- United States

- /

- Retail Distributors

- /

- NasdaqGS:WEYS

Here's Why We're Wary Of Buying Weyco Group's (NASDAQ:WEYS) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Weyco Group, Inc. (NASDAQ:WEYS) is about to trade ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 18th of March will not receive this dividend, which will be paid on the 31st of March.

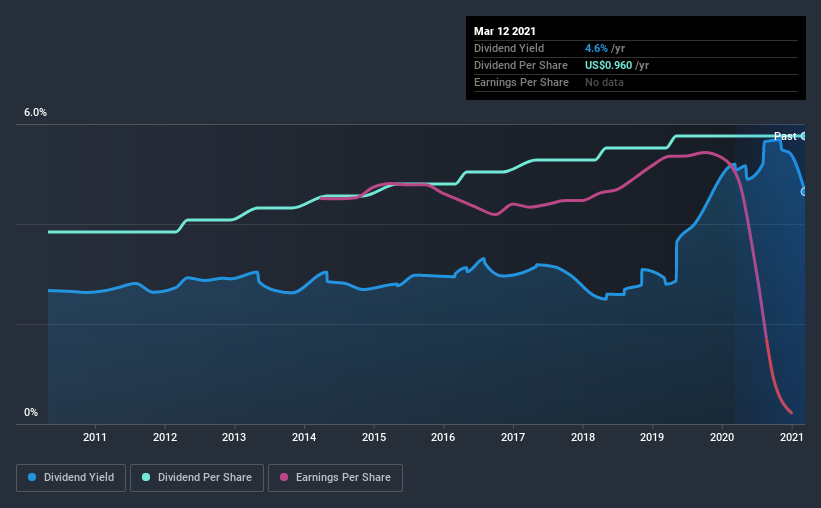

Weyco Group's upcoming dividend is US$0.24 a share, following on from the last 12 months, when the company distributed a total of US$0.96 per share to shareholders. Last year's total dividend payments show that Weyco Group has a trailing yield of 4.6% on the current share price of $20.66. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Weyco Group

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Weyco Group's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If Weyco Group didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Fortunately, it paid out only 32% of its free cash flow in the past year.

Click here to see how much of its profit Weyco Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Weyco Group reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Weyco Group has lifted its dividend by approximately 4.1% a year on average.

Get our latest analysis on Weyco Group's balance sheet health here.

The Bottom Line

Is Weyco Group worth buying for its dividend? It's hard to get used to Weyco Group paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. Bottom line: Weyco Group has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Although, if you're still interested in Weyco Group and want to know more, you'll find it very useful to know what risks this stock faces. Our analysis shows 2 warning signs for Weyco Group that we strongly recommend you have a look at before investing in the company.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Weyco Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Weyco Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WEYS

Weyco Group

Designs, markets, and distributes footwear for men, women, and children in the United States, Canada, Australia, Asia, and South Africa.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives