- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Has the Bath & Body Works Share Slump Created a Long Term Value Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Bath & Body Works is starting to look like a bargain after a rough stretch? This is where we unpack whether the current price really lines up with the company’s long term potential.

- The stock has bounced about 10.1% over the last week but is still down 24.0% over the past month and roughly 50.9% year to date, a combination that often signals either a value opportunity or a value trap.

- Recently, investors have been reacting to shifting consumer spending patterns and ongoing repositioning in the specialty retail space, which has put sentiment for many discretionary names under pressure. At the same time, Bath & Body Works has been in the spotlight as it refines its product mix and store strategy to stay relevant with shoppers despite the tougher backdrop.

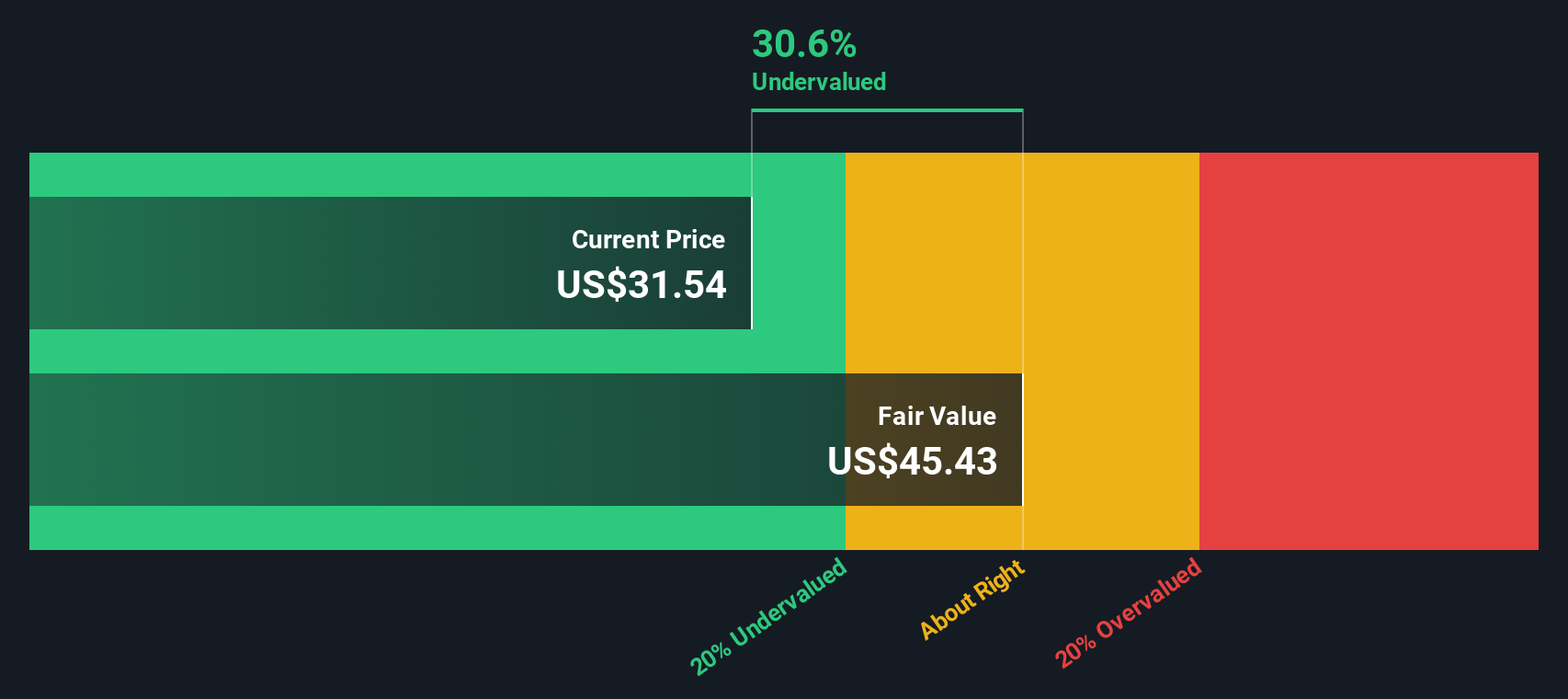

- Despite the volatility, Bath & Body Works scores a solid 5/6 on our valuation checks, suggesting it screens as undervalued on most metrics we track. Next we will walk through those valuation approaches, before finishing with a more holistic way to think about what the stock is truly worth.

Find out why Bath & Body Works's -47.9% return over the last year is lagging behind its peers.

Approach 1: Bath & Body Works Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For Bath & Body Works, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $923.9 million.

Analysts provide detailed forecasts for the next few years, and beyond that Simply Wall St extrapolates the trend based on those forecasts. Under these assumptions, Bath & Body Works free cash flow is projected to rise to roughly $1.08 billion by 2030, with a gradual moderation in growth thereafter as the business matures.

When all of those projected cash flows are discounted back, the estimated intrinsic value comes out at about $53.09 per share. Compared with the current market price, this implies the stock is calculated to be around 65.0% undervalued, indicating that the market price is materially below this valuation estimate based on the model’s cash flow assumptions.

Result: UNDERVALUED (model-based estimate)

Our Discounted Cash Flow (DCF) analysis suggests Bath & Body Works is undervalued by 65.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Bath & Body Works Price vs Earnings

For a consistently profitable retailer like Bath & Body Works, the price to earnings ratio is a useful way to gauge how much investors are paying for each dollar of current profits. In general, faster growing and less risky businesses can justify a higher PE, while slower or more uncertain names tend to trade on lower multiples.

Bath & Body Works currently trades on a PE of about 5.4x, which is far below both the Specialty Retail industry average of roughly 17.9x and the broader peer group average of around 19.5x. To go a step further, Simply Wall St calculates a Fair Ratio of about 14.9x for Bath & Body Works, which is the PE you might expect given its earnings growth outlook, margins, scale, industry and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s specific fundamentals rather than assuming all retailers deserve the same multiple. Comparing the Fair Ratio of 14.9x with the actual PE of 5.4x suggests the shares are pricing in a lot more pessimism than the fundamentals warrant, indicating that the stock may be undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bath & Body Works Narrative

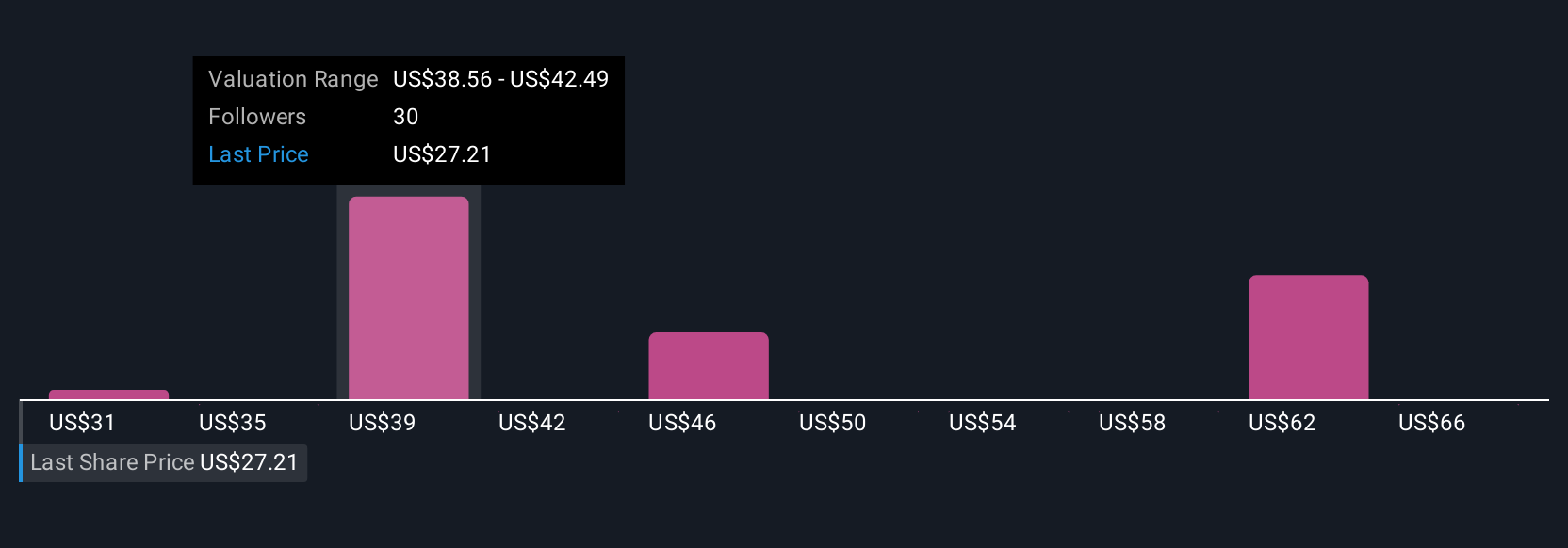

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy framework on Simply Wall St’s Community page that lets you connect your view of a company’s story with the numbers behind its future. A Narrative is your personal storyline for Bath & Body Works, where you spell out what you think happens to its revenue, earnings and margins, and then link that story directly to a forecast and a fair value estimate. Because Narratives live inside the platform used by millions of investors, they are simple to build, compare and refine, and they automatically refresh when new information, like earnings results or major news, comes in. This makes buy or sell decisions more intuitive, as you can quickly compare your Narrative fair value with the current share price and see whether the stock still fits your thesis. For example, one Bath & Body Works Narrative might assume a fair value near $64.56 based on strong lease renegotiations and loyalty growth, while another might land closer to $36.96 on more conservative growth and margin assumptions.

Do you think there's more to the story for Bath & Body Works? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026