- United States

- /

- Specialty Stores

- /

- NYSE:AN

Investors Who Bought AutoNation (NYSE:AN) Shares A Year Ago Are Now Up 23%

AutoNation, Inc. (NYSE:AN) shareholders have seen the share price descend 13% over the month. Taking a longer term view we see the stock is up over one year. However, its return of 23% does fall short of the market return of, 27%.

View our latest analysis for AutoNation

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, AutoNation actually saw its earnings per share drop 14%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

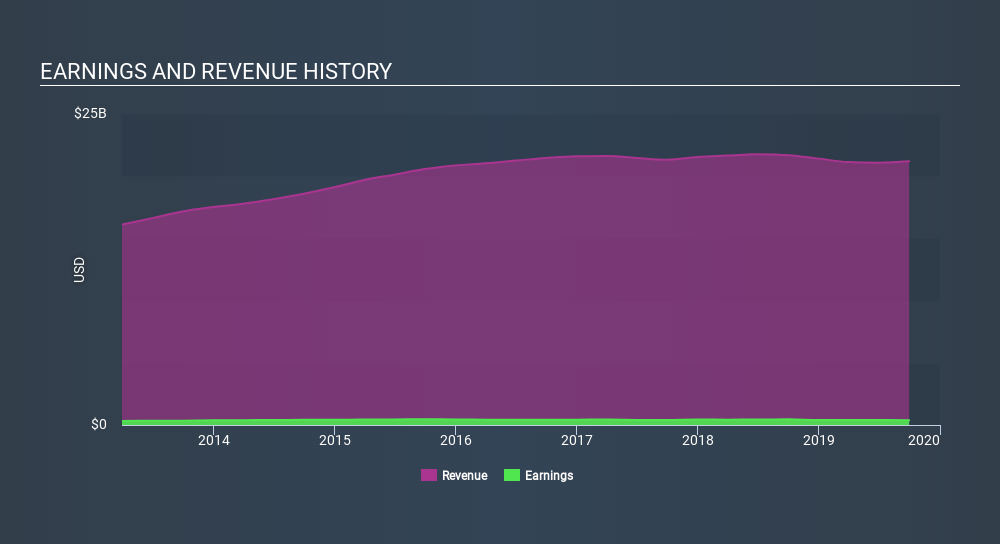

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

While share prices often depend primarily on earnings and revenue, they can be sensitive to an investment's risk level as well. For example, we've discovered 1 warning sign for AutoNation (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

AutoNation shareholders are up 23% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 4.8% per year, over five years. So this might be a sign the business has turned its fortunes around. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives