Thinking about what to do with Alibaba Group Holding stock? You are far from alone. With shares closing most recently at $165.86, Alibaba has had quite the ride, whether you have been holding on for years or are just now considering jumping in. In just the past year, Alibaba's stock has jumped an eye-catching 72.1%, while the year-to-date return is an even more impressive 95.2%. That is the kind of upswing that naturally gets investors’ attention.

Of course, those stellar numbers come after some difficult longer-term moves. The five-year return actually stands at -43.3%. This turnaround has been driven in part by reports suggesting a more favorable regulatory climate in China, along with renewed investor confidence in Alibaba’s core businesses like e-commerce and cloud computing. There is also ongoing speculation about potential asset spin-offs, which has injected some optimism around the company’s overall structure and long-term prospects.

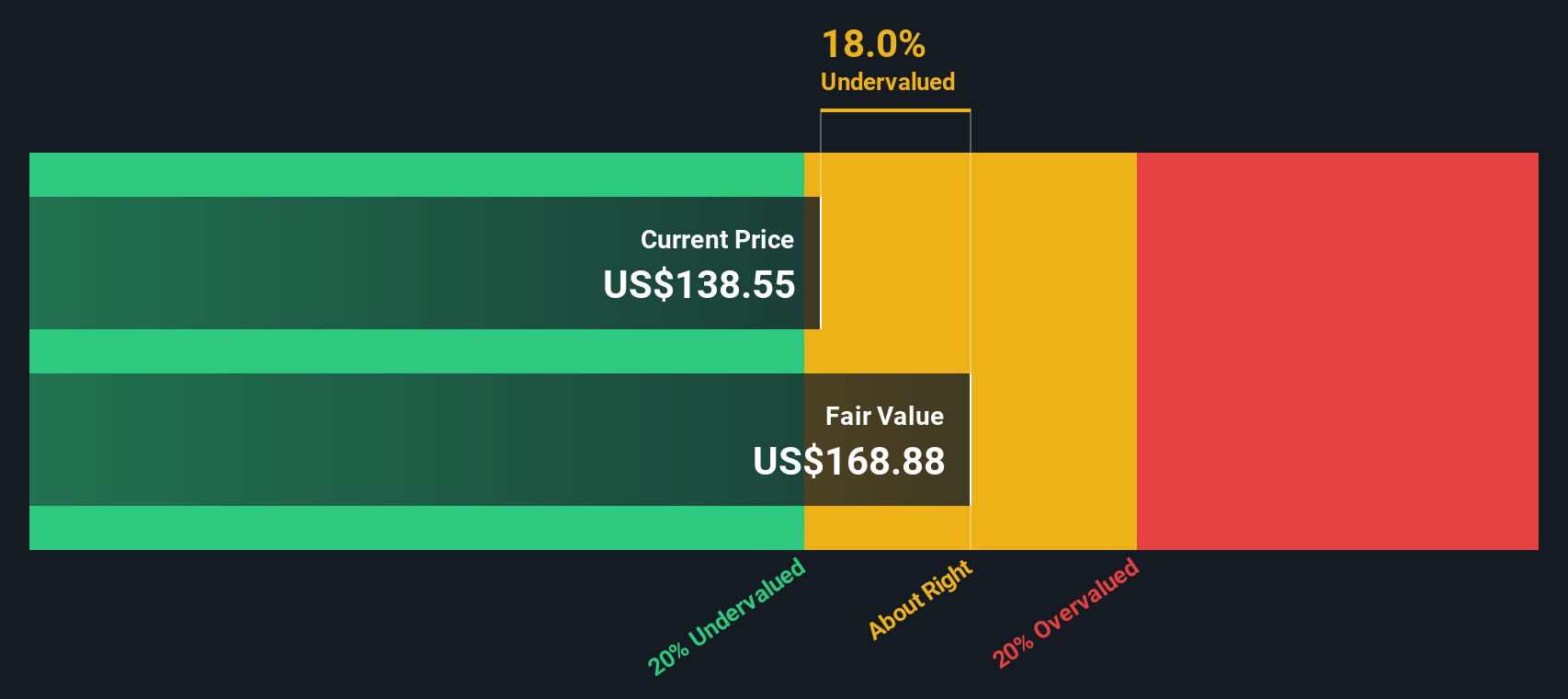

But navigating the noise and figuring out just what the stock is really worth right now is a whole other challenge. Take Alibaba’s valuation score: currently 3 out of 6, meaning it is undervalued in half the standard checks analysts often use. So how does that stack up against other methods, and is there a smarter way to size up the real opportunity here? Up next, we will walk through the classic valuation techniques, but stick around as the best perspective might be yet to come.

Approach 1: Alibaba Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those back to today's value to account for the time value of money. This approach helps investors determine whether the current share price reflects the company's actual intrinsic worth.

For Alibaba Group Holding, the latest reported Free Cash Flow (FCF) stands at approximately CN¥83.1 billion, with analysts forecasting strong growth in the coming years. Projections suggest FCF could rise to CN¥128.98 billion by 2028 and continue expanding based on long-term estimates. While analysts typically provide up to five years of direct forecasts, Simply Wall St extrapolates further to map out Alibaba’s ten-year trajectory.

Based on these cash flow projections, Alibaba’s DCF model generates an intrinsic value of $148.14 per share. With Alibaba’s stock currently trading at $165.86, this means the shares are about 12.0% above the calculated fair value. In other words, according to this model, the stock appears a bit expensive at the moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alibaba Group Holding may be overvalued by 12.0%. Find undervalued stocks or create your own screener to find better value opportunities.

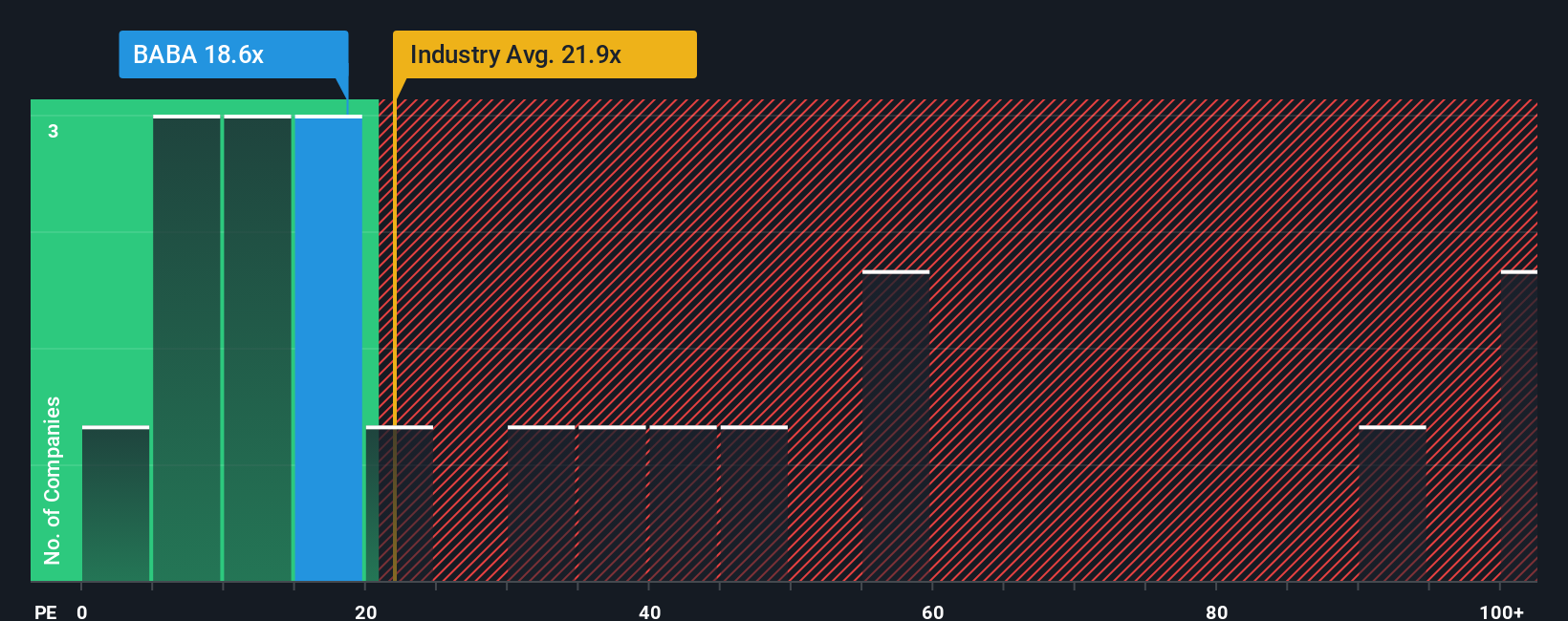

Approach 2: Alibaba Group Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Alibaba Group Holding because it directly connects a company’s earnings to its share price, giving investors a simple way to gauge whether shares are attractively priced given the company’s profitability. Growth prospects and perceived risks shape what a “normal” PE ratio should be. A company expected to grow faster or with lower risk is typically rewarded with a higher multiple, while those with more uncertain futures trade lower.

Alibaba currently trades at a PE ratio of 17.8x, which is below both its industry average of 21.6x and the peer group’s even higher average of 43.9x. This alone might suggest the stock is cheap, but benchmarking against others in the sector can miss company-specific details. To address this, Simply Wall St uses the Fair Ratio, a tailored benchmark that accounts for Alibaba’s earnings growth outlook, profit margins, market capitalization, risk factors, and position in the Multiline Retail industry. This Fair Ratio stands at 29.0x for Alibaba.

This comprehensive approach offers a more accurate assessment than simply comparing with peers or the broader industry, since it adjusts for nuances in Alibaba’s financial performance and strategic outlook. Since the current PE is notably below the Fair Ratio, this indicates the shares are undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

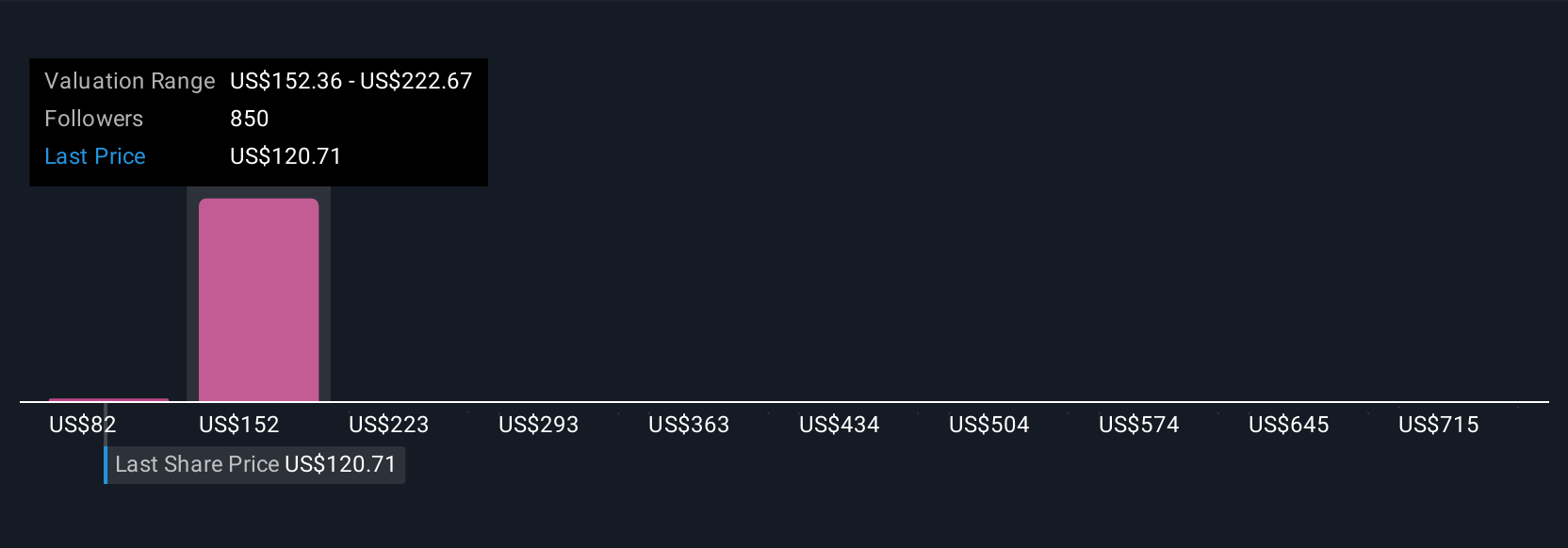

Upgrade Your Decision Making: Choose your Alibaba Group Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, intuitive tool that lets you tell your investment story: you choose how you think Alibaba will perform, plug in your own expectations for things like future revenues, earnings, and margins, and instantly see what that means for fair value.

Narratives connect the dots between Alibaba’s business story, a personalized financial forecast, and a concrete estimate of what the shares are worth right now. They are available to everyone in the Simply Wall St Community page, where millions of investors are crafting and updating their views. This means you never have to settle for averages or outdated consensus.

This approach helps you decide when to buy or sell by directly comparing your assumed fair value to the current market price, giving clarity in rapidly changing markets. Best of all, Narratives update automatically when fresh information, like news or earnings, changes the story, so your view stays as current as possible.

For example, some Alibaba Narratives see rapid AI and cloud growth driving fair values close to $193 per share. More cautious investors, concerned about regulatory and trade risks, peg fair value as low as $107. This shows there is no single “right” answer, just the one that fits your outlook.

For Alibaba Group Holding, we'll make it really easy for you with previews of two leading Alibaba Group Holding Narratives:

🐂 Alibaba Group Holding Bull Case

Fair Value: $193.43

Current Price vs. Fair Value: 14.3% below fair value

Expected Revenue Growth Rate: 8.76%

- Heavy investments in AI, cloud, and quick commerce are expected to fuel long-term revenue and margin growth. These investments may weigh on near-term profit.

- An integrated digital ecosystem and strategic partnerships are driving Alibaba's enterprise presence, increasing user engagement and raising the company’s competitive edge in digital services.

- Risks include the potential for margin compression, prolonged losses from new ventures, and heightened exposure to macroeconomic and regulatory headwinds if investments do not deliver planned returns.

🐻 Alibaba Group Holding Bear Case

Fair Value: $107.09

Current Price vs. Fair Value: 54.9% above fair value

Expected Revenue Growth Rate: 14.12%

- Despite strong operational results and accelerating growth in AI and cloud, Alibaba's current share price already factors in near-term optimism.

- Major risks are tied to US-China trade tensions, ongoing regulatory scrutiny, intensified competition, and currency exposure.

- While the business fundamentals are robust, the analyst is cautious on valuation as macro headwinds may outweigh growth. There has also been a recent trend of high-profile investors exiting their positions.

Do you think there's more to the story for Alibaba Group Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives