- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Tractor Supply (NasdaqGS:TSCO) Board Declares US$0.23 Per Share Quarterly Dividend

Reviewed by Simply Wall St

Tractor Supply (NasdaqGS:TSCO) recently affirmed a quarterly cash dividend of $0.23 per share, to be paid on June 10, 2025, which aligns with positive market trends. This announcement occurred amidst strong market performances, with indexes such as the S&P 500 maintaining upward momentum. While the company's share price remained flat last week, the dividend news added supportive weight to broader market gains. The positive economic indicators and improved investor sentiment, highlighted by rising index performances, didn't quite mirror Tractor Supply's modest market movement. Nonetheless, the dividend declaration underscores the company's commitment to returning value to shareholders.

Be aware that Tractor Supply is showing 1 risk in our investment analysis.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The announcement of Tractor Supply's quarterly cash dividend underscores its focus on shareholder value, aligning with broader market trends. The positive news comes amid a backdrop of strong earnings and revenue growth prospects, driven by supply chain diversification and PetRx integration. While the share price remained flat recently, over the past five years the company's total return, including dividends, soared 157.63%, highlighting its robust long-term performance. This stands in contrast to its underperformance against the US Specialty Retail industry and the broader US market over the past year.

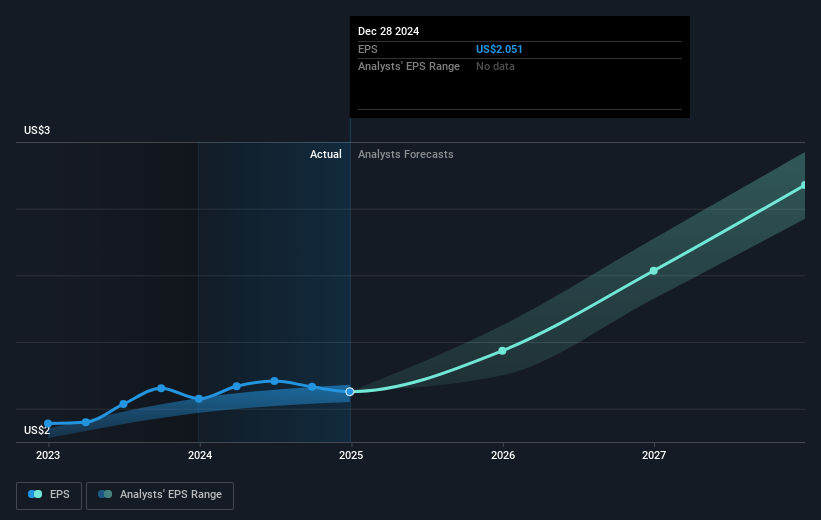

Tractor Supply's revenue and earnings forecasts may be positively influenced by these strategic moves, particularly as they seek to enhance margins through reduced reliance on Chinese imports. Despite current challenges, analysts project earnings growth of 7.8% annually, although this lags behind market expectations. The recent dividend decision could bolster investor confidence by reinforcing the company's financial health. With a current share price of US$51.02, the price target of US$54.37 indicates a modest 6.2% potential appreciation, suggesting the market views the stock as fairly priced based on consensus expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives