- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

New CMO Appointment Might Change the Case for Investing in Winmark (WINA)

Reviewed by Sasha Jovanovic

- Winmark Corporation announced in late September that Lisa Hake, with over 25 years of marketing experience at Great Clips, Best Buy, and other major brands, has joined as its new Chief Marketing Officer effective October 1, 2025.

- The creation of this executive role highlights Winmark’s focus on advancing its marketing capabilities, especially in support of franchise growth and consumer engagement.

- We’ll explore how Lisa Hake’s expertise in franchise marketing could reshape Winmark’s investment story and operational direction.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Winmark's Investment Narrative?

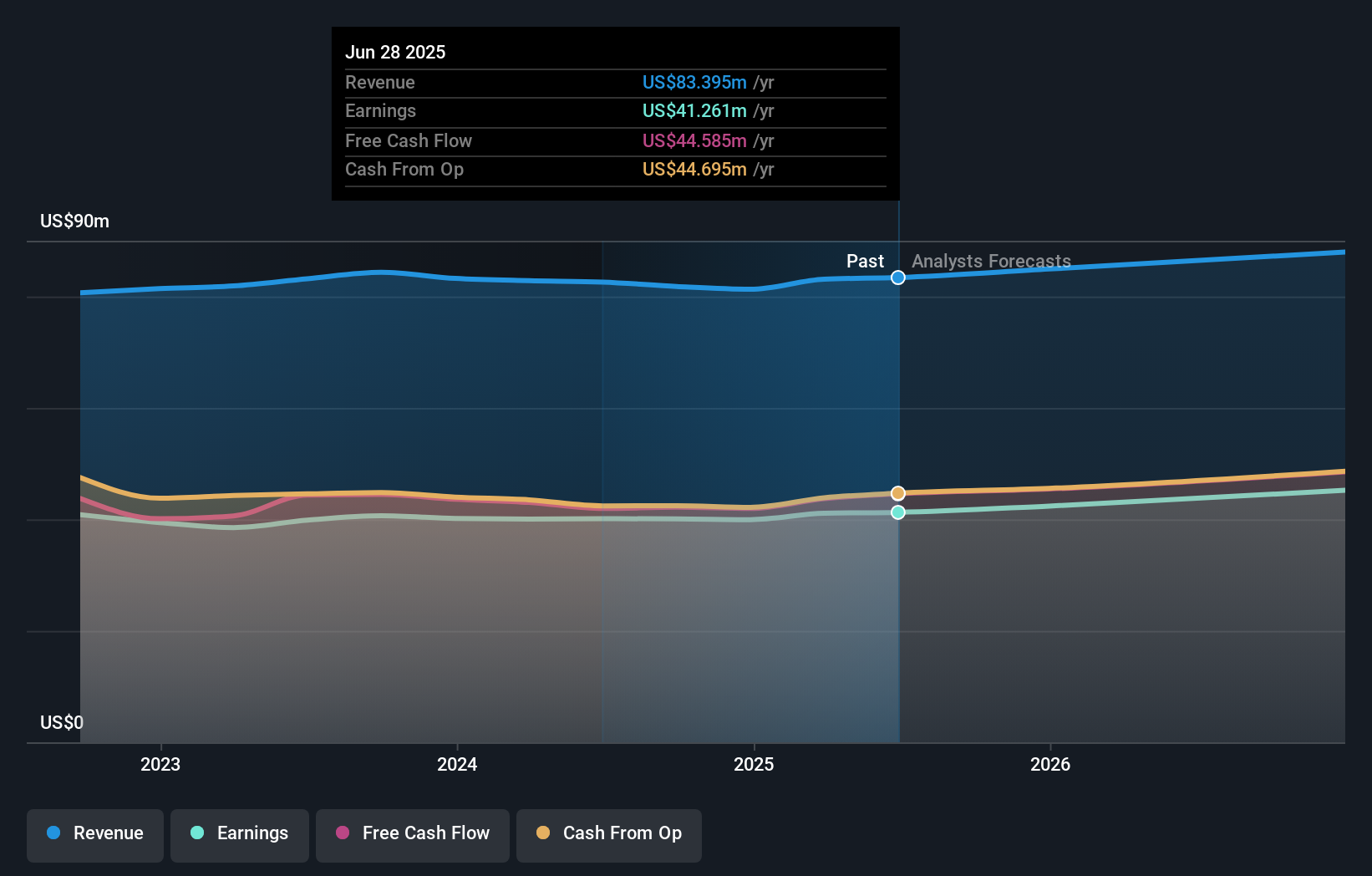

Winmark’s investment case has always hinged on reliable earnings, strong free cash flow, and a powerful franchise model. For current or prospective shareholders, the big picture belief centers on Winmark’s ability to sustainably grow its franchise base and drive recurring royalty revenues. The recent hiring of Lisa Hake as Chief Marketing Officer is the company’s boldest move yet to accelerate this core catalyst: franchise growth. With Hake’s deep franchise marketing background, there’s potential for a material positive shift in consumer engagement and franchise acquisition, an area the market had not previously priced in, based on pre-announcement consensus targets and price action. However, the biggest near-term risks remain unchanged: a still-elevated valuation, insider selling, and high debt levels that could limit flexibility if growth stalls. Hake’s arrival could tip the balance if she unlocks new marketing-driven revenue, but investors will be watching closely to see if profit margins hold while costs and competitive pressures rise. On the other hand, significant insider selling is a signal investors should keep front of mind.

Winmark's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Winmark - why the stock might be worth 46% less than the current price!

Build Your Own Winmark Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Winmark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winmark's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives