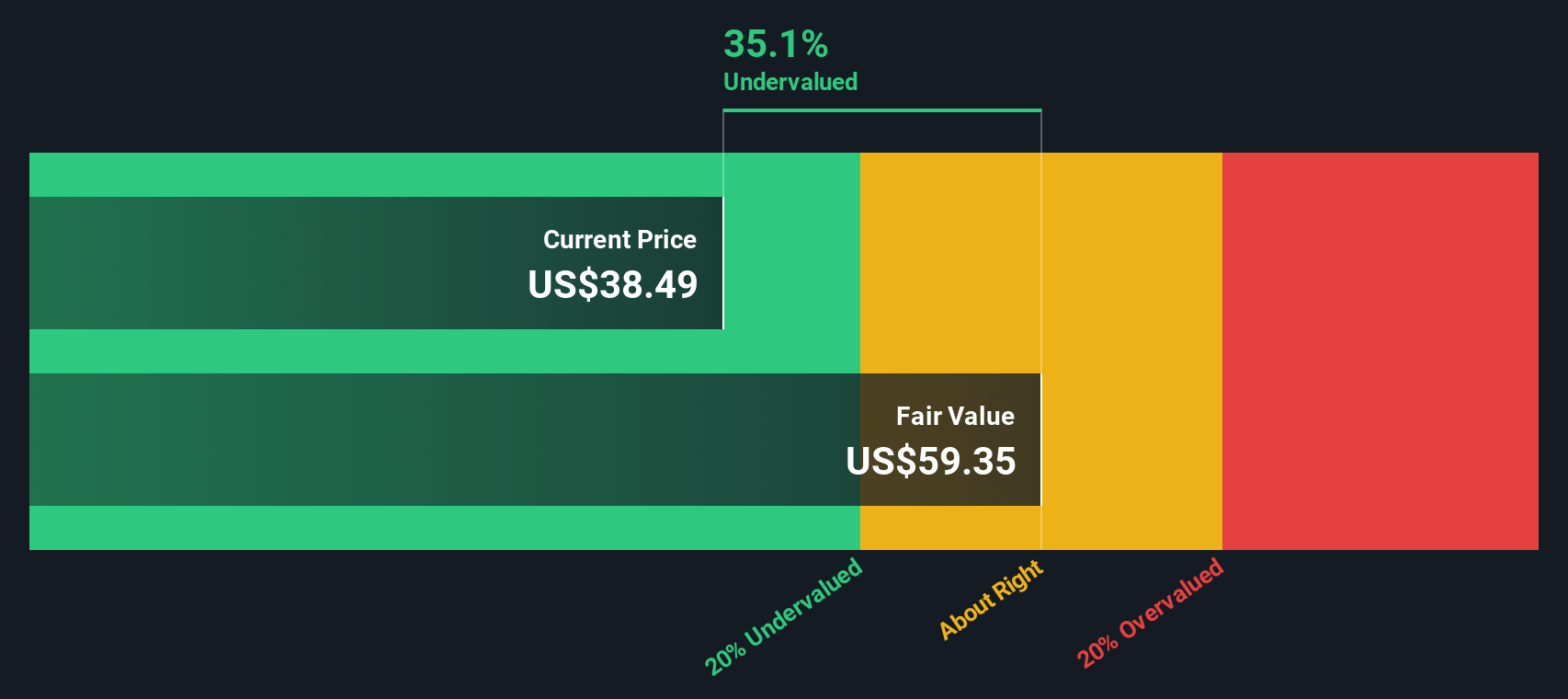

Of course, behind all these numbers, the big question is: Is Chewy undervalued, fairly priced, or still too expensive? By breaking down various valuation checks, the company scores a 3 out of 6 on our value assessment scale, so it is undervalued by half of our chosen methods. In the next section, we will dig deeper into these valuation approaches to see what is driving this score, and whether the numbers tell the full story, or if there is an even better way to understand Chewy’s true value.

Approach 1: Chewy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a stock is worth by projecting a company's future free cash flows and discounting them back to their value today. This approach is one of the most widely used models for evaluating companies like Chewy, where growth and future profitability are key concerns for investors.

Chewy's most recent twelve months free cash flow stands at $447 million. According to analysts, this figure is projected to grow steadily for the next few years, reaching $1.25 billion by 2030. Notably, the first five years of those forecasts come directly from analysts, while the remaining years are extrapolated based on industry trends and company guidance.

Using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Chewy comes in at $59.79 per share. This calculated value is significantly higher than the current share price of $37.44. According to the DCF model, this implies the stock is undervalued by roughly 37.4%.

The takeaway for investors is that based on long-term cash flow projections and discounting, Chewy could have meaningful upside compared to today's price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chewy is undervalued by 37.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Chewy Price vs Earnings (PE Ratio)

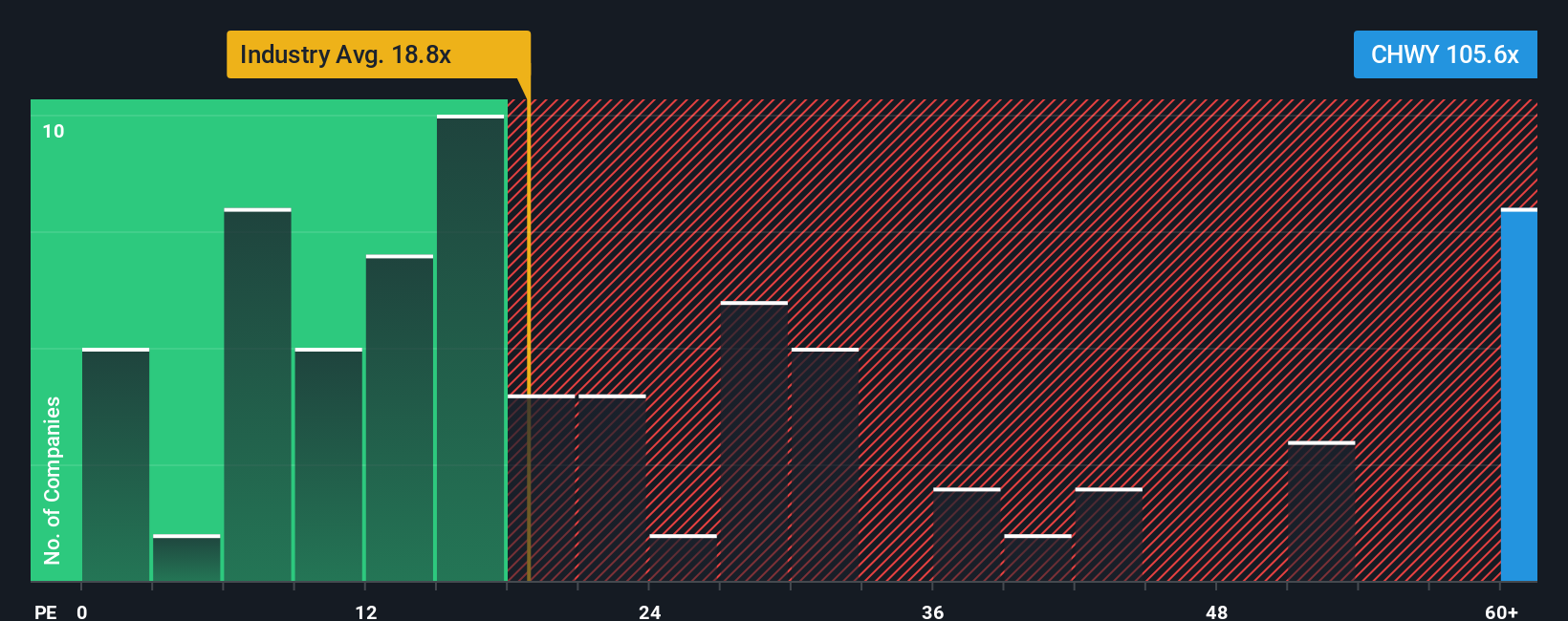

The price-to-earnings (PE) ratio is a classic valuation metric for companies that are generating profits, making it a suitable gauge for Chewy, which has transitioned into profitability. This ratio essentially tells investors how much they are paying for each dollar of the company’s earnings, and it is especially useful for assessing reasonably mature growth companies like Chewy.

It is important to remember, however, that what constitutes a "fair" PE ratio will vary depending on expectations for future earnings growth, the underlying risks of the business, and how it compares within its sector. Higher growth outlooks and lower risk often justify higher PE multiples, while the opposite can lower them.

Currently, Chewy trades at a PE ratio of 102.8x. This figure is well above the Specialty Retail industry average of 16.1x and its peer average of 23.4x. At first glance, this could suggest Chewy is significantly overvalued compared to others in the sector. But simple comparisons can be misleading, which is where Simply Wall St’s proprietary "Fair Ratio" metric comes in. This fair value PE ratio, calculated at 29.3x for Chewy, incorporates not just industry norms, but also takes into account Chewy’s unique growth prospects, profit margins, and risk profile. By doing so, it delivers a much more nuanced and tailored benchmark than simple peer comparisons.

Comparing Chewy's current PE of 102.8x to the Fair Ratio of 29.3x clearly suggests the stock is trading at a premium far beyond what its fundamentals and future outlook warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chewy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, personalized story that ties your perspective about a company’s future to actual financial forecasts and an estimated fair value, going far beyond just the current numbers or ratios.

Narratives empower you to bring the “why” behind the numbers, by letting you input your own assumptions on things like Chewy’s future revenue, earnings, and profit margins, all within an intuitive tool available right now in Simply Wall St’s Community page, used by millions of investors worldwide.

By connecting the company’s unique story to real data and forecasts, Narratives make it easier to see exactly when the fair value signals a buy or sell compared to the current share price, helping you make well-grounded decisions quickly at any point in time.

Even better, Narratives are updated automatically whenever Chewy releases earnings, gets covered in the news, or market trends shift, so your viewpoint and valuations remain relevant.

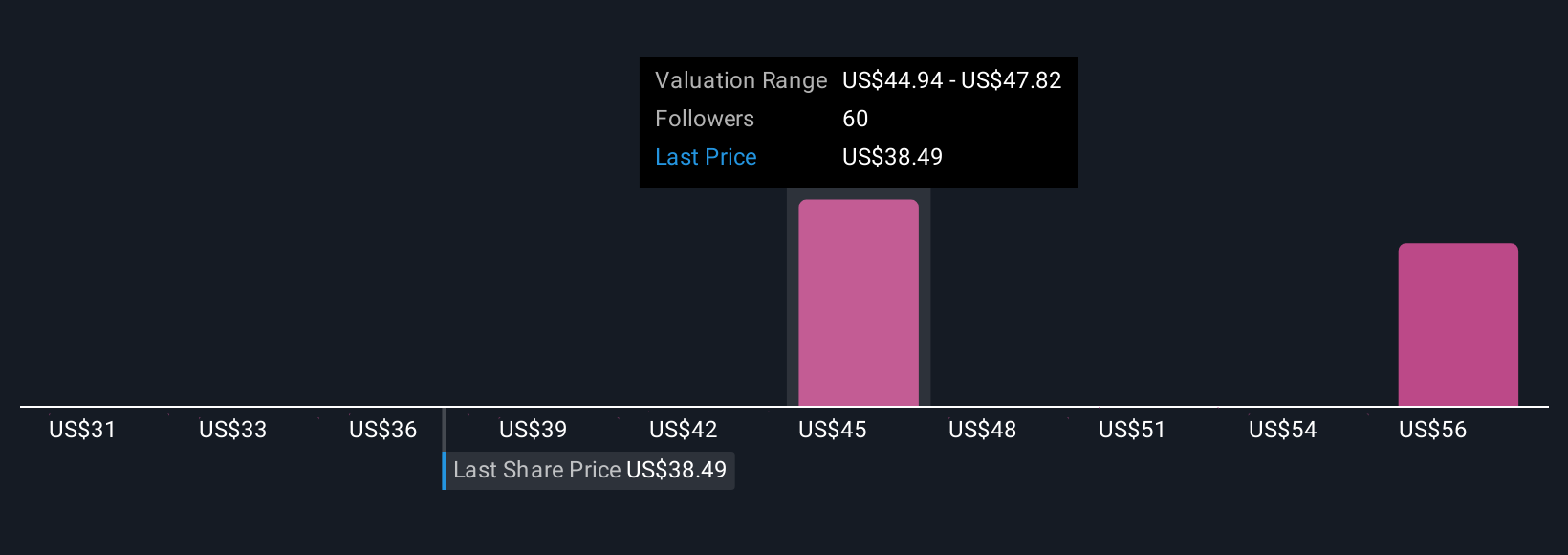

For example, some Chewy investors are optimistic, projecting rapid earnings growth from new vet clinics and product innovation, which leads them to a fair value as high as $52 per share, while more cautious investors factor in slowing customer growth or rising costs, resulting in fair values as low as $33, all visible in the Community page’s live Narratives summary.

Do you think there's more to the story for Chewy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives