- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (CHWY): Assessing Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Chewy (CHWY) shares have recently pulled back over the past month, with the stock down 11% during that period. This performance comes as investors continue to assess developments in the pet e-commerce market and Chewy’s position in the sector.

See our latest analysis for Chewy.

Despite recent volatility, Chewy’s one-year total shareholder return of 29.3% points to underlying momentum as the company navigates ongoing shifts in the pet e-commerce landscape. While the past month brought a pullback, broader performance implies investors remain alert to both growth potential and challenges ahead.

If you’re curious about what else is gaining attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

That raises a key question for investors: Is Chewy attractively undervalued at current levels, or has the market already priced in the company’s future growth outlook, leaving little room for further upside?

Most Popular Narrative: 17.4% Undervalued

Chewy’s most widely followed narrative points to substantial upside, with a calculated fair value well above the recent closing share price. The setup hinges on initiatives that could transform long-term profitability and engagement.

Chewy's strategic expansions, such as opening new Chewy Vet Care Clinics, are expected to further penetrate the $25 billion vet services market. This is likely to increase revenue and active customer engagement in 2025 and beyond. The migration to a 1P ad platform allows for enhanced advertising capabilities, including off-site ads and new content formats like video. This could grow the sponsored ads business up to 3% of total enterprise net sales, positively impacting gross margins.

Ever wondered what powers this elevated price target? The narrative is based on bold growth bets, ambitious profitability targets, and a future valuation multiple that eclipses most specialty retailers. Uncover the storyline and see which metrics made the biggest difference.

Result: Fair Value of $45.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and Chewy’s heavy reliance on its Autoship program could still threaten the company’s long-term growth narrative.

Find out about the key risks to this Chewy narrative.

Another View: Multiples Suggest Caution

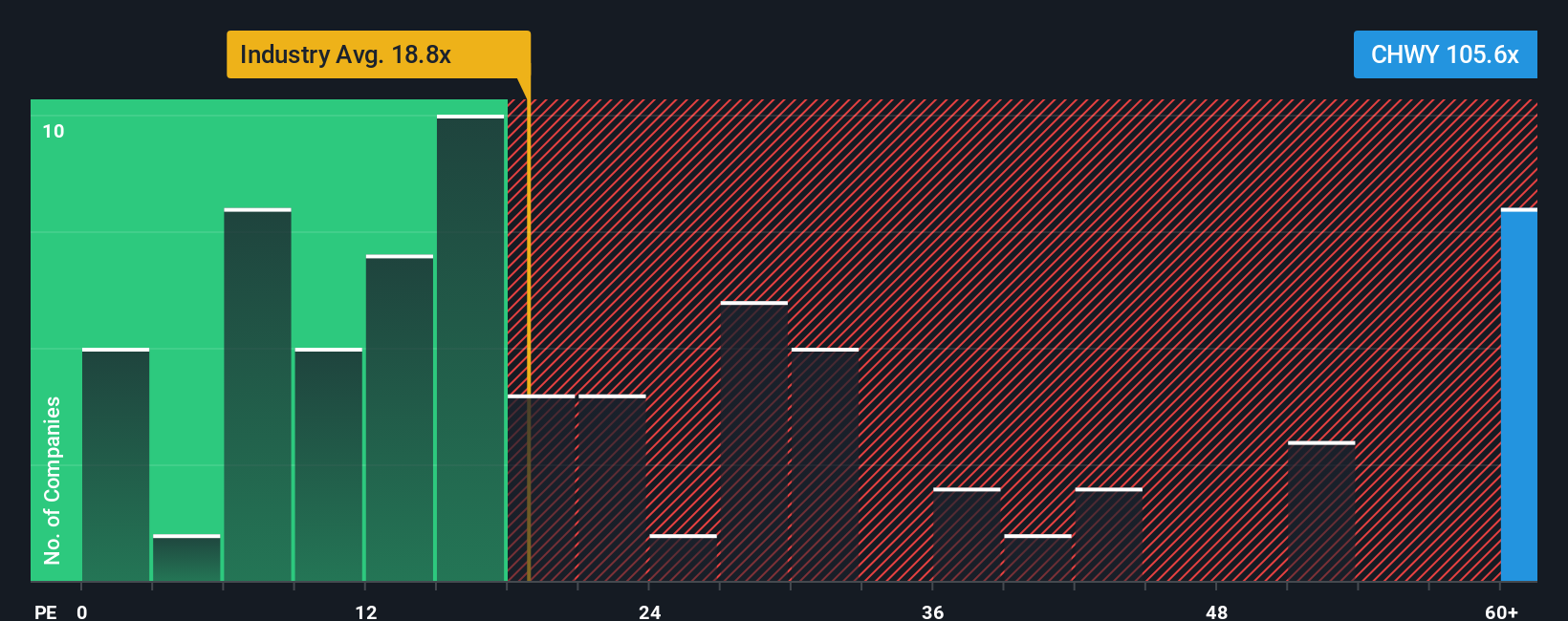

While some see Chewy’s shares as undervalued, looking at earnings multiples tells a different story. The stock trades at 103 times earnings, which is far higher than the US Specialty Retail industry average of 17.3 times or its peers’ 23.8 times. Even its fair ratio, which could reflect where the market moves over time, sits at just 29.4 times earnings. This sizable gap signals real valuation risk for investors who put weight on traditional multiples. Is the market’s optimism about Chewy’s future too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you’re interested in seeing things from a fresh perspective or want to dig into the numbers yourself, you can craft your own view in just a few minutes and Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep leveling up by searching beyond the obvious. Your next win could be waiting, so don’t let unique market opportunities pass you by.

- Target financial strength and steady income. Start with these 19 dividend stocks with yields > 3% to spot companies with solid yields above 3% and robust balance sheets.

- Accelerate your AI advantage by checking out these 24 AI penny stocks, which is packed with firms making waves in artificial intelligence and automation innovation.

- Catch undervalued gems before the crowd by reviewing these 896 undervalued stocks based on cash flows and secure exposure to stocks poised for potential gains based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives