- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch’s Valuation in Focus After Launching Athleticwear Collaboration With TJ Watt

Reviewed by Simply Wall St

Abercrombie & Fitch is making headlines this week after revealing a multi-season collaboration with NFL linebacker TJ Watt and his wife, Dani Watt, for its YPB activewear brand. This marks the company’s first foray into athletic partnerships and signals that Abercrombie is stepping up efforts to tap into performance-focused apparel. The collection, set to launch in three seasonal drops starting this fall, is being promoted as a strategic push to broaden the brand’s reach and appeal to consumers seeking a blend of style and function.

This news comes as Abercrombie & Fitch’s stock has experienced significant volatility over the past year. While the share price dipped more than 40% year-to-date, recent months have brought signs of a turnaround, with gains of 28% over the past three months and another 7% in the last month. Retail partnerships and wholesale expansion have also helped the brand maintain visibility, but a combination of modest revenue and earnings growth has kept risk perceptions fluctuating.

With momentum shifting and the company making bold strategic moves, investors may be weighing whether Abercrombie & Fitch is attractively priced after last year’s slide, or if the market has already factored in future growth.

Most Popular Narrative: 13.8% Undervalued

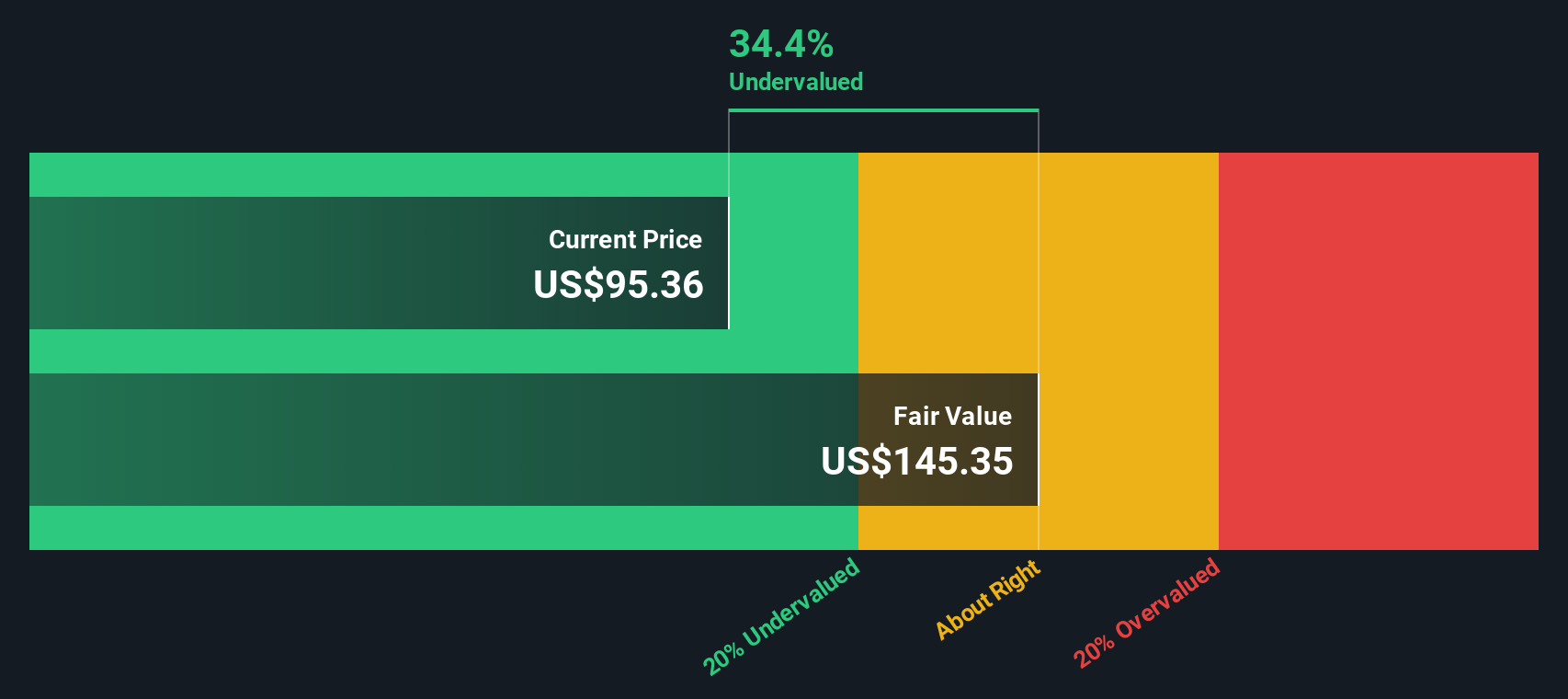

According to community narrative, Abercrombie & Fitch is currently trading below its estimated fair value, with analysts seeing meaningful upside based on future earnings and revenue growth projections.

“Abercrombie & Fitch plans to continue expanding its international presence through new store openings and entering new markets via franchise and wholesale partnerships. This is expected to increase revenue growth. The company is investing in technology to enhance the digital shopping experience, which should drive revenue growth and improve net margins by increasing online sales and reducing transaction costs.”

Curious what bold moves and financial assumptions could justify this eye-catching fair value target? Find out exactly which aggressive growth projections are fueling analyst optimism. There is a key set of financial expectations here, and the numbers just might surprise you.

Result: Fair Value of $114.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, higher shipping costs and intensified competition could present challenges for Abercrombie & Fitch as it seeks to maintain recent margin gains and meet revenue growth projections.

Find out about the key risks to this Abercrombie & Fitch narrative.Another View: Discounted Cash Flow Model

Taking a different approach, the SWS DCF model also points toward Abercrombie & Fitch being undervalued at current prices. However, can this model’s longer-term focus capture the potential risks of retail volatility?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Abercrombie & Fitch Narrative

If you have a different perspective or want to dig into the numbers on your own, you can quickly craft your own story. Why not do it your way?

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the advantage in today’s fast-moving market. There are exciting opportunities waiting just beyond Abercrombie & Fitch. Use the Simply Wall Street Screener to act on top trends and pinpoint stocks that align with your goals before others do.

- Supercharge your portfolio with leading-edge AI penny stocks that are making waves in artificial intelligence’s most promising sectors.

- Tap into reliable income streams by targeting companies offering attractive dividend stocks with yields > 3% and a proven track record of consistent payouts.

- Get ahead of innovation with the best-performing quantum computing stocks vying for breakthroughs in computing power and disruptive technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives