A Fresh Look at Alibaba (NYSE:BABA) Valuation as Shares Sustain Recent Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Alibaba Group Holding.

Alibaba’s strong rally over the past quarter is building on impressive momentum, with a 90-day share price return of nearly 39% and a 1-year total shareholder return of almost 66%. While the five-year total return is still negative, recent strength suggests investor sentiment could be turning as growth potential and valuation come back into focus.

If Alibaba’s renewed momentum has you thinking bigger, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Alibaba’s shares surging and yet still trading roughly 17% below analyst price targets, investors have to wonder if the stock is undervalued or if the market is already pricing in the company’s future growth.

Most Popular Narrative: 56% Overvalued

According to StefanoF, the most-followed valuation narrative suggests Alibaba's fair value sits far below the last close. Recent price action is seen as fully reflecting short-term growth potential rather than leaving meaningful upside. This perspective invites investors to dig deeper into the reasoning behind a price target that is much lower than today's share price.

Strong AI/cloud momentum with expanding market share, dominant e-commerce position in China, strong cash generation capabilities, reasonable valuation multiples relative to growth. Bottom Line: While Alibaba shows strong operational momentum, particularly in AI and cloud services, the current stock price appears to fully reflect near-term growth prospects given macro headwinds and geopolitical risks.

Curious how these projections stack up? The fair value calculation leans heavily on long-term revenue and profit growth assumptions, along with a discount rate fit for global tech giants. Want to know which variables might swing the outcome? The full narrative unpacks the numbers and rationale driving the surprisingly cautious fair value.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed regulatory pressures or a sharp escalation in US-China trade tensions could quickly change the cautious valuation outlook for Alibaba.

Find out about the key risks to this Alibaba Group Holding narrative.

Another View: The Market’s Multiple Tells a Different Story

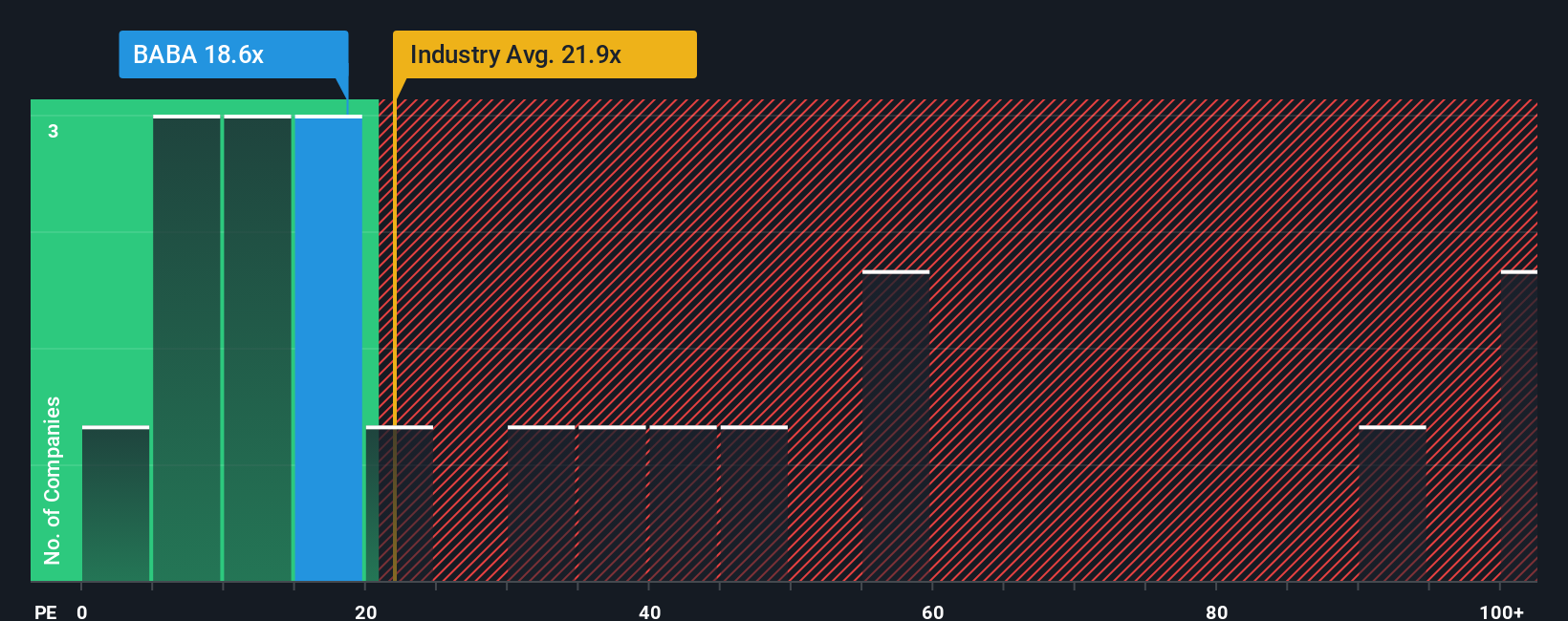

While the narrative-driven fair value points to overvaluation, a look at Alibaba’s price-to-earnings ratio paints a more optimistic picture. Trading at 17.9x, Alibaba’s valuation is well below both its industry average (20.6x) and peer average (43.7x). It also falls under the fair ratio of 28.9x. Could the market be missing a value opportunity, or is there a reason for the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you would rather rely on your own judgment or want to investigate the numbers firsthand, you can shape your own Alibaba outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for more investment ideas?

Don't settle for the obvious when there are overlooked opportunities waiting. Make your next move confidently by finding forward-thinking stocks in areas you might have missed.

- Uncover future blue chips hidden among these 3597 penny stocks with strong financials with growth potential often missed by the crowd.

- Target steady returns by checking out top income opportunities via these 18 dividend stocks with yields > 3% for yields above the market average.

- Capitalize on innovation in healthcare by accessing these 33 healthcare AI stocks, featuring companies transforming patient outcomes with advanced technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives