- United States

- /

- Hospitality

- /

- NasdaqCM:YTRA

Yatra Online's (NASDAQ:YTRA) Shareholders Are Down 69% On Their Shares

While it may not be enough for some shareholders, we think it is good to see the Yatra Online, Inc. (NASDAQ:YTRA) share price up 14% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 69% in that period. Some might say the recent bounce is to be expected after such a bad drop. Perhaps the company has turned over a new leaf.

Check out our latest analysis for Yatra Online

Yatra Online isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Yatra Online's revenue dropped 37% per year. That means its revenue trend is very weak compared to other loss making companies. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 19% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

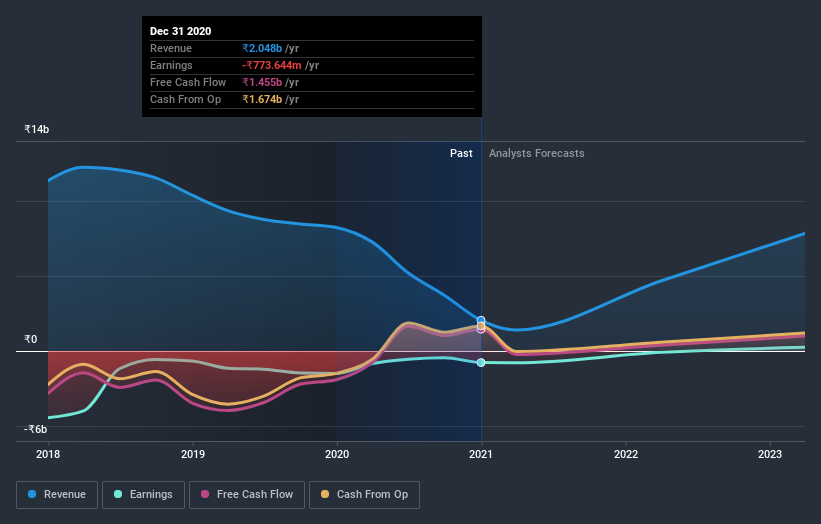

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Yatra Online shareholders are up 4.7% for the year. While you don't go broke making a profit, this return was actually lower than the average market return of about 54%. The silver lining is that the recent rise is far preferable to the annual loss of 19% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Yatra Online better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Yatra Online you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Yatra Online or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:YTRA

Yatra Online

Operates as an online travel company in India and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives