- United States

- /

- Specialty Stores

- /

- OTCPK:ALLG.F

Revenues Tell The Story For Allego N.V. (NYSE:ALLG) As Its Stock Soars 41%

Those holding Allego N.V. (NYSE:ALLG) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

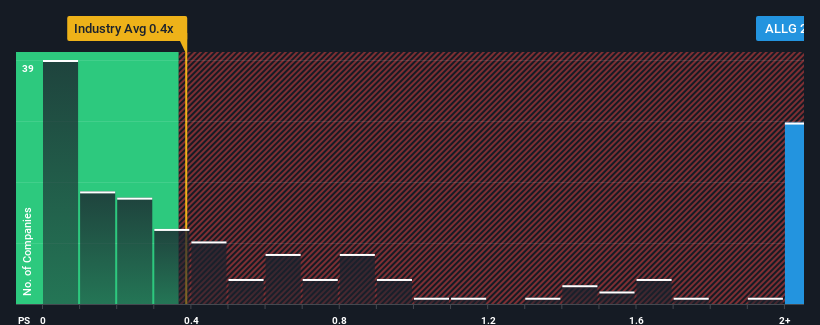

Since its price has surged higher, you could be forgiven for thinking Allego is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in the United States' Specialty Retail industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Allego

What Does Allego's Recent Performance Look Like?

Allego certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Allego's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Allego's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 256% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 48% per year during the coming three years according to the three analysts following the company. With the industry only predicted to deliver 5.7% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Allego is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Allego's P/S Mean For Investors?

Allego shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Allego maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Specialty Retail industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for Allego (3 are a bit unpleasant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:ALLG.F

Slight and overvalued.

Similar Companies

Market Insights

Community Narratives