- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

Assessing Winmark’s (WINA) Valuation Following the Appointment of Its First Chief Marketing Officer

Reviewed by Kshitija Bhandaru

Winmark has just brought on Lisa Hake as its first Chief Marketing Officer, beginning October 1. With over 25 years in marketing and franchise leadership, Hake’s arrival indicates a new emphasis on brand strategy and growth at the company.

See our latest analysis for Winmark.

The creation of Winmark’s new CMO role comes after some insider share sales and broader management activity, adding a layer of intrigue to the company’s momentum. Over the last year, Winmark’s total shareholder return stands at a solid 43%, building on steady long-term gains through a blend of growth execution and franchise focus.

If leadership shakeups catch your attention, consider taking the next step and discover what’s possible with fast growing stocks with high insider ownership.

Yet with recent gains, Winmark’s shares hover well above analyst targets. Does this present a genuine chance for investors to buy into future upside, or has the market already factored in all the company’s expected growth?

Price-to-Earnings of 44.1x: Is it justified?

Winmark trades at a price-to-earnings (P/E) ratio of 44.1x, while the stock’s last close was $512.35. This multiple signals a rich premium compared to both its peers and the broader specialty retail sector.

The P/E ratio compares a company’s current share price to its earnings per share, reflecting how much investors are willing to pay for current earnings. For a retail franchise business like Winmark, this multiple can suggest expectations of steady growth, market dominance, or reliable profitability.

However, Winmark’s P/E ratio far outpaces the US Specialty Retail industry average of just 17.3x and the peer average of 19.8x. In addition, our fair Price-to-Earnings Ratio estimate stands at just 12.4x, signaling that the market’s optimism is currently running high and may eventually recalibrate.

Explore the SWS fair ratio for Winmark

Result: Price-to-Earnings of 44.1x (OVERVALUED)

However, slower revenue growth or a sharp market correction could quickly challenge Winmark’s current valuation premium and shift sentiment among investors.

Find out about the key risks to this Winmark narrative.

Another View: DCF Valuation Paints a Different Picture

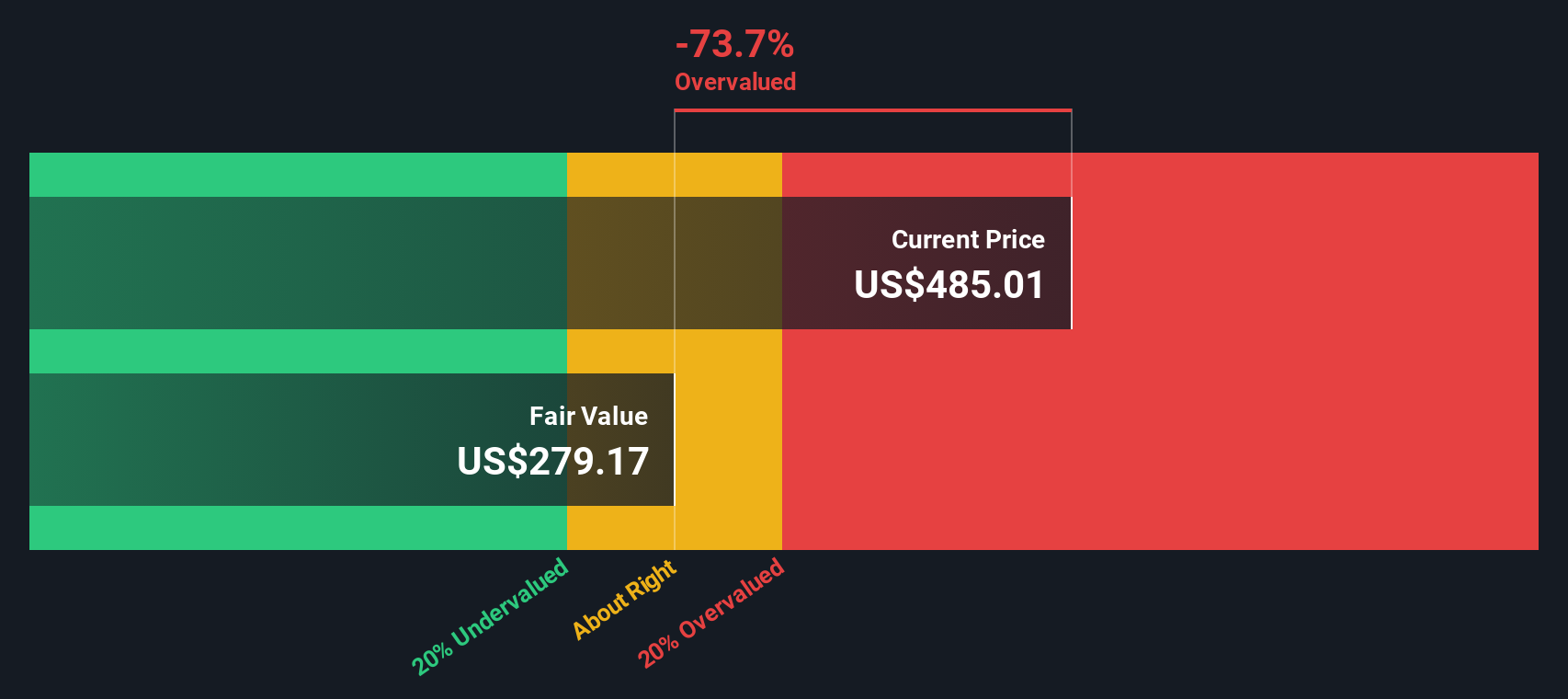

Taking a different approach, our DCF model estimates Winmark's fair value at just $279.01, which is much lower than the current share price of $512.35. This suggests the stock could be significantly overvalued if future cash flows do not justify today’s premium. With such a wide valuation gap, which perspective will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Winmark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Winmark Narrative

If you’d rather dig into the numbers and form your own perspective, you can easily build a personalized story in just a few minutes. Why not Do it your way?

A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next wave of opportunity pass you by. The Simply Wall Street Screener can point you toward fast-rising trends and exceptional stock picks with just a few clicks.

- Boost your income strategy by checking out these 19 dividend stocks with yields > 3%, offering yields above 3% from established, income-focused companies.

- Tap into the power of artificial intelligence with these 24 AI penny stocks, and spot pioneering businesses at the forefront of innovation.

- Position yourself ahead of the curve by exploring these 896 undervalued stocks based on cash flows, where compelling growth could be within reach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives