- United States

- /

- Media

- /

- NasdaqGS:SCHL

Discover 3 Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences a positive upswing, with major indices like the S&P 500 and Dow Jones Industrial Average on winning streaks, investors are keenly observing the performance of technology giants and their impact on broader economic conditions. In this dynamic environment, dividend stocks offer a compelling opportunity for those looking to balance growth potential with income generation, particularly as companies report strong earnings and make strategic investments in areas such as artificial intelligence.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.42% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.92% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.18% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.50% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.57% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.03% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.12% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.52% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.68% | ★★★★★☆ |

| Omega Flex (NasdaqGM:OFLX) | 4.54% | ★★★★★☆ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

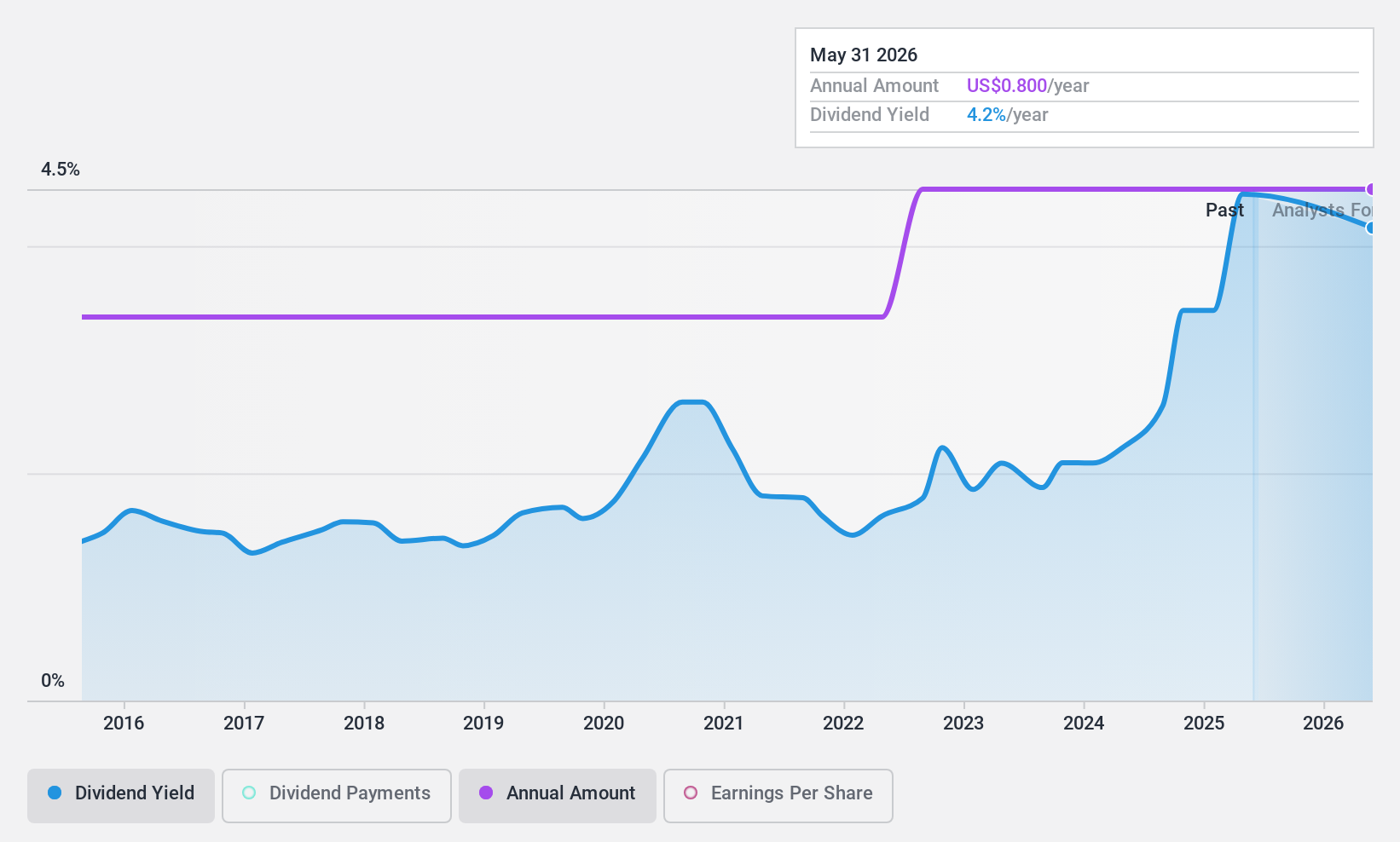

Scholastic (NasdaqGS:SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation publishes and distributes children's books globally, with a market cap of approximately $488.10 million.

Operations: Scholastic Corporation generates revenue primarily from three segments: Children's Book Publishing and Distribution ($943 million), Education Solutions ($319.80 million), and International operations ($273.60 million).

Dividend Yield: 4.4%

Scholastic's dividend yield of 4.44% is lower than the top 25% of US dividend payers, and its high payout ratio (121.5%) indicates dividends aren't well covered by earnings, though cash flows cover them better with a 65.3% cash payout ratio. The company’s dividends have been stable and reliable over the past decade, despite recent profit margin declines. Notably, Scholastic completed a significant share buyback program worth $623 million, potentially enhancing shareholder value.

- Navigate through the intricacies of Scholastic with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Scholastic's share price might be too pessimistic.

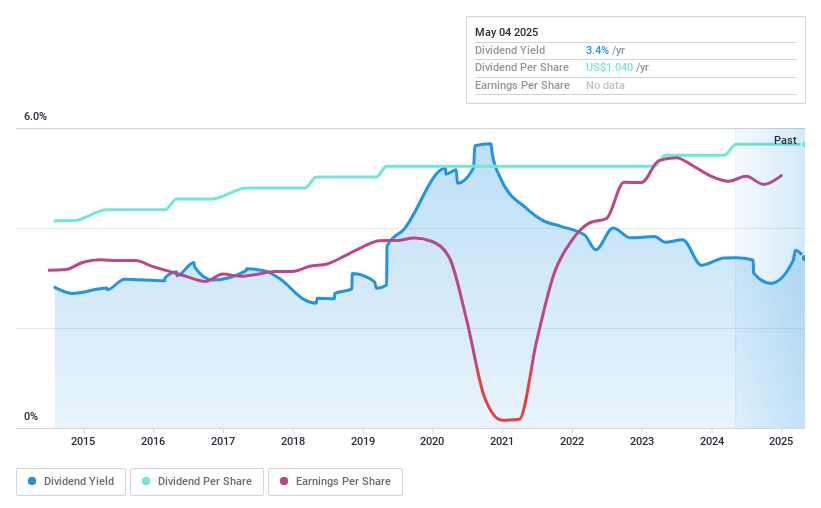

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc. is engaged in designing, marketing, and distributing footwear for men, women, and children across various regions including the United States, Canada, Australia, Asia, and South Africa with a market cap of $276.26 million.

Operations: Weyco Group's revenue is primarily derived from its Wholesale segment, which accounts for $227.94 million, followed by its Retail segment at $38.70 million.

Dividend Yield: 3.5%

Weyco Group's dividend yield of 3.48% is lower than the top 25% of US dividend payers, but dividends are well covered by earnings and cash flows with payout ratios of 32.4% and 27.3%, respectively. The company maintains stable and reliable dividends, having increased over the past decade. Despite recent board changes affecting Nasdaq compliance, Weyco continues to affirm its quarterly dividend payments, reflecting a commitment to returning value to shareholders amidst modest earnings growth.

- Unlock comprehensive insights into our analysis of Weyco Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Weyco Group is trading beyond its estimated value.

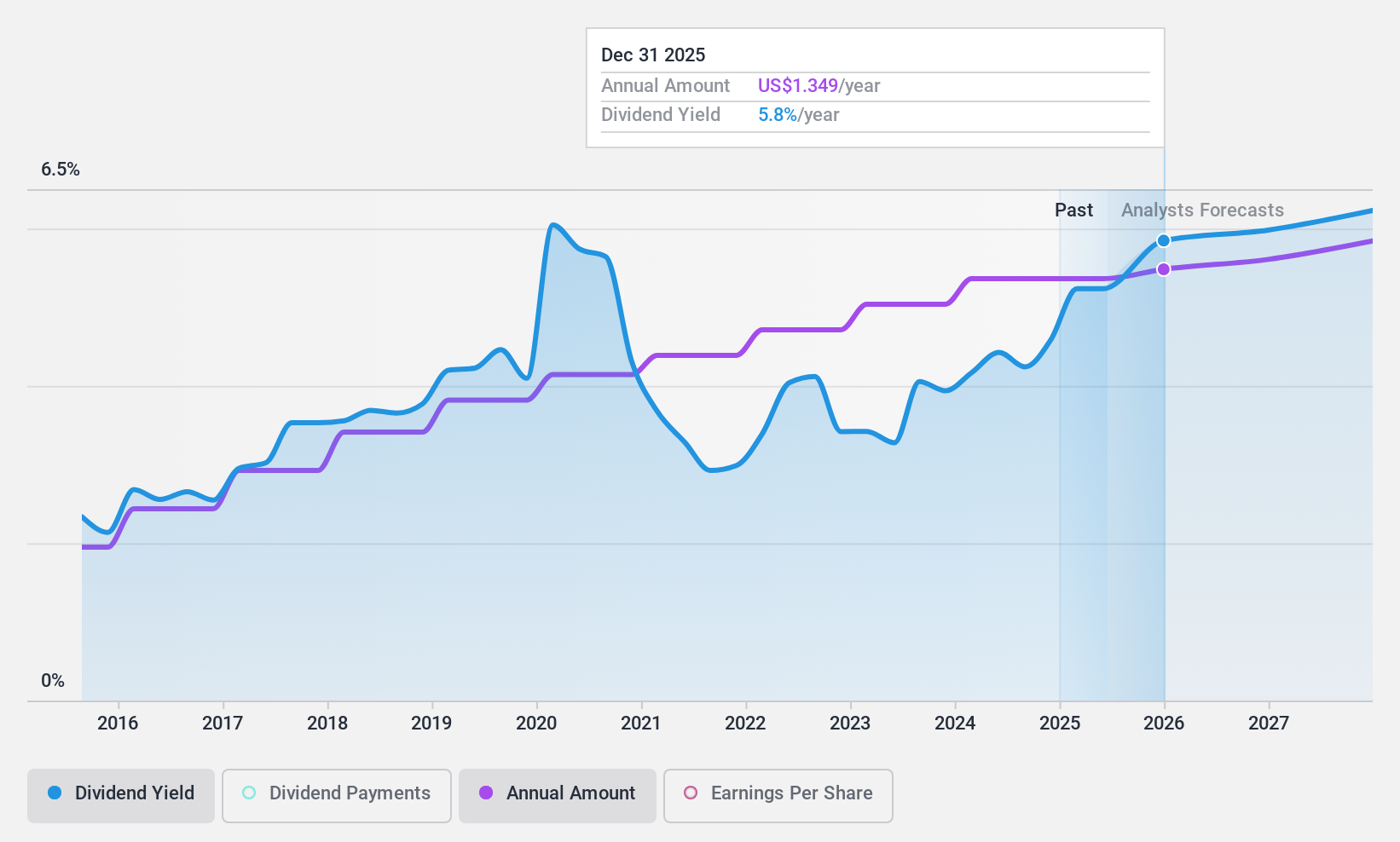

Interpublic Group of Companies (NYSE:IPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market cap of approximately $9.24 billion.

Operations: Interpublic Group of Companies generates its revenue from three main segments: Media, Data & Engagement Solutions ($4.14 billion), Integrated Advertising & Creativity Led ($3.44 billion), and Specialized Communications & Experiential Solutions ($1.42 billion).

Dividend Yield: 5.3%

Interpublic Group's dividend yield of 5.25% ranks in the top 25% of US dividend payers, although its high payout ratio suggests dividends are not well covered by earnings. Despite this, cash flows adequately support payouts with a cash payout ratio of 46.6%. The company maintains a stable and growing dividend history over the past decade but faces challenges with recent net losses and significant insider selling, which may impact future sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Interpublic Group of Companies.

- Our valuation report unveils the possibility Interpublic Group of Companies' shares may be trading at a discount.

Key Takeaways

- Explore the 154 names from our Top US Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCHL

Scholastic

Scholastic Corporation publishes and distributes children’s books worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives