- United States

- /

- Specialty Stores

- /

- NYSE:BNED

Barnes & Noble Education, Inc.'s (NYSE:BNED) Popularity With Investors Is Under Threat From Overpricing

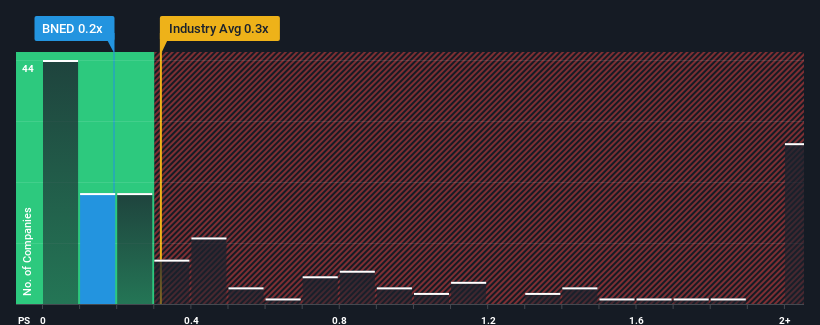

There wouldn't be many who think Barnes & Noble Education, Inc.'s (NYSE:BNED) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Specialty Retail industry in the United States is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Barnes & Noble Education

What Does Barnes & Noble Education's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Barnes & Noble Education's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on Barnes & Noble Education will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Barnes & Noble Education, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Barnes & Noble Education's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Barnes & Noble Education's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Comparing that to the industry, which is predicted to deliver 4.6% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Barnes & Noble Education's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Barnes & Noble Education's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Barnes & Noble Education's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Barnes & Noble Education you should know about.

If these risks are making you reconsider your opinion on Barnes & Noble Education, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Barnes & Noble Education might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BNED

Barnes & Noble Education

Operates bookstores for college and university campuses, and K-12 institutions primarily in the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives