- United States

- /

- Specialty Stores

- /

- NYSE:BBW

A Look at Build-A-Bear Workshop’s Valuation Following Strong Q2 Results and Upgraded 2025 Guidance

Reviewed by Simply Wall St

Build-A-Bear Workshop (BBW) has caught the market’s eye after delivering a series of upbeat announcements. The company reported strong second quarter results, showing a clear lift in revenue and net income from the previous year. Alongside the financial update, management raised its guidance for both earnings and new store locations for 2025, signaling a dose of confidence about the business’s future path.

This mix of strong earnings, upgraded guidance, and an accelerating expansion plan has fueled a striking run in the share price. Over the past month, shares have surged 26%, pushing the annual gain past 100%. While investor excitement is running high, it is also tempered by forecasts for more modest earnings growth ahead. This might suggest the market is re-evaluating just how much future potential is already reflected in the price.

With such a sharp rally and positive momentum, some investors may be questioning whether Build-A-Bear Workshop is a buy at these levels or whether the market has already accounted for all the company’s good news in its stock price.

Most Popular Narrative: 19% Undervalued

According to the most widely followed narrative, Build-A-Bear Workshop appears to trade well below its estimated fair value. Analysts view the company as undervalued by nearly 20%, driven by expectations for further growth in both earnings and expansion initiatives.

Investment in digital transformation, including enhanced social media initiatives, user-generated content, and omnichannel integration, is broadening the customer base beyond children to include higher-value "Kidult" and collector segments. This is likely driving higher average transaction values and supporting both revenue and margin expansion.

Curious what is powering this bullish target? The secret behind this narrative is not just growth, but also bold assumptions about future earnings and margins. Want to know if these forecasts hold the key to sustained upside? This narrative is built on a calculation based on a future financial leap few expect. Peel back the layers and see which numbers could justify a high fair value verdict.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising input costs and ongoing tariffs could quickly erode margins. This may challenge the bullish narrative and test management’s outlook for sustained growth.

Find out about the key risks to this Build-A-Bear Workshop narrative.Another View: What Does Our DCF Model Suggest?

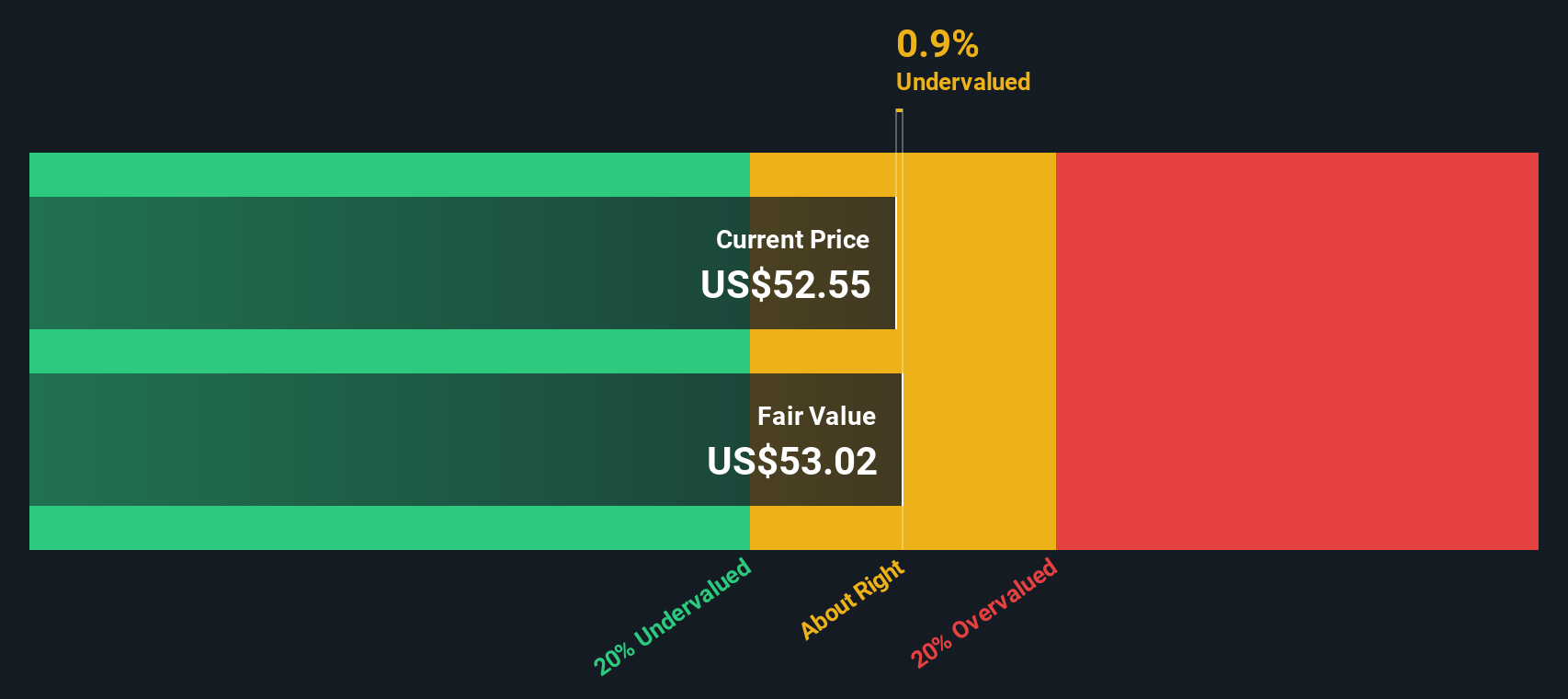

Looking at Build-A-Bear Workshop with the SWS DCF model provides a second perspective. This approach also judges the company as trading below its estimated fair value. But do different methods agree for the same reasons, or is there more to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Build-A-Bear Workshop for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Build-A-Bear Workshop Narrative

If you want to dig into the numbers and challenge these views, you can easily shape your own take on the story in just a few minutes. Do it your way.

A great starting point for your Build-A-Bear Workshop research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let the momentum stop here. Start building a smarter portfolio by checking out unique stock ideas that could redefine your investing game.

- Amplify your income stream by targeting established companies that pay solid dividend stocks with yields > 3%. These stocks can help you grow wealth with attractive yields over 3%.

- Spot tomorrow’s breakthroughs by uncovering next-generation innovators among AI penny stocks, where artificial intelligence is powering real business transformation.

- Take advantage of market mispricings and seize hidden gems with strong financials by finding undervalued stocks based on cash flows. These are built on fundamentals, not hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Build-A-Bear Workshop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:BBW

Build-A-Bear Workshop

Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)