- United States

- /

- Specialty Stores

- /

- NYSE:BARK

Further Upside For BARK, Inc. (NYSE:BARK) Shares Could Introduce Price Risks After 31% Bounce

BARK, Inc. (NYSE:BARK) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 3.8% isn't as attractive.

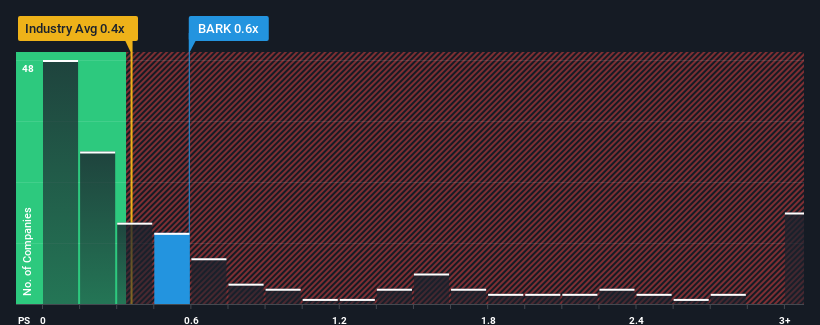

Even after such a large jump in price, there still wouldn't be many who think BARK's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for BARK

How Has BARK Performed Recently?

BARK could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on BARK will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For BARK?

The only time you'd be comfortable seeing a P/S like BARK's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.4%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.3% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 5.7% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that BARK's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does BARK's P/S Mean For Investors?

Its shares have lifted substantially and now BARK's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at BARK's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with BARK.

If you're unsure about the strength of BARK's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BARK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BARK

BARK

A dog-centric company, provides products, services, and content for dogs.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives