- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA) Is Up 11.6% After Raising 2025 Outlook and Highlighting Buybacks - What's Changed

Reviewed by Sasha Jovanovic

- In early December 2025, Ulta Beauty reported fiscal third-quarter sales of US$2,857.62 million, up from US$2,530.10 million a year earlier, while net income eased to US$230.88 million and earnings per share held steady, and the company also updated investors on progress under its US$1.01 billion share repurchase program.

- Alongside these results, Ulta Beauty raised its full-year 2025 outlook for net sales, operating margin, and diluted earnings per share, signaling management’s confidence that stronger beauty demand, new international stores, and its expanding UB marketplace can support improved profitability.

- We’ll now examine how Ulta’s upgraded full-year guidance and improving sales mix could reshape the existing investment narrative for the company.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ulta Beauty Investment Narrative Recap

To own Ulta Beauty, you need to believe that beauty remains a resilient, discretionary spend and that Ulta’s mix of prestige, mass, and wellness brands can keep guests loyal across stores and digital channels. The latest quarter’s strong sales but flat earnings do not materially change the near term catalyst of improving margin through mix and operating discipline, while the biggest risk remains rising cost pressure from stores, wages, and ongoing investment needs as the business expands.

The most relevant update here is Ulta’s higher full year 2025 outlook, with net sales now expected at about US$12.3 billion, operating margin at 12.3% to 12.4%, and diluted EPS at US$25.20 to US$25.50. This upgraded guidance ties directly into the catalyst of a broader, higher margin assortment and growing international footprint, but it also raises the stakes if expenses from new markets, digital investments, and store operations escalate faster than anticipated.

Yet even with upgraded guidance, the rising wage and store cost burden is something investors should be aware of, because it could eventually...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty’s narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028. This requires 5.9% yearly revenue growth and roughly an $0.1 billion earnings increase from $1.2 billion today.

Uncover how Ulta Beauty's forecasts yield a $603.43 fair value, in line with its current price.

Exploring Other Perspectives

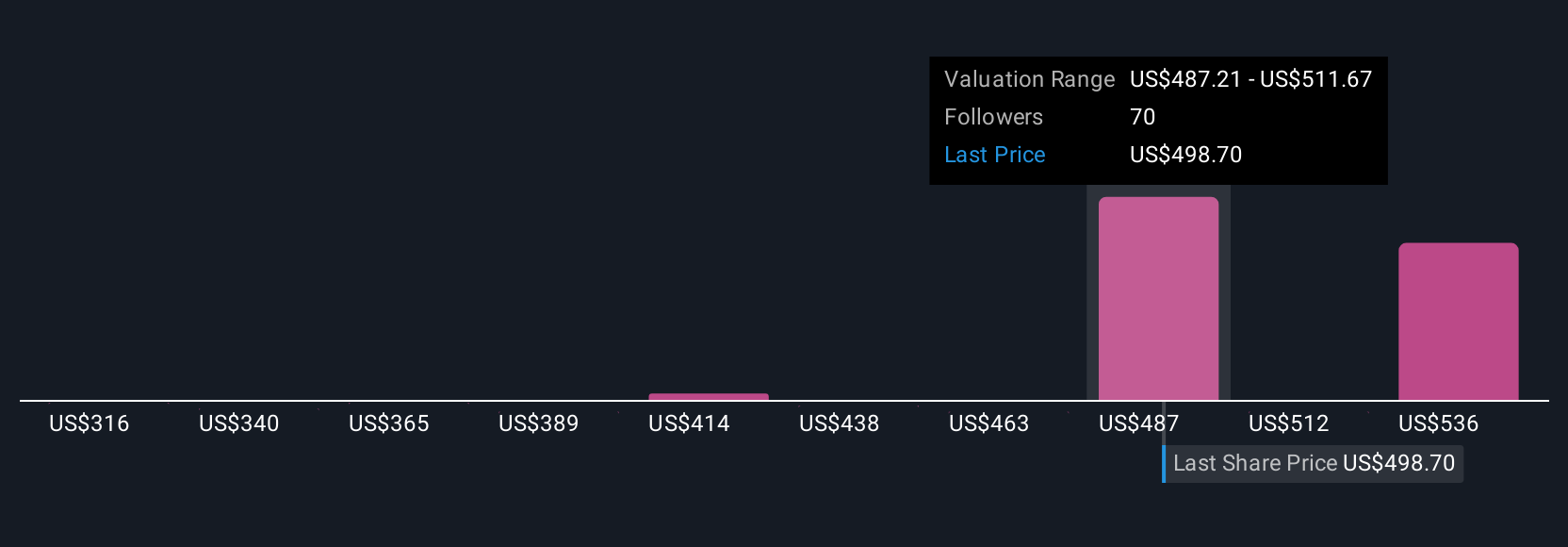

Nine members of the Simply Wall St Community value Ulta Beauty between US$384 and US$603 per share, highlighting very different views on upside. Set those against Ulta’s raised guidance and growing cost base, and you can see why it pays to compare several independent opinions.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth 36% less than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026