- United States

- /

- Specialty Stores

- /

- NYSE:AEO

Why American Eagle Outfitters (AEO) Is Up 10.1% After Sydney Sweeney Social Impact Campaign Launch and What's Next

Reviewed by Simply Wall St

- American Eagle Outfitters recently launched its Fall '25 campaign featuring Sydney Sweeney, spotlighting iconic denim styles and innovative media including 3D billboards, Snapchat lenses, and AI-enabled try-on tools.

- The campaign's introduction of "The Sydney Jean" as a limited-run, cause-related product, donating all proceeds to Crisis Text Line, reflects a growing focus on social impact alongside brand appeal for Gen Z consumers.

- We'll examine how the launch of a high-profile, social responsibility-driven campaign may affect American Eagle Outfitters' investment narrative.

American Eagle Outfitters Investment Narrative Recap

To be a shareholder in American Eagle Outfitters, you need to believe the brand can sustain relevance with younger consumers while managing cost pressures and driving operational efficiency. The new Sydney Sweeney campaign brings visibility and social impact, but the company's most important near-term catalyst, restoring consistent revenue growth, remains challenged by a softer consumer environment. The most immediate risk remains pressure on margins from increased markdowns and continued uncertainty in discretionary spending, and the campaign is unlikely to have a material short-term impact on these challenges.

Among recent announcements, the June share buyback update stands out as most relevant. American Eagle Outfitters completed sizeable repurchases this year, reducing share count by 13.6%, which could support earnings per share even through turbulent sales periods. However, with Q1 losses already reported and full-year revenue expected to decline, top-line performance remains the true test for whether initiatives like the Fall campaign move the needle.

In contrast, for investors keeping score, there is the ongoing risk that persistent markdowns...

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters is forecast to achieve $5.3 billion in revenue and $277.7 million in earnings by 2028. This projection assumes a 0.1% annual revenue decline and a $51.7 million decrease in earnings from current levels of $329.4 million.

Exploring Other Perspectives

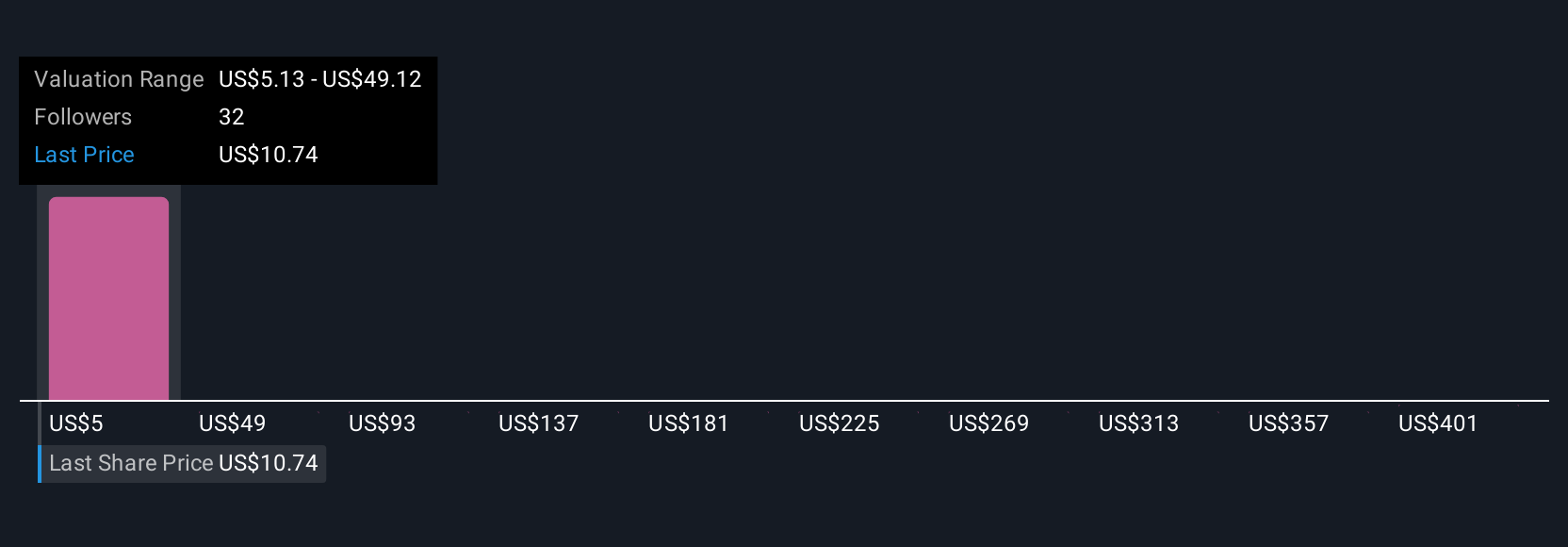

Across six fair value estimates from the Simply Wall St Community, targets span US$3.64 to US$445.03 per share. While opinions run wide, recent pressure on margins and revenue trends remain crucial factors shaping the company's outlook.

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives