- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Is Easing US-China Trade Tension Shifting the Investment Case for Best Buy (BBY)?

Reviewed by Sasha Jovanovic

- Earlier this week, Best Buy benefited from renewed investor optimism after U.S. leadership signaled a softer stance on trade with China, easing concerns about potential tariffs on electronics imports.

- This development holds particular significance for Best Buy, where sourcing substantial volumes of consumer goods from China has previously exposed the retailer to cost volatility and supply chain challenges.

- We'll explore how easing trade tensions, especially in tariff-sensitive segments, affects the company's outlook and shapes the current investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Best Buy Investment Narrative Recap

Owning Best Buy stock today means believing in the company's ability to benefit from technology upgrade cycles and the shift toward connected home solutions, while managing competitive and pricing pressures in retail. This week's easing of U.S.-China trade tensions lifted short-term sentiment, but the most important near-term catalyst remains consumer response to new computing products, particularly during the holiday season. Meanwhile, ongoing risk from shrinking profit margins in lower-priced categories continues to weigh on longer-term earnings potential, and these latest headlines do little to change that outlook.

Among recent announcements, Best Buy’s expansion of its digital marketplace ahead of the holiday season stands out, offering a wider assortment and early access deals as it seeks to capture replacement demand for electronics. While this initiative aligns closely with the computing cycle catalyst, it also requires careful margin management, especially if competitive pricing intensifies during key sales periods.

However, despite relief on tariffs, investors should also remain focused on profit margin pressures, especially as the product mix continues to shift toward...

Read the full narrative on Best Buy (it's free!)

Best Buy's outlook projects $44.5 billion in revenue and $1.5 billion in earnings by 2028. This scenario is based on a 2.3% annual revenue growth rate and reflects an increase in earnings of $722 million from the current $778 million.

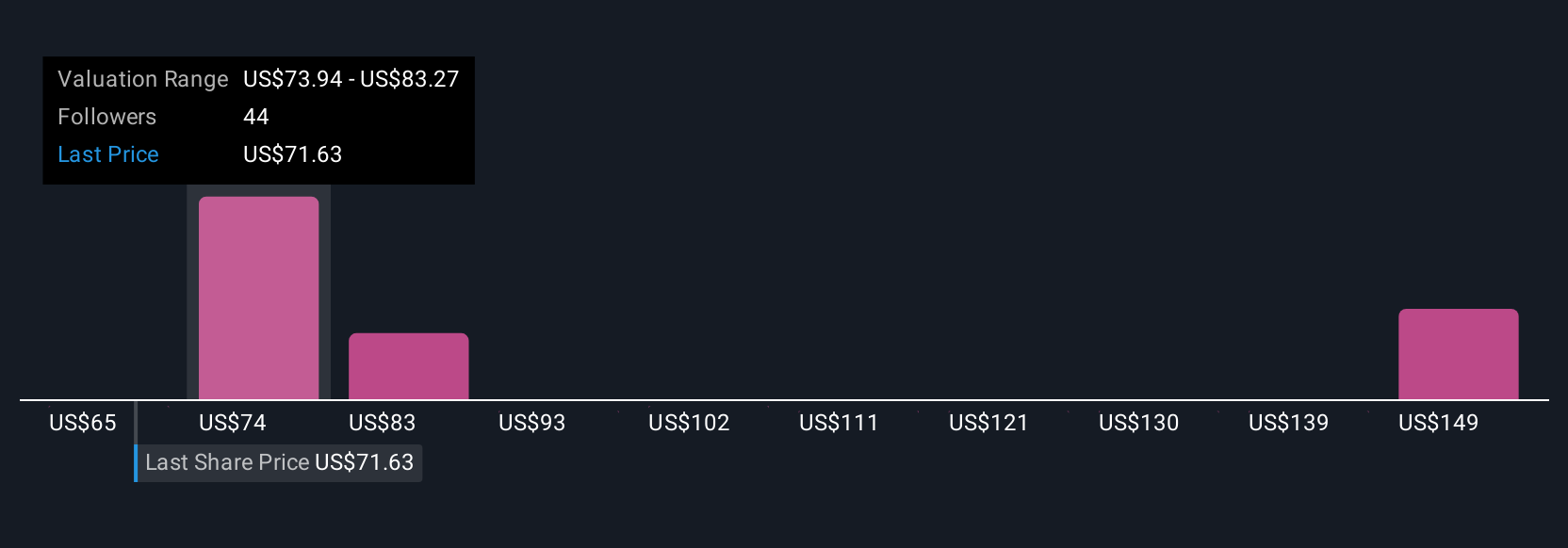

Uncover how Best Buy's forecasts yield a $79.76 fair value, in line with its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimate Best Buy’s fair value anywhere from US$64.62 to US$167.54 per share, reflecting diverse outlooks on future growth. Uncertainty around gross profit rates and intense holiday competition mean you’ll find plenty of views for consideration.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth 18% less than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Offers technology products and solutions in the United States, Canada, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives