- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Burlington (BURL) Valuation Check After Strong Q3 Results, Upbeat Guidance and New Store Expansion Plan

Reviewed by Simply Wall St

Burlington Stores (BURL) just paired a solid third quarter earnings beat with upbeat guidance and a plan to add more than 100 net new stores, a combination that naturally caught investors attention.

See our latest analysis for Burlington Stores.

Despite the upbeat earnings, guidance and buyback activity, Burlington Stores 1 month share price return of minus 9.9 percent and year to date share price return of minus 12.9 percent suggest momentum has cooled. However, the 3 year total shareholder return of roughly 25 percent still points to a solid longer term story.

If you like Burlington's growth narrative but want more retail ideas, this could be a good moment to explore fast growing stocks with high insider ownership for other fast growing names with skin in the game.

With earnings climbing, guidance pointing higher and analysts seeing more than 30 percent upside to their price targets, is Burlington quietly trading at a discount, or is the market already baking in every bit of that future growth?

Most Popular Narrative Narrative: 28.1% Undervalued

Compared with Burlington Stores last close of $248.85, the most followed narrative sees fair value much higher, implying sizeable upside if its roadmap plays out.

The ongoing upgrades to merchandising and store operations (Burlington 2.0 initiatives), including modernized layouts and improved associate engagement, have produced measurable improvements in sales productivity and margin control, indicating potential for further net margin expansion as these initiatives scale across the chain.

Want to see why steady revenue gains, rising margins and a still rich future earnings multiple can all coexist in this story? The full narrative unpacks the precise growth runway, profitability step up and valuation reset needed to justify that higher fair value, and how each piece fits together across the next few years.

Result: Fair Value of $345.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tariff pressure and a heavier bet on physical store expansion could quickly compress margins and test how resilient this growth story really is.

Find out about the key risks to this Burlington Stores narrative.

Another Lens on Valuation

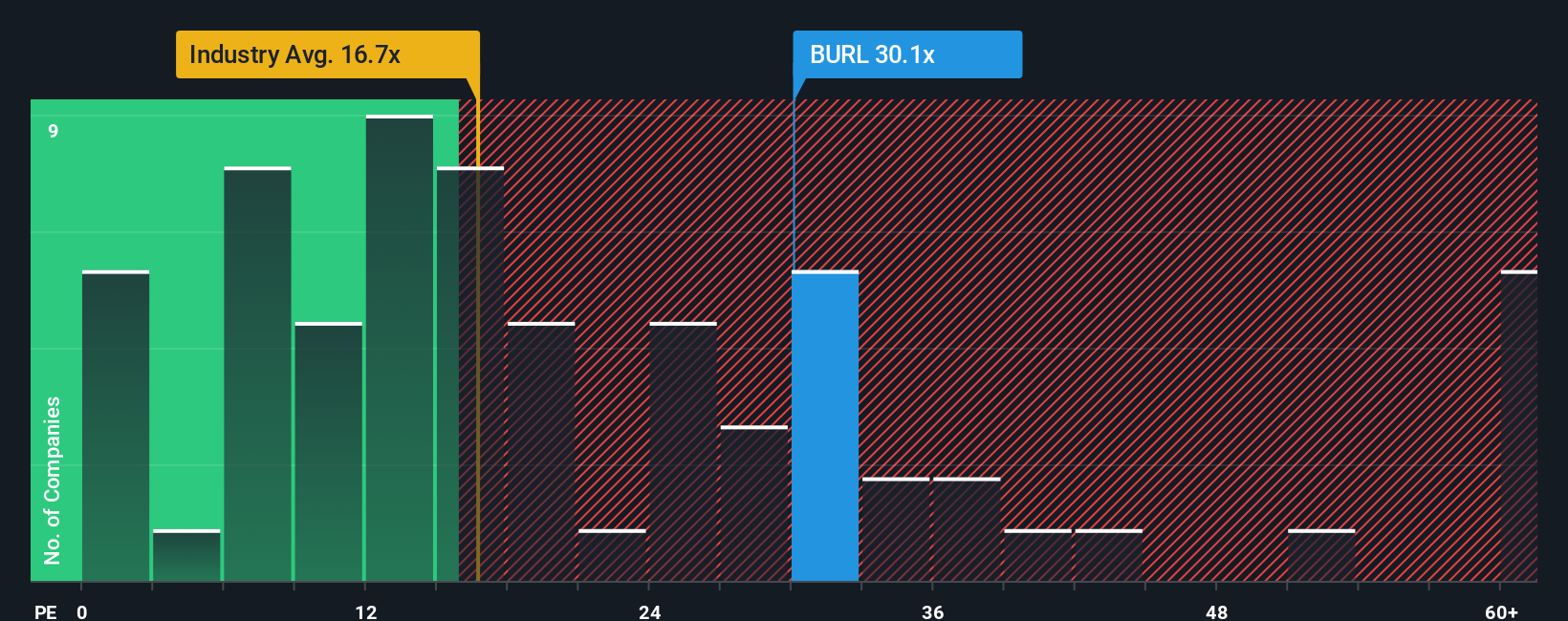

The community narrative leans on future earnings power, but current pricing tells a tougher story. Burlington trades on a 27.6 times price to earnings ratio, well above the industry at 17.9 times and a fair ratio of 20.6 times, suggesting investors are paying up for execution risk. Could that premium unwind if growth even slightly disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If the community view does not quite match your own thinking, dive into the numbers yourself and build a custom story in minutes, Do it your way.

A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next opportunity by scanning targeted stock ideas on Simply Wall St, where data backed screens surface potential candidates efficiently.

- Explore early stage opportunities with these 3573 penny stocks with strong financials that have small market caps and room to scale.

- Review these 30 healthcare AI stocks that use algorithms to support diagnostics, manage costs and build recurring revenue streams.

- Focus on these 14 dividend stocks with yields > 3% that combine dividend income with balance sheets designed to handle market downturns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026