Alibaba Group (BABA) Is Up 14.4% After $3.17B Bond Raise to Fund AI and Cloud Expansion – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this week, Alibaba Group Holding completed a US$3.17 billion zero-coupon convertible bond offering, with most proceeds allocated to expanding data center infrastructure, technology upgrades, and artificial intelligence investment through 2032.

- This marks a significant capital commitment likely to accelerate Alibaba’s expansion across both advanced technology and international e-commerce platforms.

- We’ll explore how this major funding initiative for AI and cloud investment could influence Alibaba’s overall investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Alibaba Group Holding Investment Narrative Recap

To be a shareholder in Alibaba today, you need confidence that the company’s substantial AI and cloud investments will ultimately deliver higher growth and margin improvement, overcoming short-term profit pressures and intense competition. Alibaba’s US$3.17 billion zero-coupon convertible bond offering reinforces its focus on advanced technology and international e-commerce, but does not immediately alter the primary short-term catalyst, realizing tangible progress from its major AI and cloud bets, or alleviate the key risk of compressed margins if these investments struggle to pay off.

The recent announcement of Alibaba’s RMB 380 billion commitment to AI and cloud infrastructure is particularly relevant, as it aligns crisply with the use of funds from the new convertible bond offering. This supports the view that Alibaba’s growth catalyst revolves around execution in AI and cloud, with investment scale and return on capital remaining under close investor scrutiny as these projects ramp up.

However, investors should be aware that increased spending on cloud and AI may also heighten exposure to...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's narrative projects CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This requires 8.0% yearly revenue growth and a CN¥22.8 billion earnings increase from CN¥148.3 billion today.

Uncover how Alibaba Group Holding's forecasts yield a $165.48 fair value, a 7% upside to its current price.

Exploring Other Perspectives

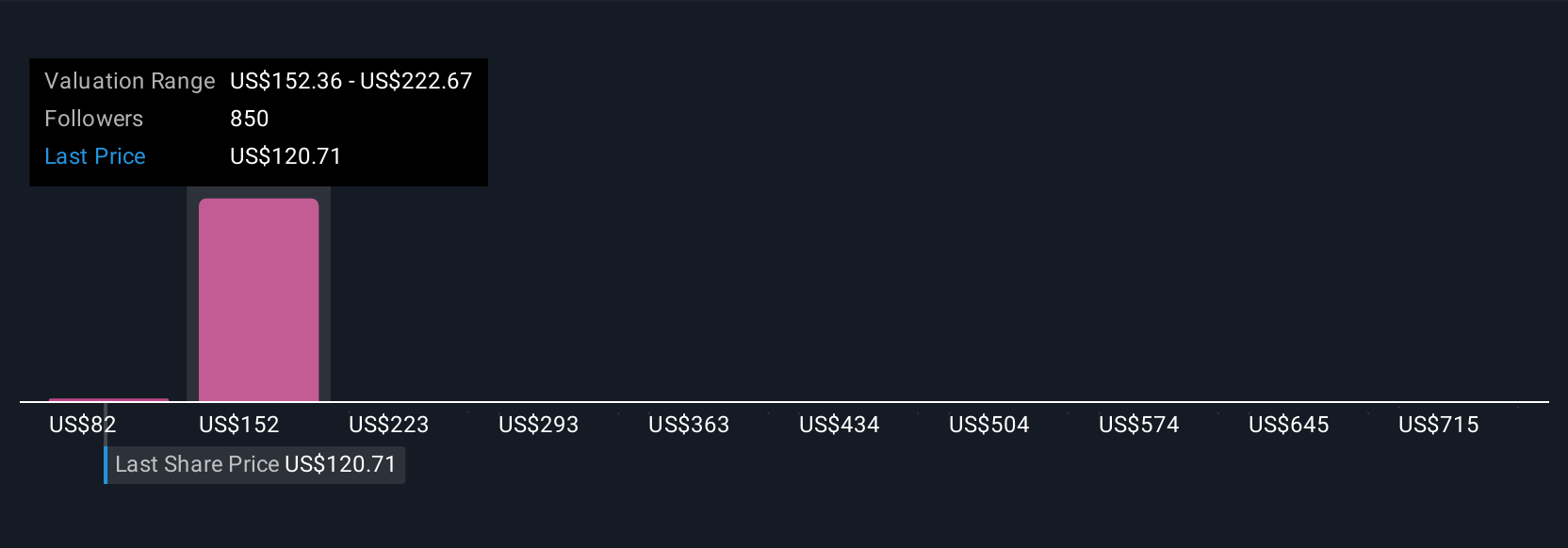

Simply Wall St Community members provided 78 fair value estimates for Alibaba, ranging from US$106.47 to US$785.21 per share. While some expect significant upside, remember that intensified competition and heavy investment demands could keep profit margins under pressure longer than expected, explore these diverse viewpoints for a broader picture.

Explore 78 other fair value estimates on Alibaba Group Holding - why the stock might be worth 31% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives