Will Alibaba's (BABA) Note Exchange Success Reveal Deeper Shifts in Its AI Growth Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Alibaba Group Holding Limited completed an exchange offer for its US dollar-denominated senior unsecured notes originally issued in November 2024, with nearly all holders tendering their notes for new registered securities under the U.S. Securities Act.

- This successful exchange offer underscores investor confidence, coinciding with heightened interest in Alibaba's AI and cloud advancements and expanded institutional investment.

- We'll explore how Alibaba's progress in artificial intelligence, particularly through innovations like the Aegaeon computing pooling solution, reshapes its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alibaba Group Holding Investment Narrative Recap

To be an Alibaba shareholder, you need to believe in the company’s ability to monetize its leadership in e-commerce and realize returns on major investments in AI and cloud, even as those bets pressure short-term profitability. The recent successful exchange offer for senior unsecured notes improves capital structure flexibility, but does not materially shift the biggest near-term catalyst, AI and cloud revenue acceleration, or the primary risk of further margin compression from heavy investment.

Among recent announcements, Alibaba's beta-tested Aegaeon computing pooling solution stands out. Deployed in Alibaba Cloud’s model marketplace, it reportedly reduced Nvidia GPU requirements by 82 percent, supporting the thesis that Alibaba’s technological innovation could enhance operating efficiency and help drive the next wave of cloud growth.

However, against these advances, investors should be keenly aware of the company’s ongoing exposure to margin pressure and the possibility that aggressive investment may not deliver expected returns, especially if...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's outlook anticipates CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028, based on an 8.0% annual revenue growth rate and a CN¥22.8 billion earnings increase from the current CN¥148.3 billion.

Uncover how Alibaba Group Holding's forecasts yield a $193.43 fair value, a 12% upside to its current price.

Exploring Other Perspectives

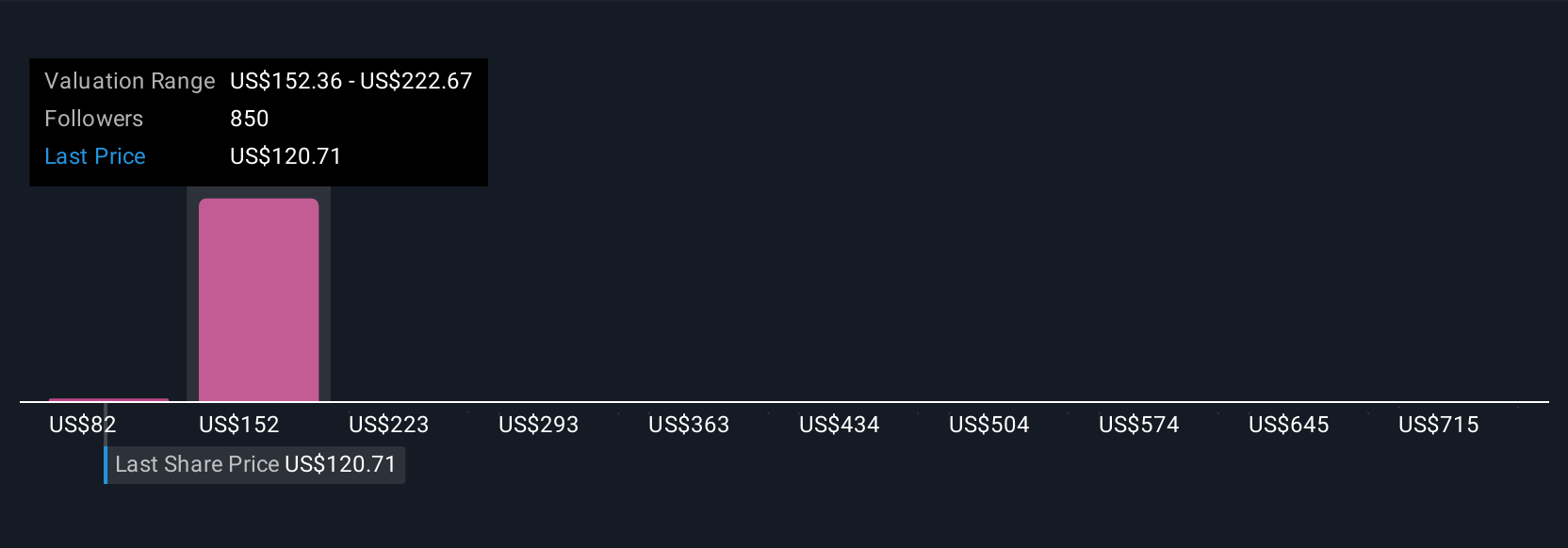

Sixty-seven members of the Simply Wall St Community estimate Alibaba’s fair value anywhere from US$107.09 to US$254 per share. With heavy ongoing expenditure in AI and cloud still creating risk for profit margins, you can see investors approach these forecasts from sharply different angles.

Explore 67 other fair value estimates on Alibaba Group Holding - why the stock might be worth as much as 46% more than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives