- United States

- /

- Specialty Stores

- /

- NYSE:BNED

Barnes & Noble Education Insiders Land Bargain With Gains Of US$747k

Insiders who bought Barnes & Noble Education, Inc. (NYSE:BNED) stock lover the last 12 months are probably not as affected by last week’s 16% loss. After taking the recent loss into consideration, the US$1.69m worth of stock they bought is now worth US$2.43m, indicating that their investment yielded a positive return.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Barnes & Noble Education

The Last 12 Months Of Insider Transactions At Barnes & Noble Education

The Chairman of the Board William Martin made the biggest insider purchase in the last 12 months. That single transaction was for US$922k worth of shares at a price of US$7.19 each. Even though the purchase was made at a significantly lower price than the recent price (US$10.26), we still think insider buying is a positive. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

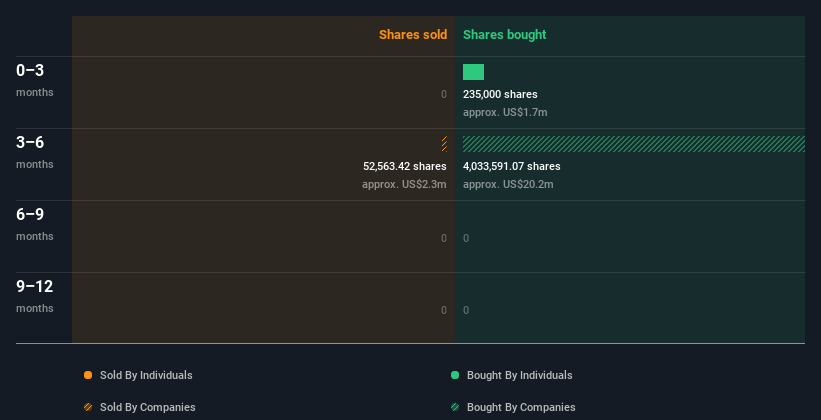

Barnes & Noble Education insiders may have bought shares in the last year, but they didn't sell any. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Barnes & Noble Education Insiders Bought Stock Recently

Over the last three months, we've seen significant insider buying at Barnes & Noble Education. Overall, two insiders shelled out US$1.7m for shares in the company -- and none sold. This could be interpreted as suggesting a positive outlook.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Our data suggests Barnes & Noble Education insiders own 1.2% of the company, worth about US$3.3m. We consider this fairly low insider ownership.

What Might The Insider Transactions At Barnes & Noble Education Tell Us?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. But on the other hand, the company made a loss during the last year, which makes us a little cautious. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Barnes & Noble Education insiders are reasonably well aligned, and optimistic for the future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Barnes & Noble Education. To help with this, we've discovered 4 warning signs (3 can't be ignored!) that you ought to be aware of before buying any shares in Barnes & Noble Education.

Of course Barnes & Noble Education may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Barnes & Noble Education, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barnes & Noble Education might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BNED

Barnes & Noble Education

Operates bookstores for college and university campuses, and K-12 institutions primarily in the United States.

Low and slightly overvalued.