- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

There's Reason For Concern Over Winmark Corporation's (NASDAQ:WINA) Massive 27% Price Jump

Winmark Corporation (NASDAQ:WINA) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

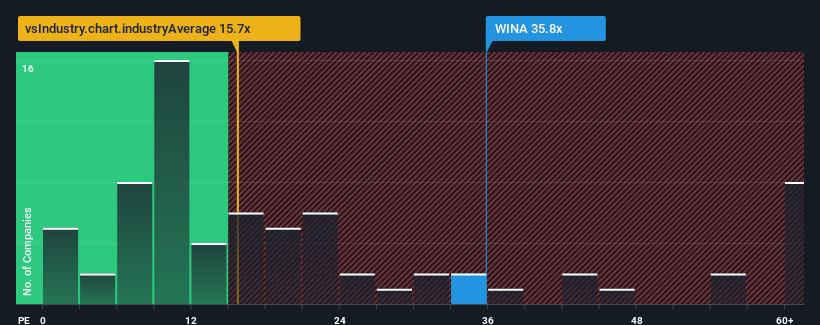

Following the firm bounce in price, Winmark's price-to-earnings (or "P/E") ratio of 35.8x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

We've discovered 4 warning signs about Winmark. View them for free.Winmark could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Winmark

Is There Enough Growth For Winmark?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Winmark's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Turning to the outlook, the next year should generate growth of 0.9% as estimated by the only analyst watching the company. With the market predicted to deliver 13% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Winmark is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Winmark's P/E

Shares in Winmark have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Winmark currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 4 warning signs for Winmark (1 is a bit concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than Winmark. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives