- United States

- /

- Specialty Stores

- /

- NYSE:BYON

Beyond, Inc. (NYSE:BYON) Stock's 31% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Beyond, Inc. (NYSE:BYON) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

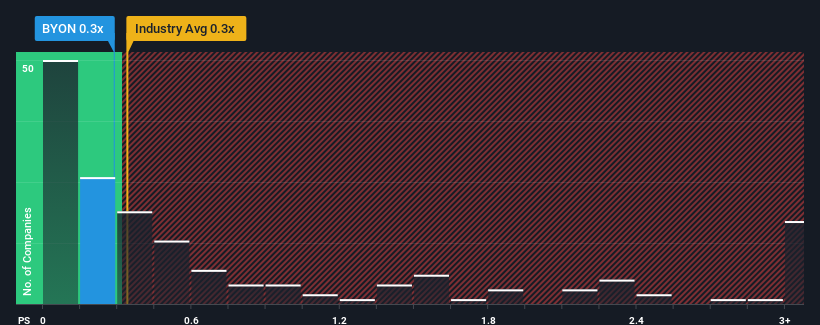

Even after such a large drop in price, there still wouldn't be many who think Beyond's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in the United States' Specialty Retail industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beyond

What Does Beyond's P/S Mean For Shareholders?

Beyond hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beyond will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Beyond would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.8%. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 8.7% over the next year. That's shaping up to be materially higher than the 3.6% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Beyond's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Beyond's P/S

With its share price dropping off a cliff, the P/S for Beyond looks to be in line with the rest of the Specialty Retail industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beyond currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Beyond.

If you're unsure about the strength of Beyond's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beyond might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BYON

Beyond

Operates as an online retailer of furniture and home furnishings products in the United States and Canada.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives