- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Is There Opportunity in Advance Auto Parts After Its Recent 50% Share Price Rebound in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Advance Auto Parts stock? You are not alone. The last few years have been a wild ride, and the numbers tell the story. After cratering by over 60% in the past three years, shares have staged a big comeback, up more than 50% in the past twelve months and still holding on to a solid 21.1% gain for the year to date. Of course, the past week has been a bit bumpy, with the stock slipping 7.4%, and the past month shows a small loss of 3.5%. So, is the party over, or is there more upside waiting in the wings?

Recent shifts in the auto parts sector, including changes in consumer demand and supply chain improvements, seem to be reducing some of the risk premium once priced into the stock. Still, after such outsized moves, there is plenty of debate around whether Advance Auto Parts is truly undervalued or just riding a wave of shifting sentiment.

This is where things get interesting. By putting Advance Auto Parts through six key valuation tests, the company racked up a score of 4 out of 6 for undervaluation, which is a strong showing that suggests value hunters should be paying attention. But before you make a decision, let us break down these valuation checks and, later in the article, dig into an even more telling way to gauge what the stock is really worth.

Approach 1: Advance Auto Parts Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth based on projected future cash flows, which are then discounted back to today's value to reflect the time value of money. In essence, DCF asks what all the future cash generated by Advance Auto Parts would be worth if you received it today.

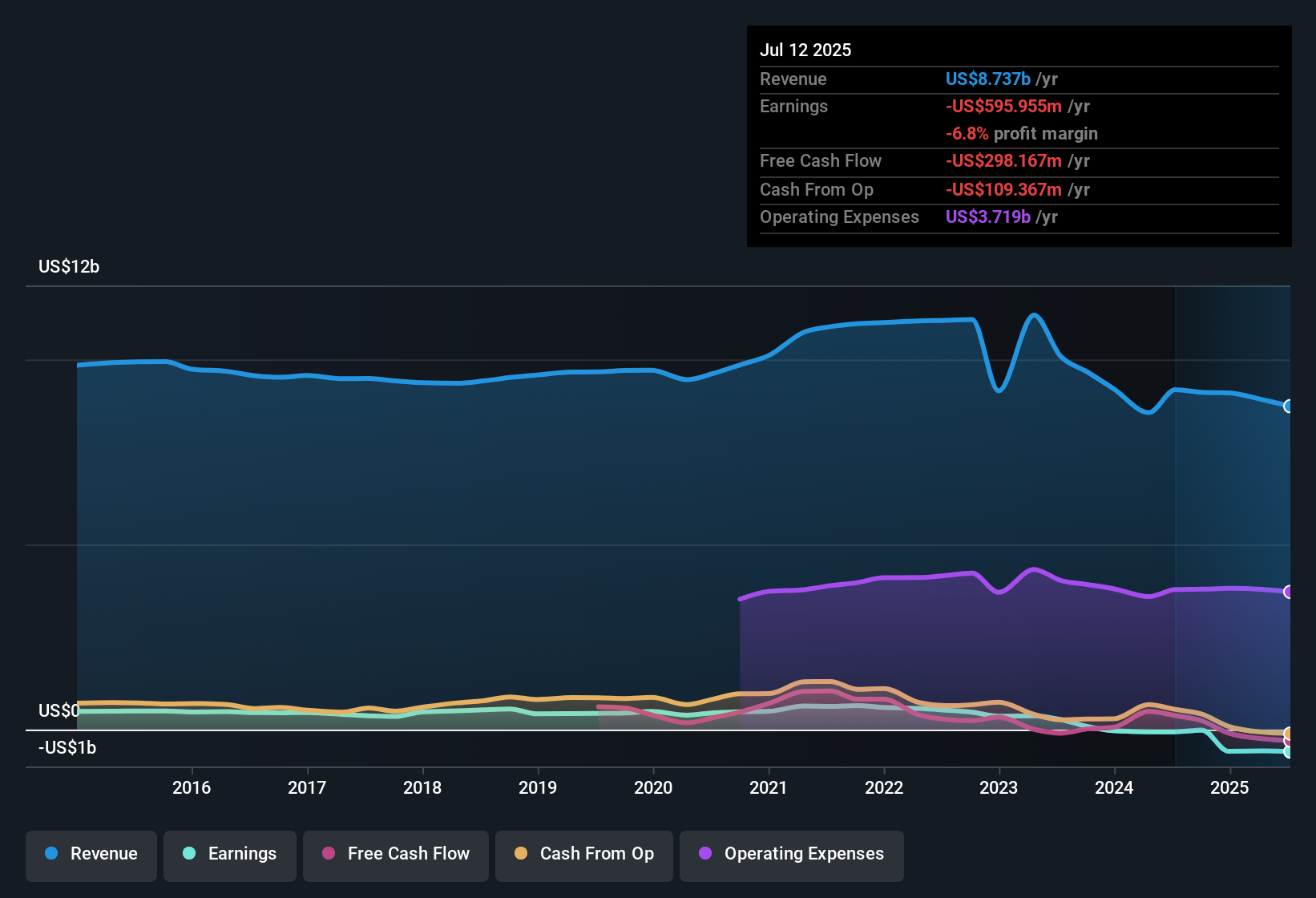

According to the latest data, Advance Auto Parts currently has a last twelve months Free Cash Flow (FCF) of -$332 million. Analysts project significant improvement over time, with FCF expected to climb to approximately $631 million by 2035. Initial FCF forecasts are available for the first five years, with subsequent years extrapolated. These forecasts show anticipated annual growth driven by operational gains and sector trends.

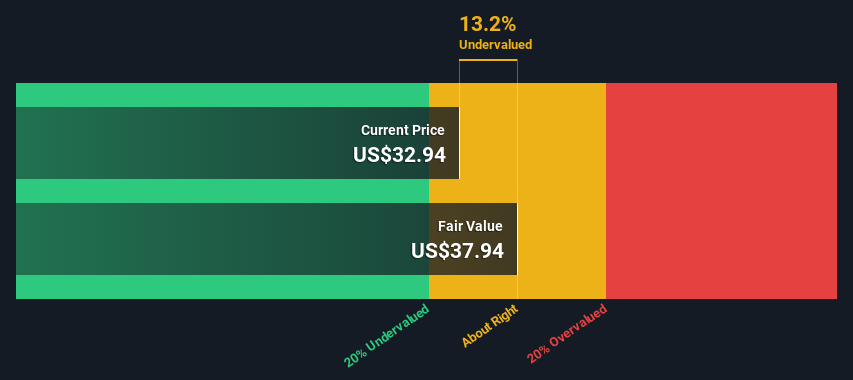

Using the two-stage Free Cash Flow to Equity approach, this model calculates an intrinsic value of $81.69 per share. That figure represents a 28.6% discount to the current share price, suggesting Advance Auto Parts is trading well below what its future cash flows might be worth today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advance Auto Parts is undervalued by 28.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Advance Auto Parts Price vs Sales

For companies like Advance Auto Parts, which are in a challenging earnings environment, the Price-to-Sales (P/S) ratio can be a helpful valuation tool. The P/S ratio looks at a company's share price compared to its revenue, making it especially useful when profits are volatile or temporarily negative, as it better reflects core operational performance.

What counts as a “normal” or “fair” P/S ratio depends a lot on a company's growth prospects and risk profile. Generally, companies with higher expected revenue growth or lower risk can justify higher multiples, while slower or riskier businesses trade at a discount.

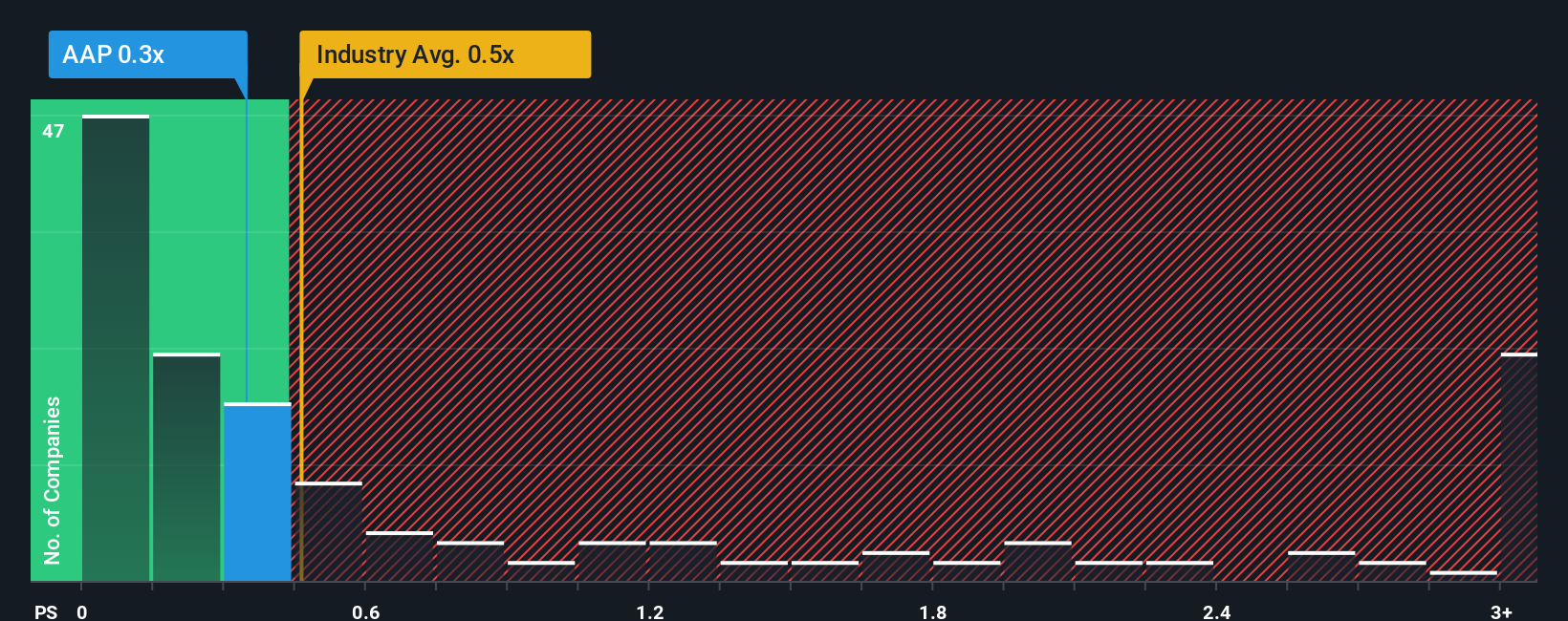

Advance Auto Parts currently trades at a P/S ratio of 0.40x. This is below the Specialty Retail industry average of 0.49x and also below its peer group average of 0.28x. However, comparisons like these do not tell the full story because growth rates, profitability, market dynamics, and risk all play a part in what is truly “fair.”

This is where Simply Wall St's proprietary Fair Ratio comes into play. The Fair Ratio, in this case 0.54x, adjusts for the company’s specific characteristics, including expected growth, risk, profit margins, and market size. By combining these variables, the Fair Ratio gives a more meaningful benchmark than the industry or peer average alone.

Comparing Advance Auto Parts’ actual P/S of 0.40x to its Fair Ratio of 0.54x shows the stock may be undervalued relative to its fundamentals and potential. This suggests there could be upside ahead if the market starts to price in the company’s strengths.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advance Auto Parts Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story or perspective that ties together your view on a company's future by linking your assumptions about its growth, earnings, and margins to a forecast, and ultimately a fair value for the stock.

Instead of relying on just numbers, Narratives allow you to articulate why you think Advance Auto Parts is undervalued or overvalued, giving context to your estimates and painting a clearer picture of what might happen next. On Simply Wall St's Community page, used by millions of investors, Narratives are an accessible, easy-to-use tool that help you express your view, whether you are an optimist seeing recovery or a skeptic anticipating challenges ahead.

The power of Narratives is that they update dynamically when new information comes out, such as earnings releases or major news, so your story stays relevant as the facts change. This means you can quickly compare the Fair Value from your Narrative against the current stock price and decide with confidence when to buy, hold, or sell.

For example, with Advance Auto Parts, some investors believe efficiency initiatives will boost margins and set a Fair Value as high as $65 per share, while others are more cautious, factoring in risks and setting a Fair Value closer to $30. Your Narrative helps put these perspectives in context so you can make the decision that fits your outlook.

Do you think there's more to the story for Advance Auto Parts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives