- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Evaluating Petco (WOOF) Stock: Is There Hidden Value in the Latest Market Moves?

Reviewed by Kshitija Bhandaru

Petco Health and Wellness Company (WOOF) stock has caught the attention of investors as it navigates recent market movements. The company's share price has changed over the past month, offering fresh insight into how the market views its outlook.

See our latest analysis for Petco Health and Wellness Company.

Momentum for Petco Health and Wellness Company has faded, with the share price edging only slightly higher in recent months and the 1-year total shareholder return down nearly 29%. Recent moves reflect a shift in how investors are weighing growth potential against ongoing risks, as the business looks for stability after notable declines over the past three years.

Curious what other investors are watching? Now might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares treading water and analyst targets just above the current price, the key question is whether Petco is an undervalued bargain or if the market already reflects its future prospects. Is there upside ahead, or is everything priced in?

Most Popular Narrative: 1.9% Undervalued

The latest narrative puts Petco Health and Wellness Company's fair value just above the most recent close. This subtle gap sets the stage for a deeper look at what is driving the small difference in estimated upside.

Expanding in-store experiences and wellness services aims to drive customer engagement, higher margins, and recurring revenue through premium offerings and service integration. Enhanced omnichannel strategy, loyalty programs, and differentiated merchandising seek to boost retention, operational efficiency, and brand exclusivity for long-term profitability.

Want to know what could supercharge the next chapter? There is a bold set of quantitative bets on earnings momentum, margin transformation, and a premium future valuation that defies typical retail stocks. Want to see which numbers make this tiny undervaluation possible? The details behind this fair value are sure to surprise you.

Result: Fair Value of $3.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing e-commerce struggles and industry-wide stagnation could quickly undermine the bullish case if digital performance and core sales do not recover.

Find out about the key risks to this Petco Health and Wellness Company narrative.

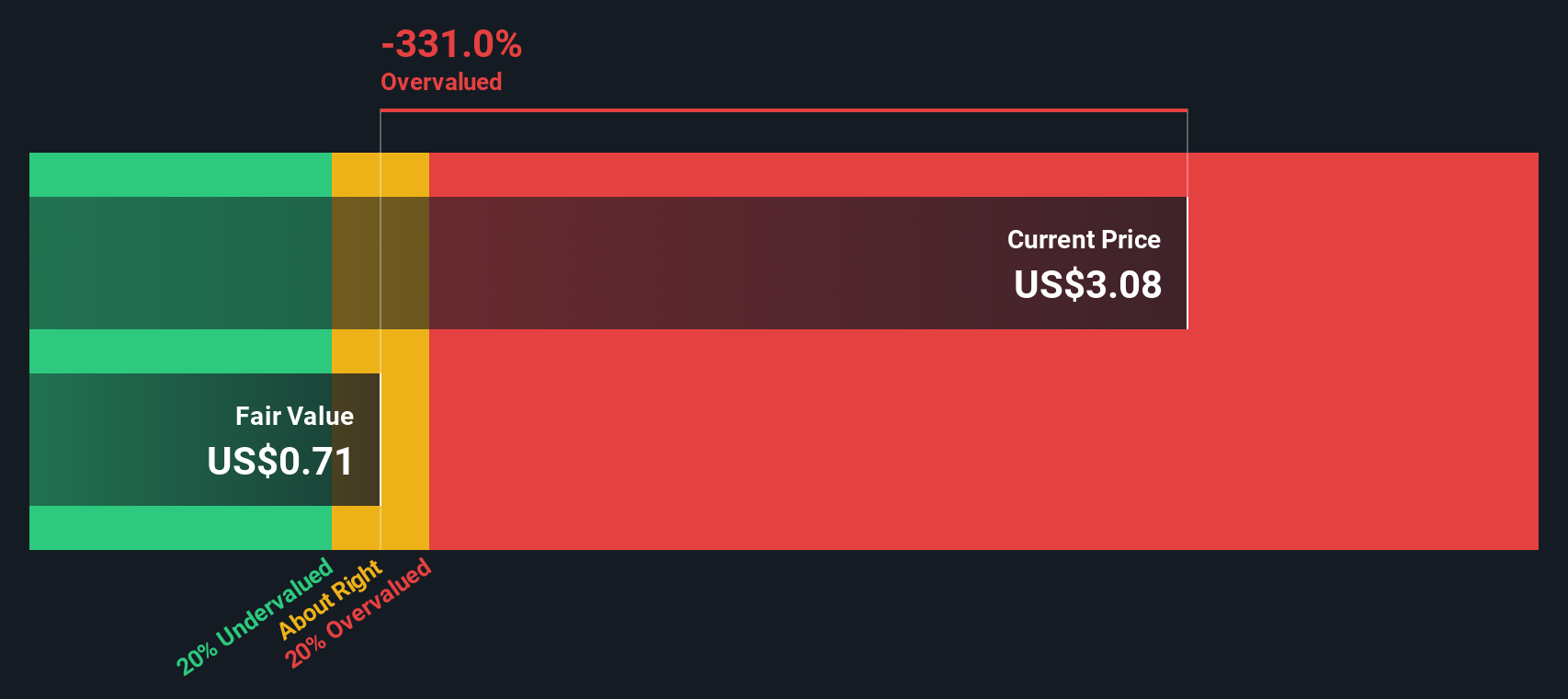

Another View: Discounted Cash Flow Model

While the analyst price target points to a fair value just above the current share price, our DCF model offers a different perspective. According to this method, Petco shares are trading above what the SWS DCF model considers fair value, suggesting the stock may be overvalued based on long-term cash flows. Which approach do you trust more: analyst targets or fundamental cash flow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Petco Health and Wellness Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Petco Health and Wellness Company Narrative

If this perspective does not resonate with you or you prefer to dig into the facts yourself, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your Petco Health and Wellness Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their opportunities. Take charge of your next big move by checking out tomorrow's winners in fresh segments that could supercharge your returns.

- Capitalize on overlooked value by reviewing these 901 undervalued stocks based on cash flows, which features businesses trading below their intrinsic worth.

- Secure dependable income streams by targeting these 19 dividend stocks with yields > 3%, a selection that consistently delivers yields above 3%.

- Ride the AI wave and seize advantage with these 24 AI penny stocks, highlighting those shaping the future of technology-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion