- United States

- /

- Specialty Stores

- /

- NYSE:AEO

Should You Revisit American Eagle After Shares Fall 16% and Q1 Earnings Surprise?

Reviewed by Bailey Pemberton

Thinking about what to do with American Eagle Outfitters stock? You are not alone. With the price at $15.15 and some puzzling moves lately, it is only natural to wonder whether now is the time to buy, hold, or look elsewhere. Over just the last seven days, shares have dropped 10.6%, and they are down 15.8% across the past month too. That might sound rough, but if you zoom out, there are signs of real resilience. Despite this year’s 11.6% slide and a tough past 12 months, the stock is up 63.3% over the last three years and 13.6% in five. Those stretches of growth suggest this retailer can surprise investors when market sentiment shifts or competitive pressures ease.

But what about value? For a company like American Eagle Outfitters, it is not just about the headlines or recent setbacks. It is about whether the market is giving it fair credit for its earning power and potential. Based on six classic valuation checks, American Eagle Outfitters is scoring a 3 out of 6, meaning it looks undervalued on half those key measures. That could be a hint the market is underestimating what this retailer has going for it, or just that risks are getting more attention than normal for now.

Let’s break down how investors typically judge value, and why the right combination of these approaches might be the best roadmap for you. Plus, at the end of this article, I will share a perspective that could help you cut through all the noise and get to the heart of what American Eagle Outfitters is truly worth.

Why American Eagle Outfitters is lagging behind its peers

Approach 1: American Eagle Outfitters Discounted Cash Flow (DCF) Analysis

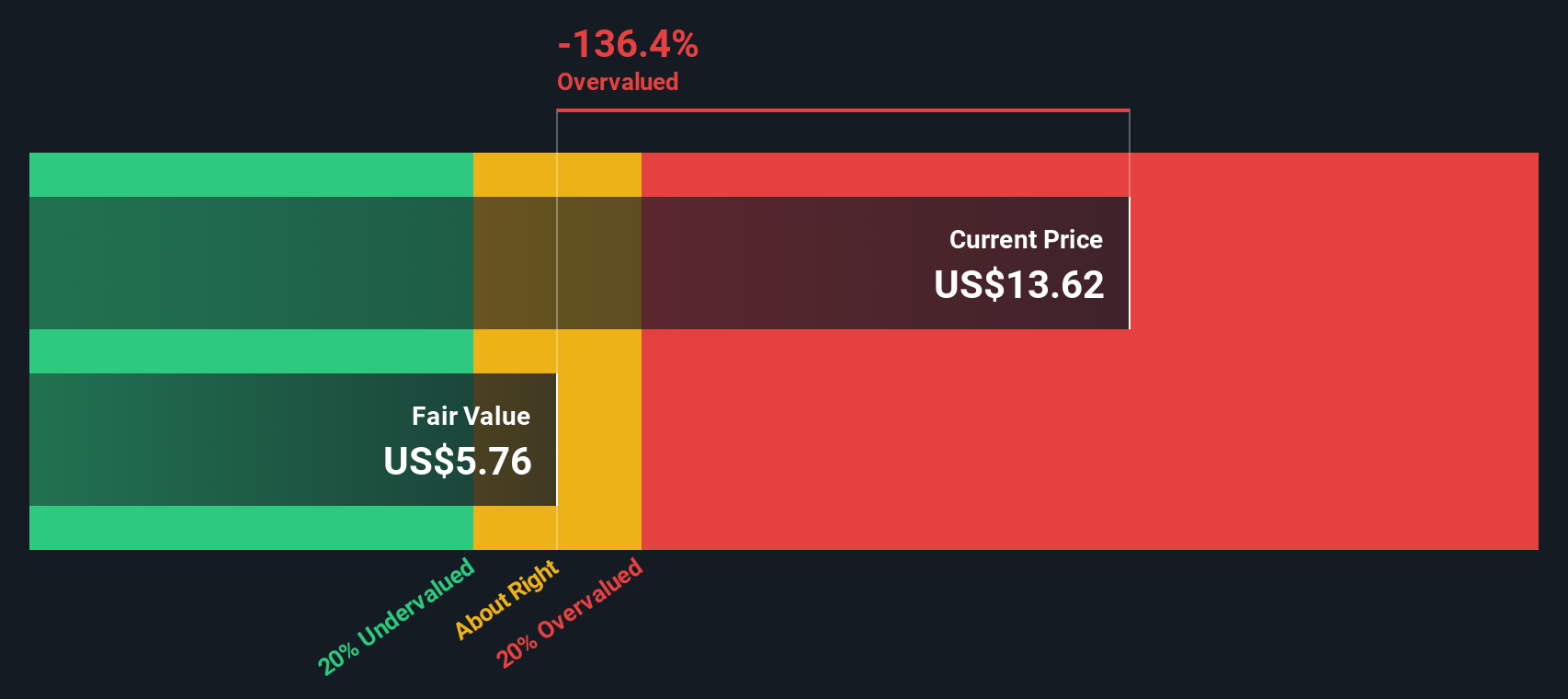

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows and discounting them back to today’s dollars. For American Eagle Outfitters, this approach helps investors understand what the company could be worth based on expected cash generation, rather than only current earnings or sales multiples.

According to the DCF model, American Eagle Outfitters generated $188.2 million in free cash flow over the last twelve months. Analysts project that future free cash flow will fluctuate, reaching roughly $157 million by 2028. While professional forecasts usually extend up to five years, projections beyond that are extrapolated using available trends and industry insights. Over the next ten years, estimates suggest annual free cash flow may move in a narrow range, reflecting both challenges and stability in the company’s operating performance.

The result of this analysis puts the company’s fair value at $10.28 per share. Compared to the current share price of $15.15, the DCF indicates the stock is about 47.3% overvalued. The method behind this number is thorough, and the conclusion is clear for investors watching for value: American Eagle Outfitters’ current price is not backed up by its projected cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Eagle Outfitters may be overvalued by 47.3%. Find undervalued stocks or create your own screener to find better value opportunities.

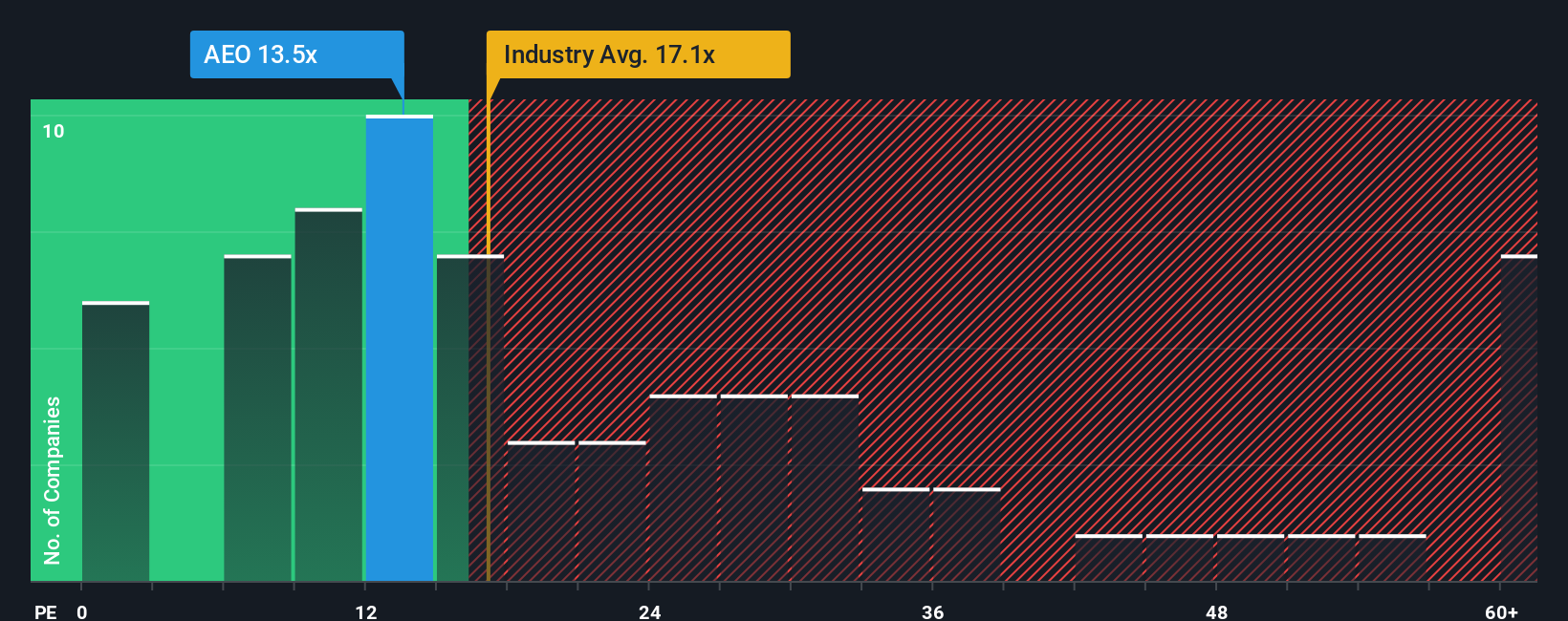

Approach 2: American Eagle Outfitters Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like American Eagle Outfitters because it directly relates the company’s share price to its reported earnings per share. For investors, it offers a straightforward way to assess whether the market is asking too much, or not enough, for every dollar of profit the company generates.

However, what counts as a “normal” or “fair” PE ratio does not exist in a vacuum. If a company is expected to grow its earnings rapidly and has low risk factors, investors will often accept a higher PE ratio. In contrast, modest growth or higher risks tend to result in lower PE multiples being justified by the market.

Currently, American Eagle Outfitters trades at a PE of 13x. That is less than both the Specialty Retail industry average of about 16.7x and the peer average of 17.3x. This puts the company below its direct competitors and the broader industry, painting a picture of relative caution from the market.

To dig deeper, the Simply Wall St “Fair Ratio” trims away the noise of basic comparisons. Rather than just measuring against peers or industry averages, the Fair Ratio also reflects factors like earnings growth, profit margin, market cap and overall business risks. For American Eagle Outfitters, the Fair Ratio comes in at 22.9x, suggesting the company could reasonably justify a much higher multiple based on these broader metrics.

Since the current PE of 13x is well below the Fair Ratio of 22.9x, American Eagle Outfitters appears undervalued by this standard.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Eagle Outfitters Narrative

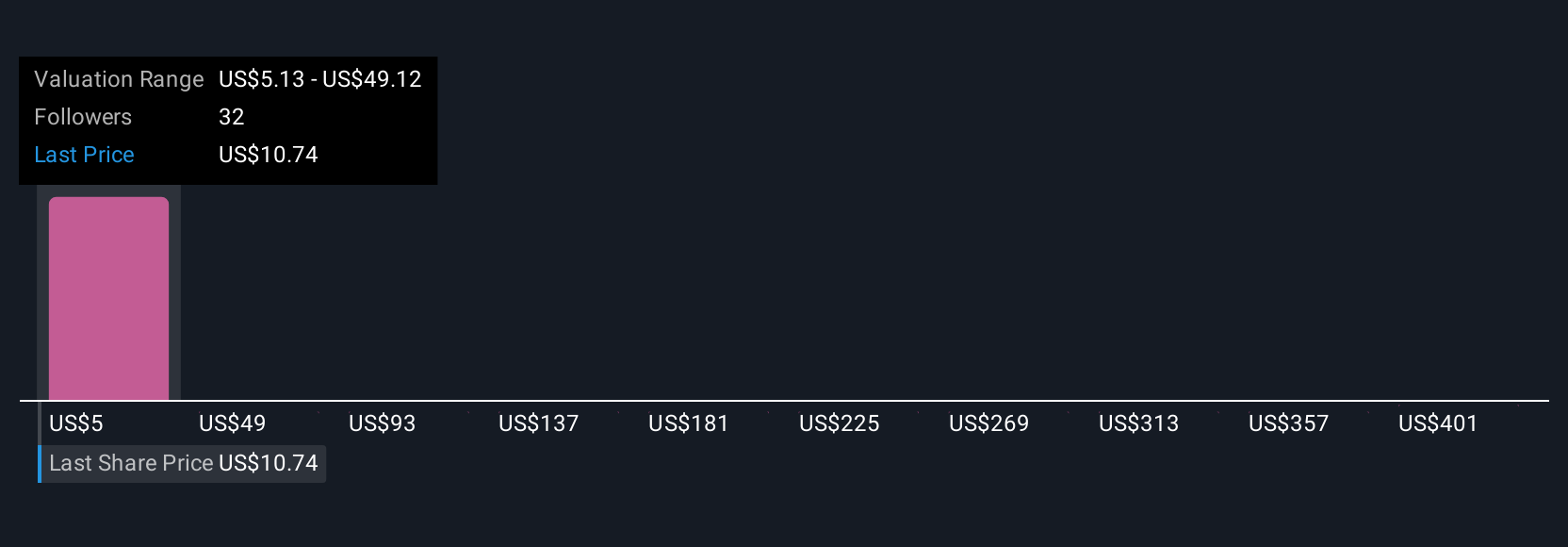

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives bring your investment decision to life by combining numbers and story. They let you map out your view of a company by stating your assumptions about future revenue, profit margins, and risks, and then linking those beliefs to a fair value and forecasted outcomes.

In practical terms, a Narrative helps turn your perspective into a concrete, dynamic financial forecast, making it easier to understand exactly why a company might be a buy, hold, or sell on your terms. Narratives are available on the Simply Wall St platform’s Community page, where millions of investors can build, share, and compare their outlooks in just a few clicks. These stories go further than traditional valuation tools by showing how different assumptions (both optimistic and pessimistic) create a range of possible fair values and automatically update as new news or earnings data becomes available.

For example, one Narrative for American Eagle Outfitters may see upside from continued expansion in Aerie and OFFLINE, with a bullish price target of $21.5. Another takes a more cautious approach, highlighting consumer uncertainty and margin pressures, and arrives at a price target of just $10. Narratives let you explore these diverse perspectives, compare fair value to the current price, and decide for yourself based on the full picture.

Do you think there's more to the story for American Eagle Outfitters? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives