Alibaba (NYSE:BABA) is still Attractively Valued but Risks are Increasing

Alibaba Group Holding Limited’s ( NYSE:BABA ) share price has come under pressure once again after the company released 2nd quarter earnings that fell short of expectations. The stock price has been under pressure for the last 12 months due to the regulatory pressure in China, but the share was widely considered a bargain prior to these results. Some investors are now questioning Alibaba’s growth outlook and how it relates to the valuation.

Second quarter financial highlights:

- Revenue up 29% to RMB200.69 bln, up 29% from a year ago, but ~2% below estimates

- Non-GAAP EPS (per ADS) RMB11.20, and RMB1.24 below estimates

- Operating Income up 10% to RMB15 bln

- Net Income down 87% to RMB3.377 bln

- Non-GAAP free cash flow was RMB22,239 mln

- Cloud revenue up 33%

- Annual active consumers up 62 million from the previous quarter to 1.24 billion FY 2022 Revenue to grow 20 to 23%.

This guidance marks a significant slowdown in revenue growth. Analysts estimates have actually been declining since August, but were still closer to 30%. However, over the longer term, most analysts expected growth to be closer to 15%.

The large decline in net income was related to new investments, hence the large disparity between net income and cash flow.

See our latest analysis for Alibaba Group Holding

What is Alibaba worth?

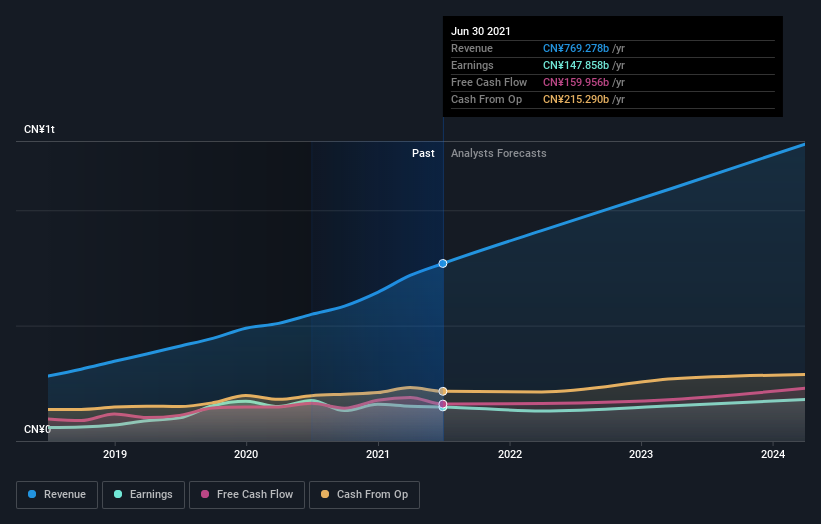

When we estimate the fair value for Alibaba based on forecast cash flows, we arrive at a value of $295, implying that the stock is trading at a 51% discount. This estimate is based on analyst estimates as they stood before the latest results were released. These estimates are likely to be adjusted now that the outlook has been revised lower, but the implied discount does imply a margin of safety.

The price-to-earnings (PE) ratio of 16.81x is below its peer average of 23.72x, and the broader market’s 18x. This also implies that the stock is attractively priced. Ultimately though, how the stock performs will depend on how expectations change in the coming months and years.

What does the future of Alibaba Group Holding look like?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Profits are currently expected to grow by 22% over the next few years and if they do the current price would be very attractive. Of course the latest guidance suggests growth may be lower, which may limit upside for investors.

What this means for shareholders:

Alibaba’s current valuation does provide some margin to compensate for risks. But the risks do seem to be increasing. Besides the regulatory risk in China which is difficult to quantify, Alibaba may be struggling to grow from the current very high base. There are also some concerns that the company is facing increased competition from smaller rivals like JD.com ( NasdaqGS:JD ).

We suggest keeping an eye on consensus estimates and see how these are adjusted in the coming weeks. You can track these estimates and our estimate of the valuation with our free analysis for Alibaba Group Holding

If you are no longer interested in Alibaba Group Holding, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives